Question: please i need help keep getting it wrong Intro 8 years ago, a new machine cost $8,000,000 to purchase and an additional $600,000 for the

please i need help keep getting it wrong

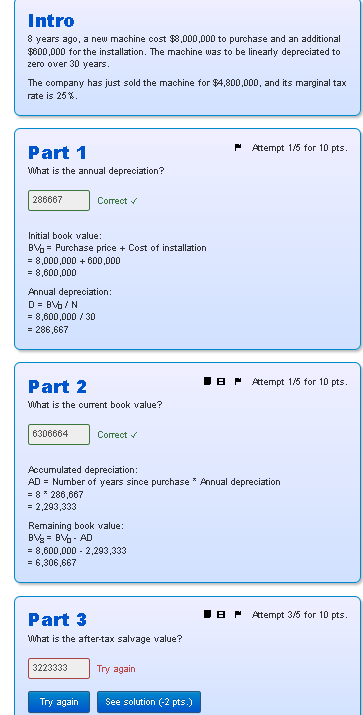

Intro 8 years ago, a new machine cost $8,000,000 to purchase and an additional $600,000 for the installation. The machine was to be linearly depreciated to zero over 30 years. The company has just sold the machine for $4,800,000, and its marginal tax rate is 25 \% Part 1 P Attempt 1/5 for 10pts. vuhat is the annual depreciation? Correct r Initial book value: BV = Purchase price + Cost of installation =8,000,000+600,000 =8,600,000 Annual depreciation: D=Bwo/N=8,600,000/30=286,667 Part 2 . F Attempt 1/5 for 10pts. volut is the cument book value? Correct r Accumulated depreciation: AD= Number of years since purchase * Annual depreciation =8286,667 =2,293,333 Remaining book value: BVB=BVDAD =8,600,0002,293,333 =6,306,667 Part 3 F Attempt 3/5 for 10pts. What is the after-tax salvage value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts