Question: Please, I need help with both questions. The projected cash flows for two mutually exclusive projects are as follows: 31. Proiect A Year Project E

Please, I need help with both questions.

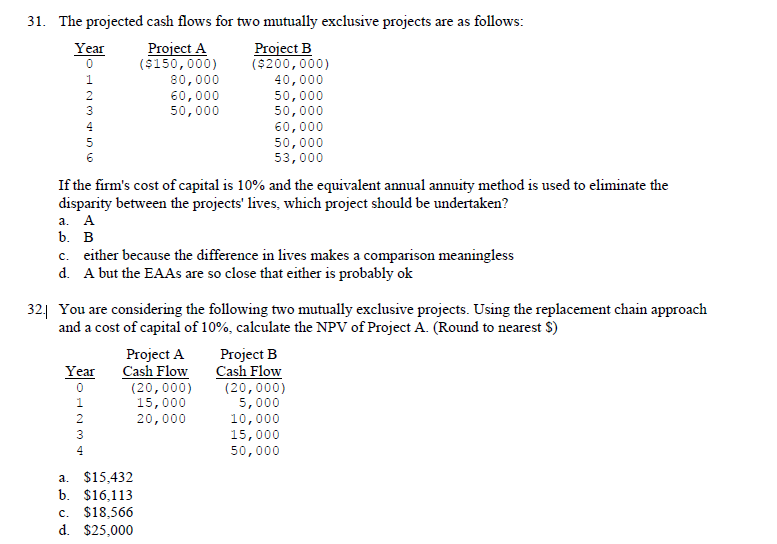

The projected cash flows for two mutually exclusive projects are as follows: 31. Proiect A Year Project E ($150,000) 80,000 60,000 50,000 ($200,000) 40,000 50,000 50,000 60,000 50,000 53, 000 1 If the firm's cost of capital is 10% and the equivalent annual annuity method is used to eliminate the disparity between the projects' lives, which project should be undertaken? a. A b. B c. either because the difference in lives makes a comparison meaningless d. A but the EAAs are so close that either is probably ok 32| You are considering the following two mutually exclusive projects. Using the replacement chain approach and a cost of capital of 10%, calculate the NPV of Project A. (Round to nearest $) Project A Project B Year Cash Flow Cash Flow (20,000) (20,000) 5,000 10,000 15,000 50,000 15,000 20,000 a. $15.432 b. $16,113 c. $18,566 d. $25,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts