Question: Please, I need help with this problem Tom and Jerry are divisions within the Iron Company and are investment responsibility centers, with rewards based on

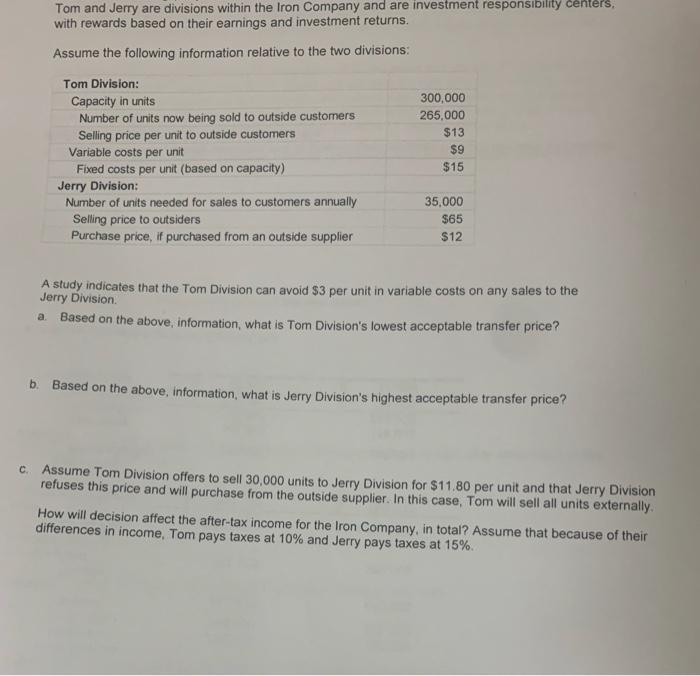

Tom and Jerry are divisions within the Iron Company and are investment responsibility centers, with rewards based on their earnings and investment returns. Assume the following information relative to the two divisions: n Tom Division: Capacity in units Number of units now being sold to outside customers Selling price per unit to outside customers Variable costs per unit Fixed costs per unit (based on capacity) Jerry Division: Number of units needed for sales to customers annually Selling price to outsiders Purchase price, if purchased from an outside supplier 300,000 265,000 $13 $9 $15 35,000 $65 $12 A study indicates that the Tom Division can avoid $3 per unit in variable costs on any sales to the Jerry Division a. Based on the above, information, what is Tom Division's lowest acceptable transfer price? b Based on the above, information, what is Jerry Division's highest acceptable transfer price? c. Assume Tom Division offers to sell 30,000 units to Jerry Division for $11.80 per unit and that Jerry Division refuses this price and will purchase from the outside supplier. In this case, Tom will sell all units externally How will decision affect the after-tax income for the Iron Company, in total? Assume that because of their differences in income, Tom pays taxes at 10% and Jerry pays taxes at 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts