Question: please i need help with pink boxes correction. At the beginning of the current year, Andy Company has equipment that originally cost $70,000, has $49,000

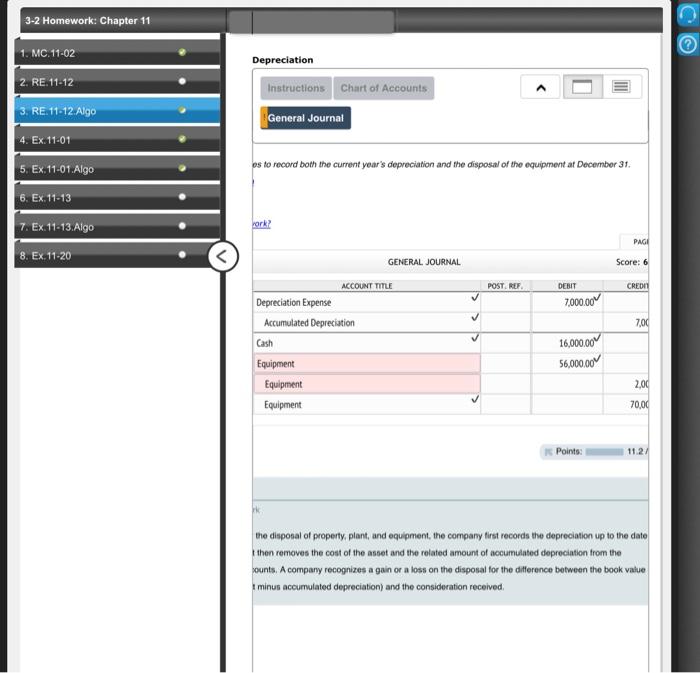

At the beginning of the current year, Andy Company has equipment that originally cost $70,000, has $49,000 accumulated depreciation, and is being depreciated at $7,000 per year. Andy sells this quipment for $16,000 at the end of the current year. Required: Prepare journal entries to record both the current year's depreciation and the disposal of the equipment. es to record both the current year's depreciation and the disposal of the equipment at December 31 . ark} Is Points: 11.21 the disposal of property, plant, and equipment, the company first records the depreciation up to the date t then removes the cost of the asset and the related amount of accumulated depreciation from the pounts. A company recognizes a gain or a loss on the disposal for the difference between the book value 1 minus accumulated depreciation) and the consideration received

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts