Question: Please, I need help with this problem 3. Performance Measures: ROS, Turnover, ROI and Res The Freedom Division of the Love All Company currently is

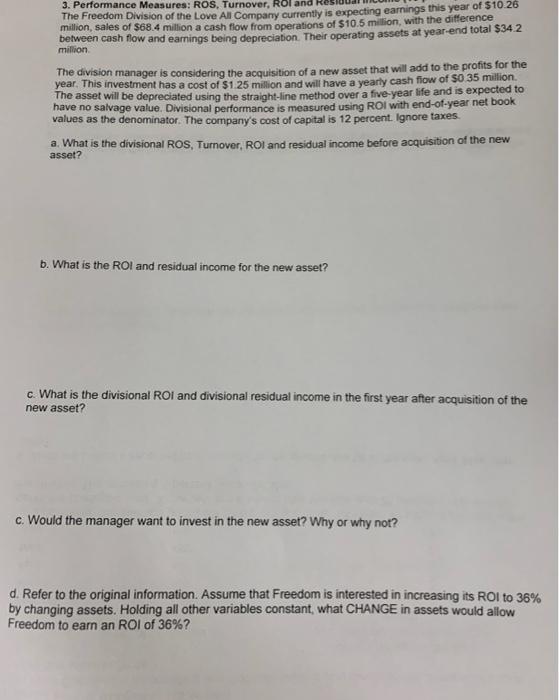

3. Performance Measures: ROS, Turnover, ROI and Res The Freedom Division of the Love All Company currently is expecting earnings this year of $10.26 million, sales of $68.4 million a cash flow from operations of $10.5 million, with the difference between cash flow and earnings being depreciation. Their operating assets at year-end total $34.2 million. The division manager is considering the acquisition of a new asset that will add to the profits for the year. This investment has a cost of $1.25 million and will have a yearly cash flow of $0.35 million. The asset will be depreciated using the straight-line method over a five-year life and is expected to have no salvage value. Divisional performance is measured using ROI with end-of-year net book values as the denominator. The company's cost of capital is 12 percent. Ignore taxes. a. What is the divisional ROS, Turnover, ROI and residual income before acquisition of the new asset? b. What is the ROI and residual income for the new asset? c. What is the divisional ROI and divisional residual income in the first year after acquisition of the new asset? c. Would the manager want to invest in the new asset? Why or why not? d. Refer to the original information. Assume that Freedom is interested in increasing its ROI to 36% by changing assets. Holding all other variables constant, what CHANGE in assets would allow Freedom to earn an ROI of 36%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts