Question: please. i need help with this one Check my work 3 Required information [The following information applies to the questions displayed below) Bunnell Corporation is

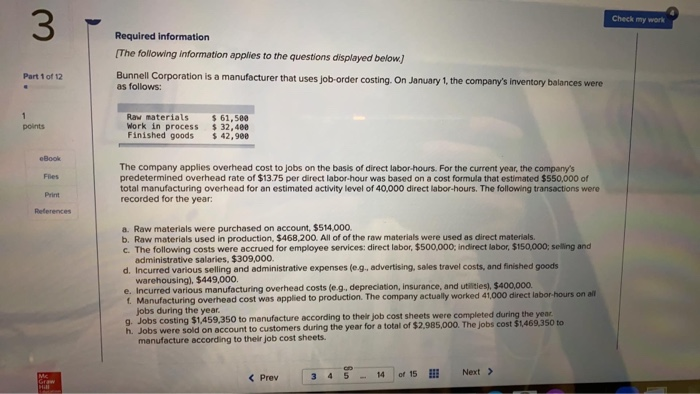

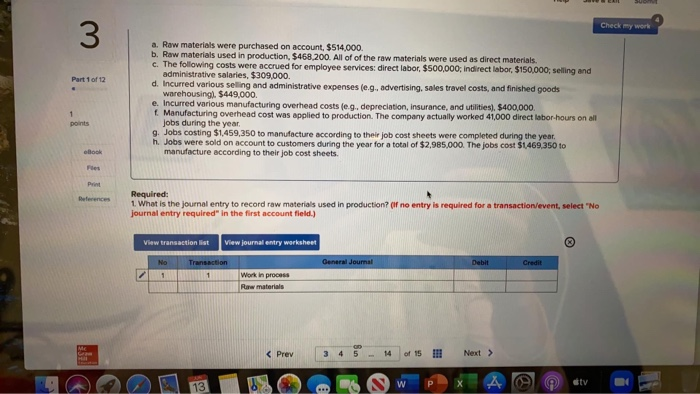

Check my work 3 Required information [The following information applies to the questions displayed below) Bunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company's inventory balances were as follows: Part 1 of 12 1 points Raw materials Work in process Finished goods $ 61,500 $ 32,400 $ 42,900 eBook Fies The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate of $13.75 per direct labor-hour was based on a cost formula that estimated $550,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: Print References a. Raw materials were purchased on account, $514,000. b. Raw materials used in production, $468,200. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $500,000; indirect labor, $150,000; selling and administrative salaries, $309,000 d. Incurred various selling and administrative expenses (eg, advertising, sales travel costs, and finished goods warehousing). $449,000. e. Incurred various manufacturing overhead costs (e.g. depreciation, insurance, and utilities, $400,000. 1. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor hours on all jobs during the year. g. Jobs costing $1,459,350 to manufacture according to their job cost sheets were completed during the year h. Jobs were sold on account to customers during the year for a total of $2,985,000. The jobs cost $1,469,350 to manufacture according to their job cost sheets. 14 Me GE 3 4 5 of 15 Check my work 3 Part 1 of 12 a. Raw materials were purchased on account, $514,000. b. Raw materials used in production, $468,200. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $500,000; Indirect labor, $150,000, selling and administrative salaries, $309,000. d. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods warehousingl. $449,000 e. Incurred various manufacturing overhead costs (e.g. depreciation, insurance, and utilities). $400,000 [ Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor hours on all Jobs during the year 9. Jobs costing $1,459,350 to manufacture according to their job cost sheets were completed during the year. h. Jobs were sold on account to customers during the year for a total of $2,985,000. The jobs cost $1,469,350 to manufacture according to their job cost sheets. 1 points book References Required: 1. What is the journal entry to record raw materials used in production? (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet No Transaction General Journal Debit Credit 1 1 Work in process Raw materials ME I 13 W A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts