Question: Please I need help understanding how to solve these two questions, do a step by step solution. Thanks in advance. 4. Your financial firm needs

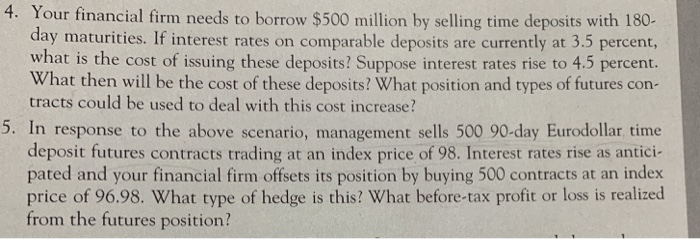

4. Your financial firm needs to borrow $500 million by selling time deposits with 180 day maturities. If interest rates on comparable deposits are currently at 3.5 percent, what is the cost of issuing these deposits? Suppose interest rates rise to 4.5 percent. What then will be the cost of these deposits? What position and types of futures con- tracts could be used to deal with this cost increase? 5. In response to the above scenario, management sells 500 90-day Eurodollar, time deposit futures contracts trading at an index price of 98. Interest rates rise as antici- pated and your financial firm offsets its position by buying 500 contracts at an index price of 96.98. What type of hedge is this? What before-tax profit or loss is realized from the futures position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts