Question: please i need help thank you Sec. E01 (4447 11) You are considering a stock investment in one of two firms (A and B), both

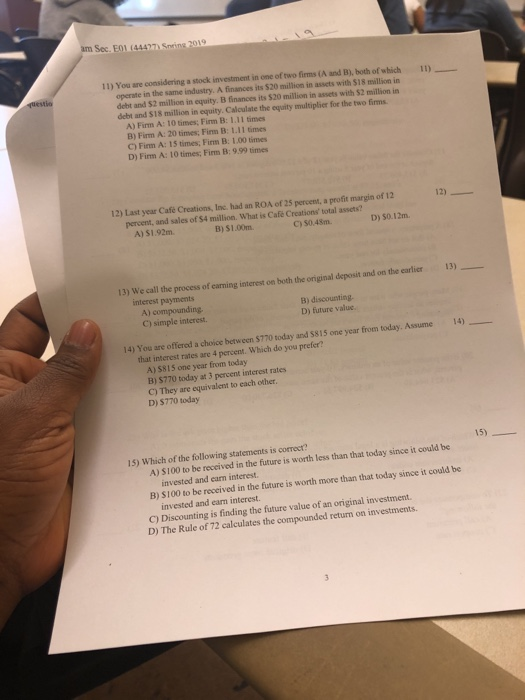

Sec. E01 (4447 11) You are considering a stock investment in one of two firms (A and B), both of which 10) operate in the same industry. A finances its $20 million in assets with $18 million in debt and $2 million in equity. B finances its $20 million in assets with $2 million in debt and $18 million in equity. Caloulate the equity multiplier for the two firms A) Firm A: 10 times; Firm B: 1.11 times B) Firm A: 20 times;Fim B: 1.11 times C) Firm A: 15 times; Firm B: 1.00 times D) Firm A: 10 times; Firm B:9.99 times 12) Last year Cafe Creations, Inc. had an ROA of 25 percent, a profit margin of percent, and sales of $4 million. What is Cafe Creations' total assets? A) $1.92m. 12) B) $1.00m. C) 50.43m. D) S0.12m. 13) 13) We call the process of earning interest on both the orniginal deposit and on the earlier interest payments B) discounting. A) compounding C) simple interest D) future value. 14) You are offered a choice between $770 today and 5815 one year from today. Assume that interest rates are 4 percent. Which do you prefer? A) 5815 one year from today B) $770 today at 3 percent interest rates C) They are equivalent to each other. D) $770 today 14) 15) Which of the following statements is correct? A) $100 to be received in the future is worth less than that today since it could be invested and earn interest. B) S100 to be received in the future is worth more than that today since it could be invested and earn interest. C) Discounting is finding the future value of an original investment. D) The Rule of 72 calculates the compounded return on investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts