Question: Please I need help with this problem, it only one problem that has many part. On January 1, 2018, the general ledger of Freedom Fireworks

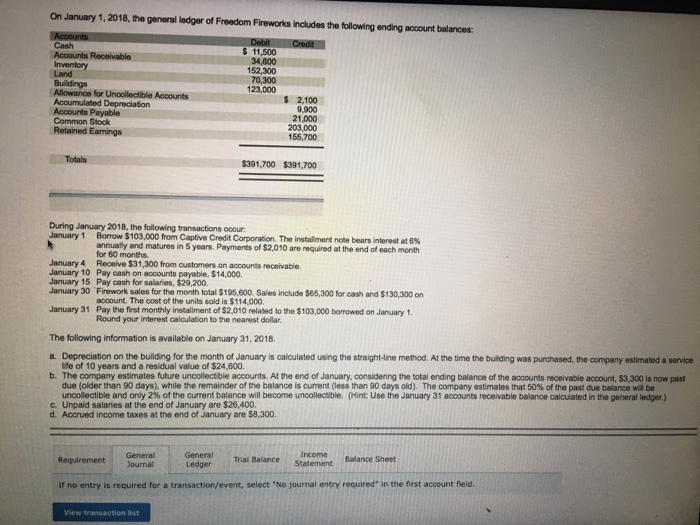

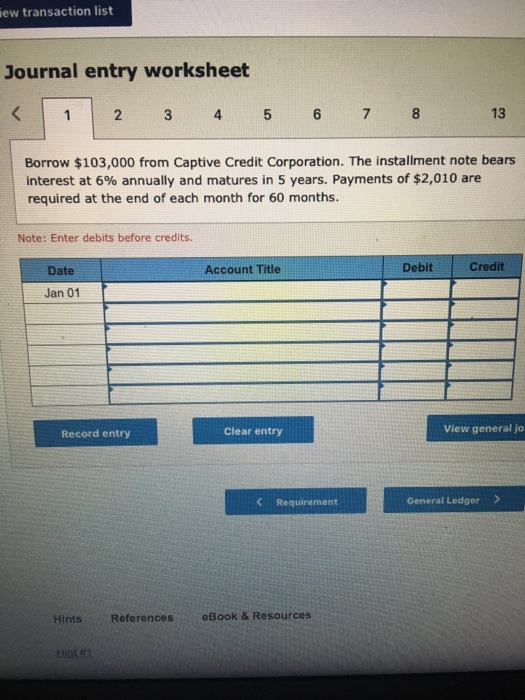

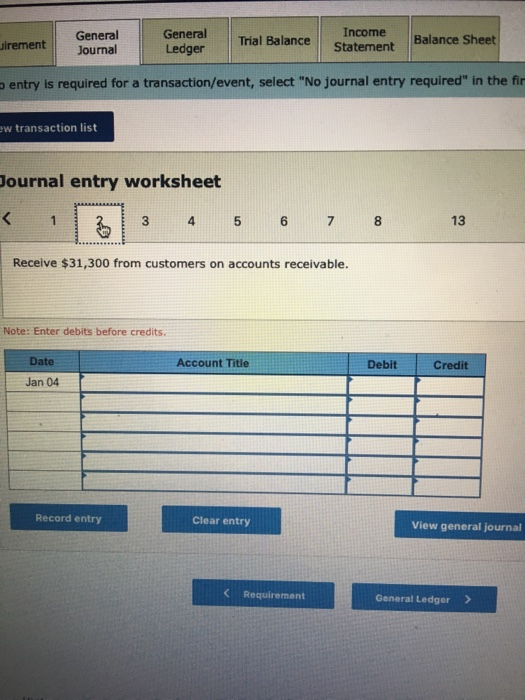

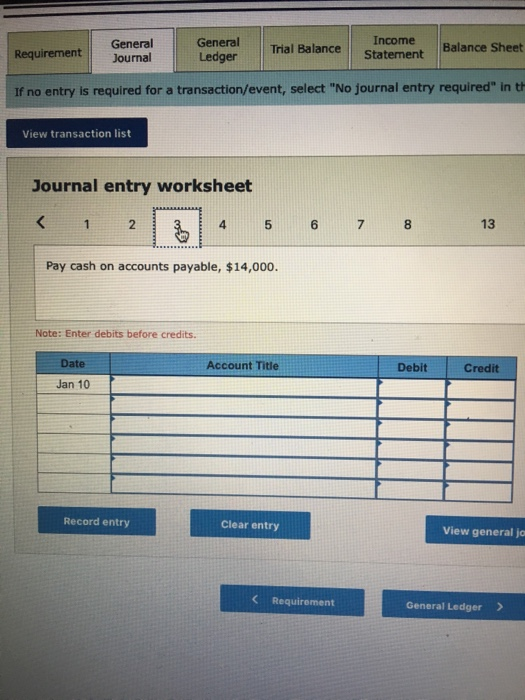

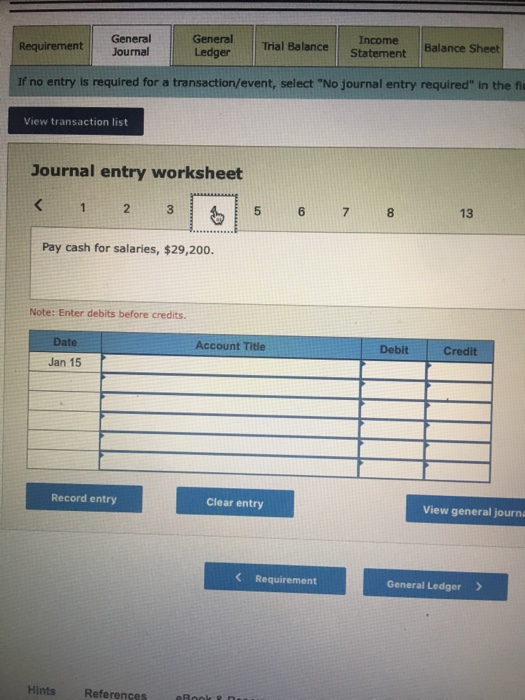

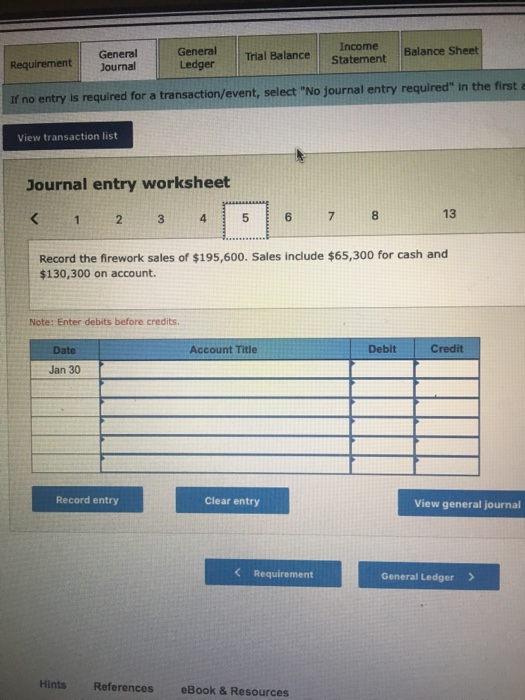

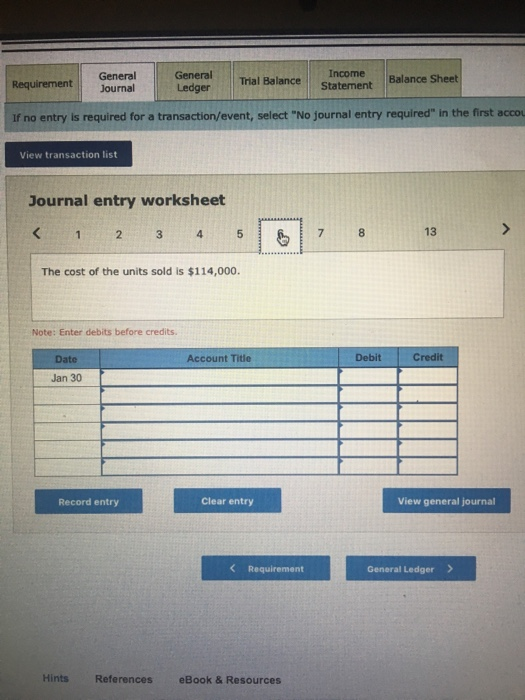

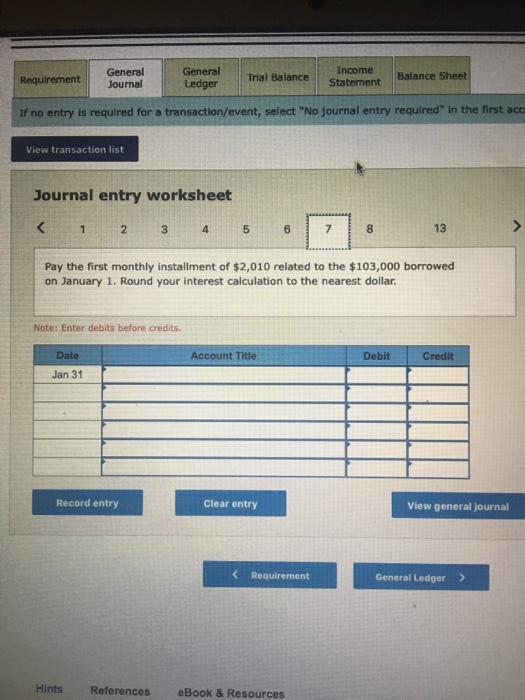

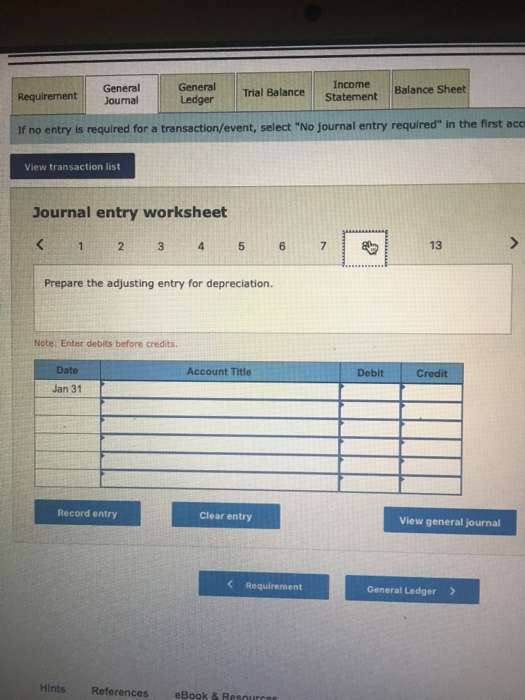

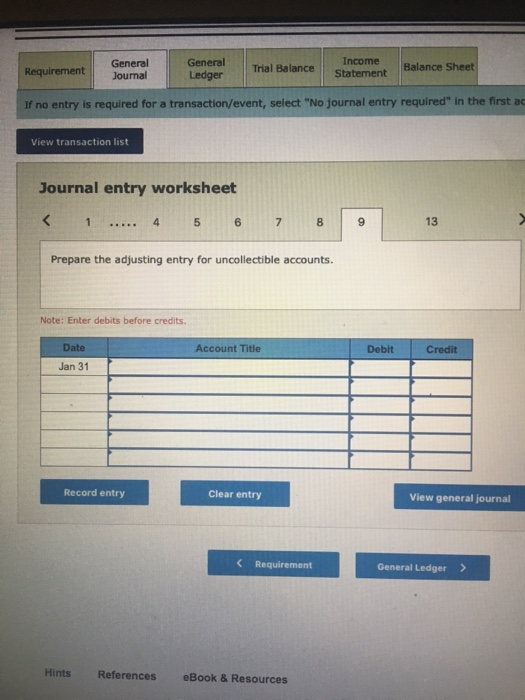

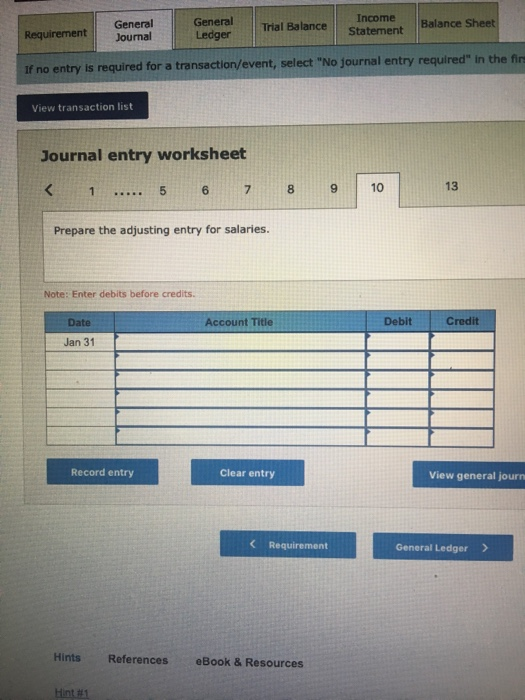

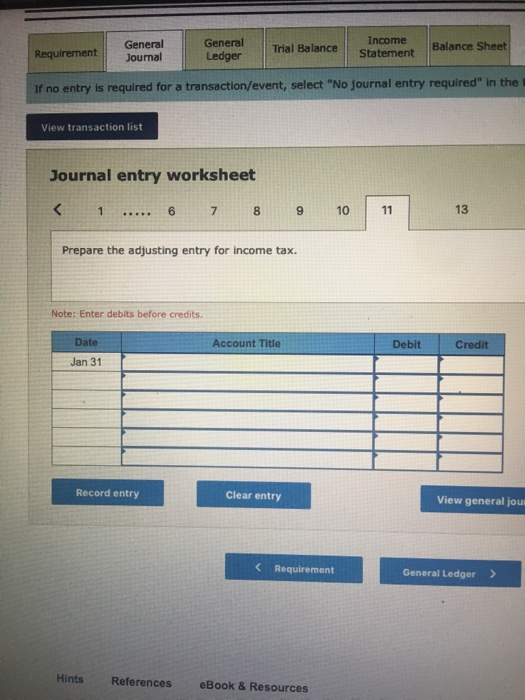

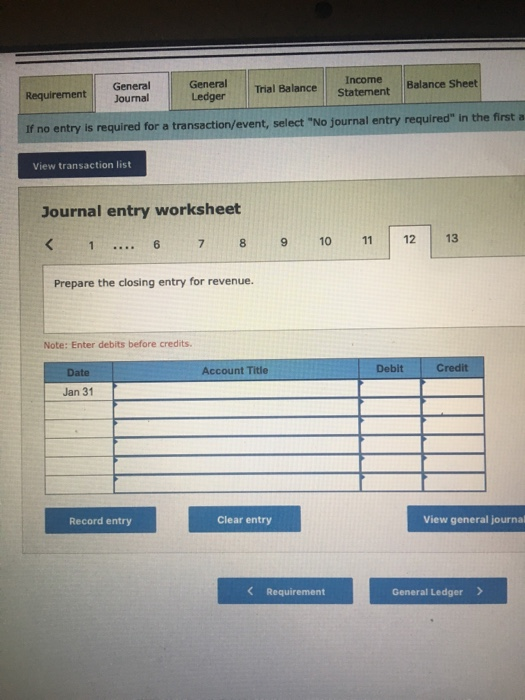

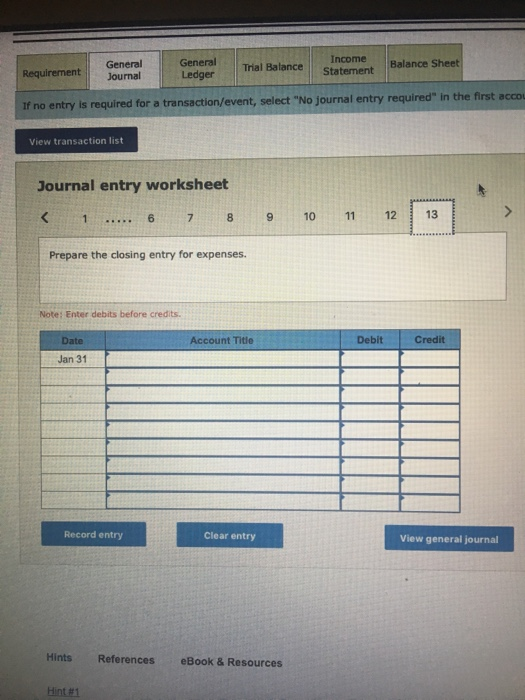

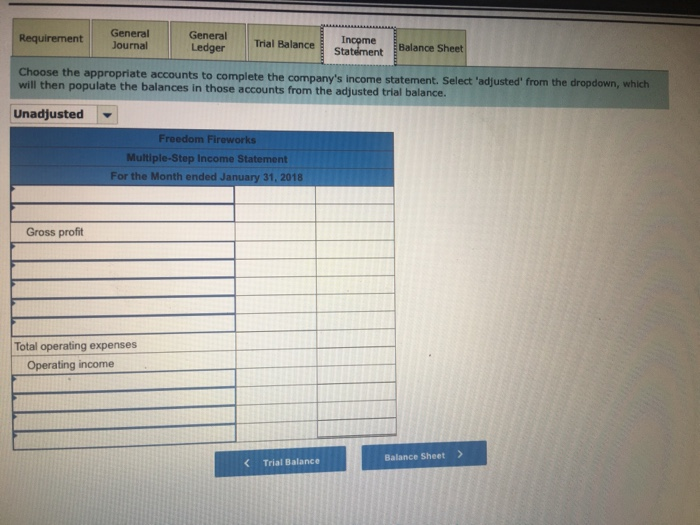

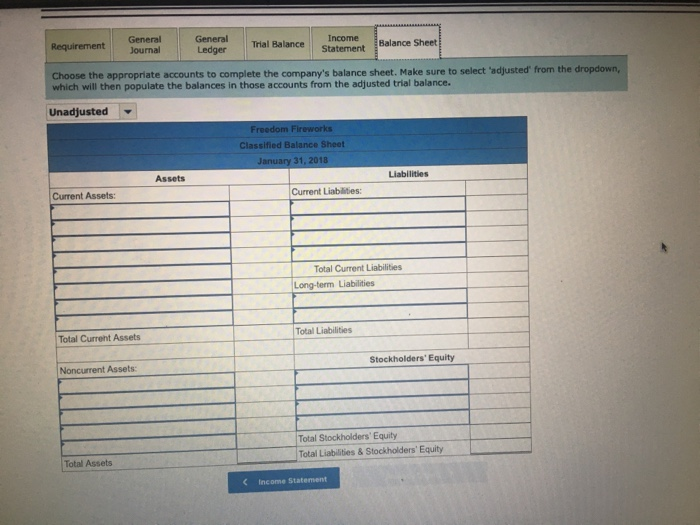

On January 1, 2018, the general ledger of Freedom Fireworks includes the following ending account balances: Cash Land Buildings Allowance for Unoollectible Accounts S11,500 34,600 152,300 70,300 123,000 2,100 9,900 21,000 203,000 155,700 Common Stock Totals $391,700 $391,700 During January 2018, the following transactions occur January 1 Borrow $103,000 from Captive Credit Corporation. The instalment note bears interest at 6% annually and matures in 5 yoars. Payments of $2,010 are required at the end of oach month for 60 months. January 4 Receive $31,300 from customers on accounts receivable. January 10 Pay cash on accounts payable, $14,000. January 15 Pay cash for salaries, $29,200 January 30 Firework sales for the month total $195,600. Sales include $65,300 for cash and $130,300 on account. The cost of the units sold is $114.000 January 31 Pay the first monthly installment of $2,010 related to the $103,000 borrowed on January 1 Round your interest caloulation to the nearest dollar The following information is available on January 31, 2018. a. Depreciation on the building for the month of January is calculated using the straight-line method. At the time the building was purchased, the company estimated a service l'e of 10 years and a residual value of $24,600 b. The company estimates future uncollectible accounts. At the end of January, considering the total ending balance of the accounts receivable account, $3,300 is now past due (older than 90 days), while the remainder of the balance is rent (ess than 90 days old). The company estimates that 50% of the past de balance be uno le ble and only 2% ofthe current balance will become un oli tble hint use the January 31 ao unts recevable baan aluated in the general i er c. Unpaid salaries at the end of January are $26,400. d. Accrued income taxes at the end of January are $8,300. GeneralTrial Balance Statement Requirement General Statement Balance Sheet ournal If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View trans ction list

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts