Question: Please I need help with this one Part c . Calculate the quoted price for the agency bond issued by FNMA. Assume the usual stelement

Please I need help with this one Part c . Calculate the quoted price for the agency bond issued by FNMA. Assume the usual stelement for this quoted yield

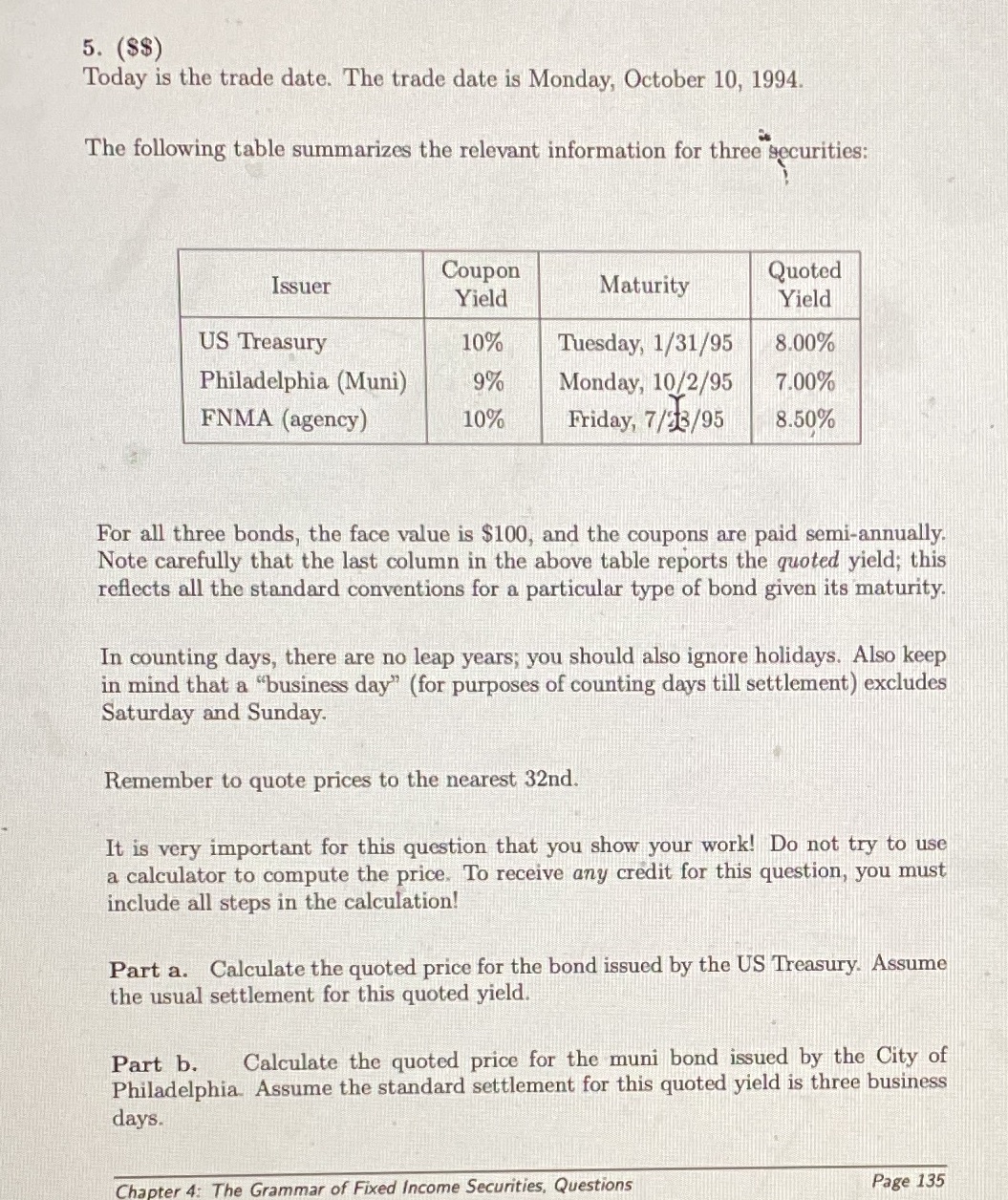

5. ($$) Today is the trade date. The trade date is Monday, October 10, 1994. The following table summarizes the relevant information for three securities: Coupon Issuer Quoted Yield Maturity Yield US Treasury 10% Tuesday, 1/31/95 8.00% Philadelphia (Muni) 9% Monday, 10/2/95 7.00% FNMA (agency) 10% Friday, 7/23/95 8.50% For all three bonds, the face value is $100, and the coupons are paid semi-annually. Note carefully that the last column in the above table reports the quoted yield; this reflects all the standard conventions for a particular type of bond given its maturity. In counting days, there are no leap years; you should also ignore holidays. Also keep in mind that a "business day" (for purposes of counting days till settlement) excludes Saturday and Sunday. Remember to quote prices to the nearest 32nd. It is very important for this question that you show your work! Do not try to use a calculator to compute the price. To receive any credit for this question, you must include all steps in the calculation! Part a. Calculate the quoted price for the bond issued by the US Treasury. Assume the usual settlement for this quoted yield. Part b. Calculate the quoted price for the muni bond issued by the City of Philadelphia Assume the standard settlement for this quoted yield is three business days. Chapter 4: The Grammar of Fixed Income Securities, Questions Page 135

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts