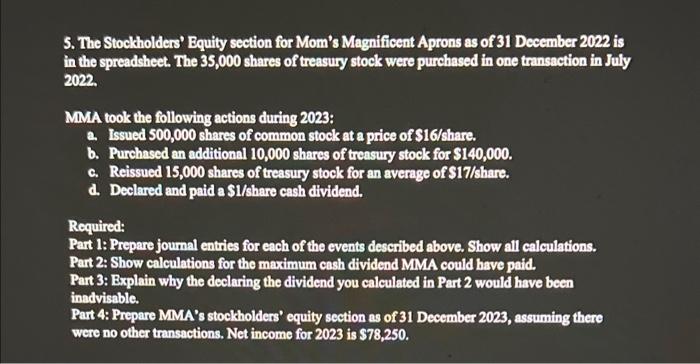

Question: please i need help with this question 5. The Stockholders' Equity section for Mom's Magnificent Aprons as of 31 December 2022 is in the spreadsheet.

5. The Stockholders' Equity section for Mom's Magnificent Aprons as of 31 December 2022 is in the spreadsheet. The 35,000 shares of treasury stock were purchased in one transaction in July 2022. MMA took the following actions during 2023: a. Issued 500,000 shares of common stock at a price of $16/ share. b. Purchased an additional 10,000 shares of treasury stock for $140,000. c. Reissued 15,000 shares of treasury stock for an average of $17/ share. d. Declared and paid a S1/share cash dividend. Required: Part 1: Prepare joumal entries for each of the events described above. Show all calculations. Part 2: Show calculations for the maximum cash dividend MMA could have paid. Part 3: Bxplain why the declaring the dividend you calculated in Part 2 would have been inadvisable. Part 4: Prepare MMA's stockholders' equity section as of 31 December 2023, assuming there were no other transactions. Net income for 2023 is $78,250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts