Question: please i need help on this question from an Expert. Thanks. SNDL Y 20M X y SNDLX 10 (13)1 X . 10 (131 5 X

please i need help on this question from an Expert. Thanks.

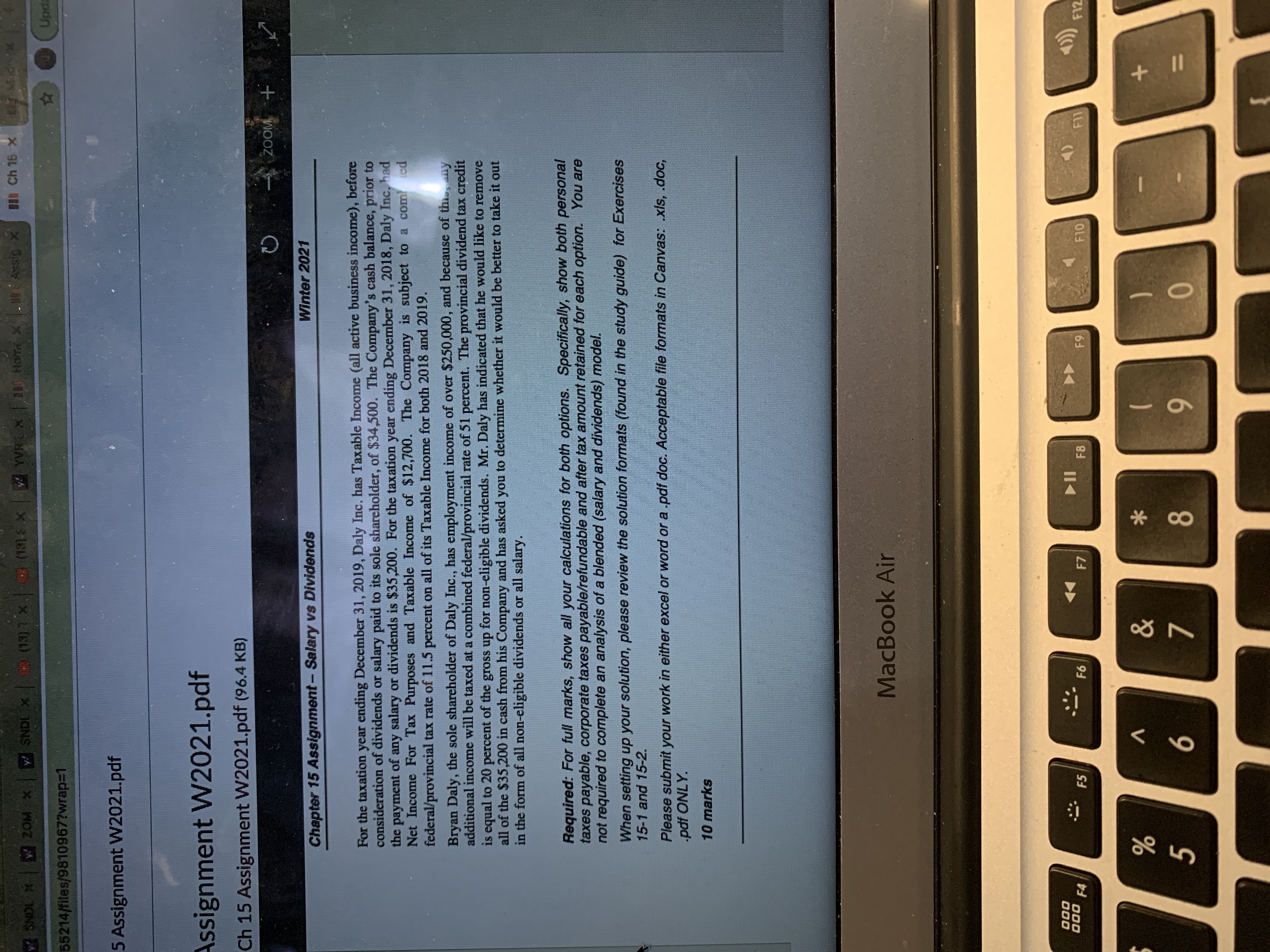

SNDL Y 20M X y SNDLX 10 (13)1 X . 10 (131 5 X - YVREX | DID HOT X . . As50 x 810 Ch 15 X $5214/files/9810967?wrap=1 Up 5 Assignment W2021.pdf Assignment W2021.pdf Ch 15 Assignment W2021.pdf (96.4 KB) ZOOM Chapter 15 Assignment - Salary vs Dividends Winter 2021 For the taxation year ending December 31, 2019, Daly Inc. has Taxable Income (all active business income), before consideration of dividends or salary paid to its sole shareholder, of $34,500. The Company's cash balance, prior to the payment of any salary or dividends is $35,200. For the taxation year ending December 31, 2018, Daly Inc, had Net Income For Tax Purposes and Taxable Income of $12,700. The Company is subject to a com! ied federal/provincial tax rate of 11.5 percent on all of its Taxable Income for both 2018 and 2019. Bryan Daly, the sole shareholder of Daly Inc., has employment income of over $250,000, and because of this, any additional income will be taxed at a combined federal/provincial rate of 51 percent. The provincial dividend tax credit is equal to 20 percent of the gross up for non-eligible dividends. Mr. Daly has indicated that he would like to remove all of the $35,200 in cash from his Company and has asked you to determine whether it would be better to take it out in the form of all non-eligible dividends or all salary. Required: For full marks, show all your calculations for both options. Specifically, show both personal taxes payable, corporate taxes payable/refundable and after tax amount retained for each option. You are not required to complete an analysis of a blended (salary and dividends) model. When setting up your solution, please review the solution formats (found in the study guide) for Exercises 15-1 and 15-2. Please submit your work in either excel or word or a .pdf doc. Acceptable file formats in Canvas: .xIs, .doc, .pdf ONLY. 10 marks MacBook Air 900 000 F4 F5 F6 F7 F8 F9 F10 F17 V 8