Question: Please I need help with this. QUESTION 1 Suppose a corporation currently has $500 Million of USDs in excess cash available to repurchase stock or

Please I need help with this.

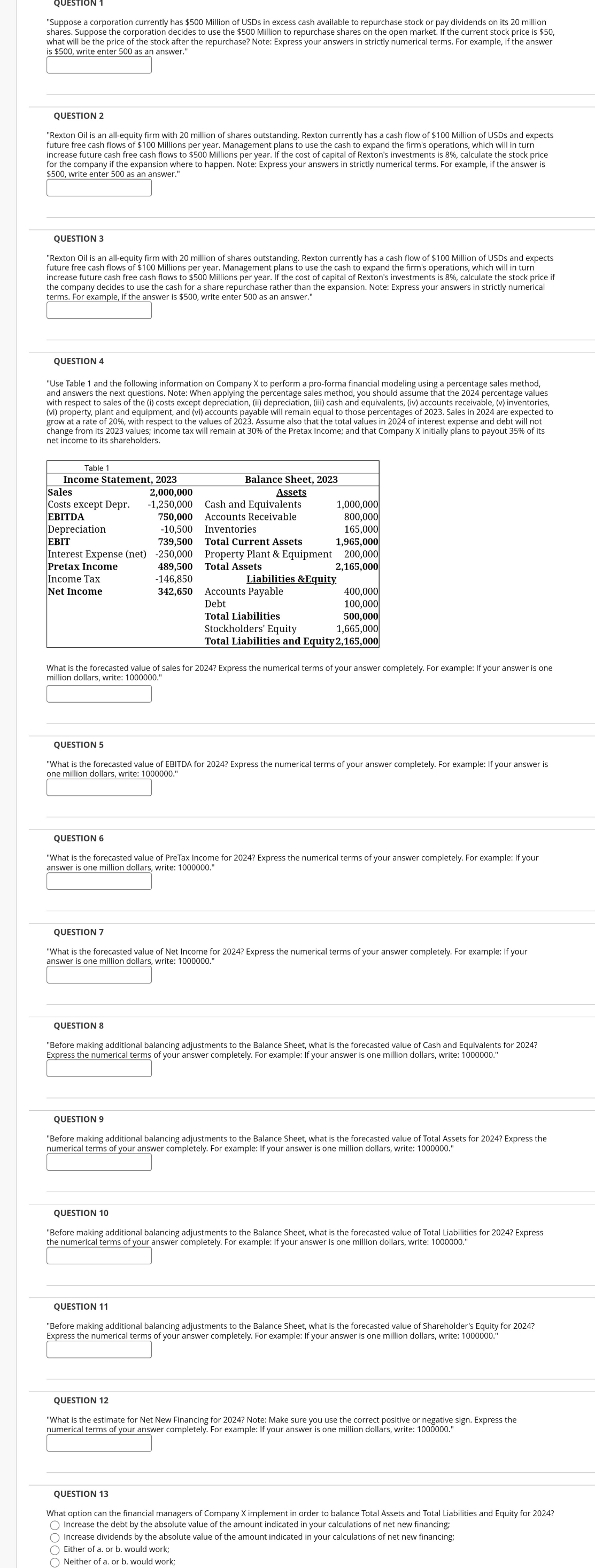

QUESTION 1 \"Suppose a corporation currently has $500 Million of USDs in excess cash available to repurchase stock or pay dividends on its 20 million shares. Suppose the corporation decides to use the $500 Million to repurchase shares on the open market. If the current stock price is $50, what will be the price of the stock after the repurchase? Note: Express your answers in strictly numerical terms. For example, if the answer is $500, write enter 500 as an answer." QUESTION 2 \"Rexton Oil is an all-equity firm with 20 million of shares outstanding. Rexton currently has a cash flow of $100 Million of USDs and expects future free cash flows of $100 Millions per year. Management plans to use the cash to expand the firm's operations, which will in turn increase future cash free cash flows to $500 Millions per year. If the cost of capital of Rexton's investments is 8%, calculate the stock price for the company if the expansion where to happen. Note: Express your answers in strictly numerical terms. For example, if the answer is $500, write enter 500 as an answer.\" QUESTION 3 "Rexton Oil is an all-equity firm with 20 million of shares outstanding. Rexton currently has a cash flow of $100 Million of USDs and expects future free cash flows of $100 Millions per year. Management plans to use the cash to expand the firm's operations, which will in turn increase future cash free cash flows to $500 Millions per year. If the cost of capital of Rexton's investments is 8%, calculate the stock price if the company decides to use the cash for a share repurchase rather than the expansion. Note: Express your answers in strictly numerical terms. For examlfls, if the answer is $500, write enter 500 as an answer." QUESTION 4 \"Use Table 1 and the following information on Company X to perform a pro-forma financial modeling using a percentage sales method, and answers the next questions. Note: When applying the percentage sales method, you should assume that the 2024 percentage values with respect to sales of the (i) costs except depreciation, (i) depreciation, (iii) cash and equivalents, (iv) accounts receivable, (v) inventories, (vi) property, plant and equipment, and (vi) accounts payable will remain equal to those percentages of 2023. Sales in 2024 are expected to grow at a rate of 20%, with respect to the values of 2023. Assume also that the total values in 2024 of interest expense and debt will not change from its 2023 values; income tax will remain at 30% of the Pretax Income; and that Company X initially plans to payout 35% of its net income to its shareholders. Table 1 Income Statement, 2023 Balance Sheet, 2023 Sales 2,000,000 Assets Costs except Depr. ~ -1,250,000 Cash and Equivalents 1,000,000| EBITDA 750,000 Accounts Receivable 800,000 Depreciation -10,500 Inventories 165,000 EBIT 739,500 Total Current Assets 1,965,000 Interest Expense (net) -250,000 Property Plant & Equipment 200,000 Pretax Income 489,500 Total Assets 2,165,000 Income Tax -146,850 Liabilities &Equity Net Income 342,650 Accounts Payable 400,000 Debt 100,000| Total Liabilities 500,000 Stockholders' Equity 1,665,000 Total Liabilities and Equity 2,165,000) What is the forecasted value of sales for 20242 Express the numerical terms of your answer completely. For example: If your answer is one million dollars, write: 1000000." QUESTION 5 \"What is the forecasted value of EBITDA for 20242 Express the numerical terms of your answer completely. For example: If your answer is one million dollars, write: 1000000." QUESTION 6 \"What is the forecasted value of PreTax Income for 2024? Express the numerical terms of your answer completely. For example: If your answer is one million dollars, write: 1000000." QUESTION 7 \"What is the forecasted value of Net Income for 20247 Express the numerical terms of your answer completely. For example: If your answer is one million dollars, write: 1000000." QUESTION 8 "Before making additional balancing adjustments to the Balance Sheet, what is the forecasted value of Cash and Equivalents for 2024? Ex%ress the numerical terms of your answer completely. For example: If your answer is one million dollars, write: 1000000." QUESTION 9 "Before making additional balancing adjustments to the Balance Sheet, what is the forecasted value of Total Assets for 20242 Express the numerical terms ol%ouranswer completely. For example: If your answer is one million dollars, write: 1000000." QUESTION 10 \"Before making additional balancing adjustments to the Balance Sheet, what is the forecasted value of Total Liabilities for 20247 Express the numerical terms of%wr answer completely. For example; If your answer is one million dollars, write; 1000000." QUESTION 11 "Before making additional balancing adjustments to the Balance Sheet, what is the forecasted value of Shareholder's Equity for 20247 Ex?resslhe numerical terms of your answer completely. For example: If your answer is one million dollars, write: 1000000 QUESTION 12 \"What is the estimate for Net New Financing for 2024? Note: Make sure you use the correct positive or negative sign. Express the numerical terms of %uuranswer(omp{ele\\y For example: If your answer is one million dollars, write: 1000000." QUESTION 13 What option can the financial managers of Company X implement in order to balance Total Assets and Total Liabilities and Equity for 20242 (O Increase the debt by the absolute value of the amount indicated in your calculations of net new financing: (O Increase dividends by the absolute value of the amount indicated in your calculations of net new financing: () Either of . or b. would work; (O Neither of a. or b. would work