Question: Please I need help to write a complete Java program for this project. Also make sure to address all aspects for the project. Create a

Please I need help to write a complete Java program for this project. Also make sure to address all aspects for the project.

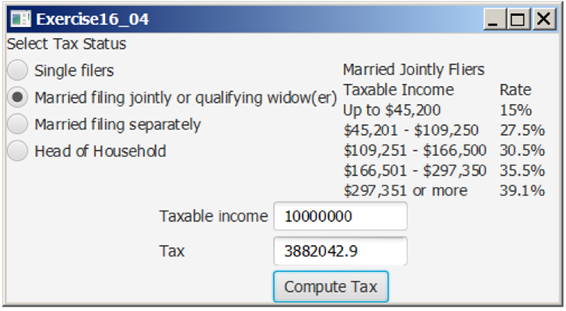

Create a GUI program to compute tax. The program lets the user select tax status and enter taxable income. It computes the tax based on the table given in the Tax Computation assignment.

2009 U.S. Federal Personal Tax Rates

| Marginal Tax Rate | Single | Married Filing Jointly or Qualified Widow(er) | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | $0 - $8,350 | $0 - $16,700 | $0 - $8,350 | $0 - $11,950 |

| 15% | $8,351- $33,950 | $16,701 - $67,900 | $8,351 - $33,950 | $11,951 - $45,500 |

| 25% | $33,951 - $82,250 | $67,901 - $137,050 | $33,951 - $68,525 | $45,501 - $117,450 |

| 28% | $82,251 - $171,550 | $137,051 - $208,850 | $68,525 - $104,425 | $117,451 - $190,200 |

| 33% | $171,551 - $372,950 | $208,851 - $372,950 | $104,426 - $186,475 | $190,201 - $372,950 |

| 35% | $372,951+ | $372,951+ | $186,476+ | $372,951+ |

Sample interface:

Exercise16 04 X Select Tax Status C Single filers Married Jointly Fliers Married filing jointly or qualifying widow(er) Taxable Income Rate Up to $45,200 15% Married filing separately $45,201 - $109,250 27.5% Head of Household $109,251 - $166,500 30.5% $166,501 - $297 ,350 35.5% $297 ,351 or more 39.1% Taxable income 10000000 Tax 3882042.9 Compute Tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts