Question: Please, I need help with this questions? If a satisfactory result is not reached during an IRS examination with the IRS, the taxpayer can litigate

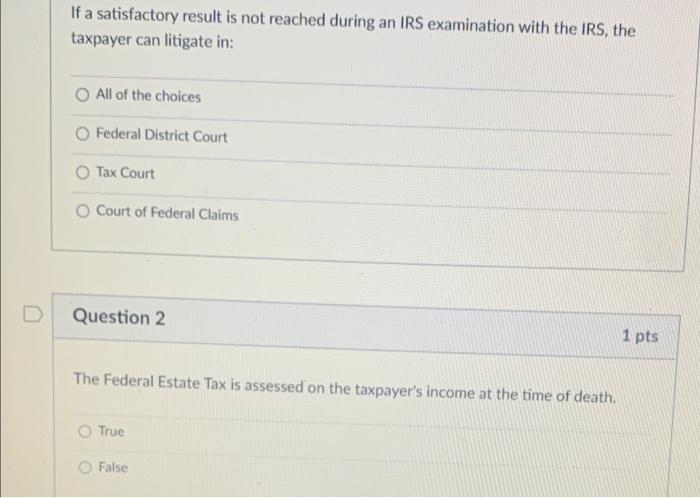

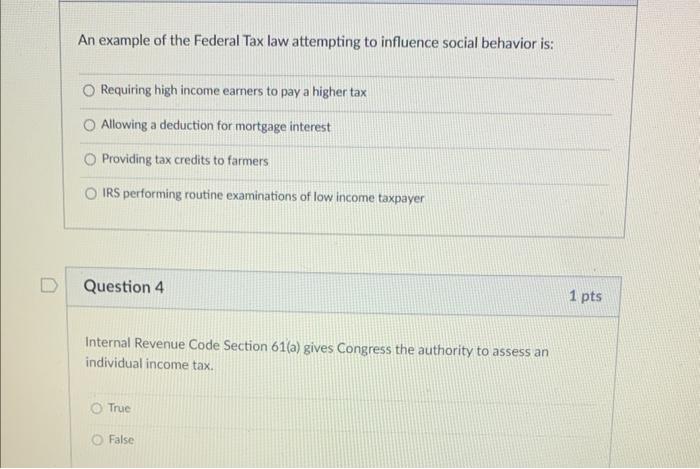

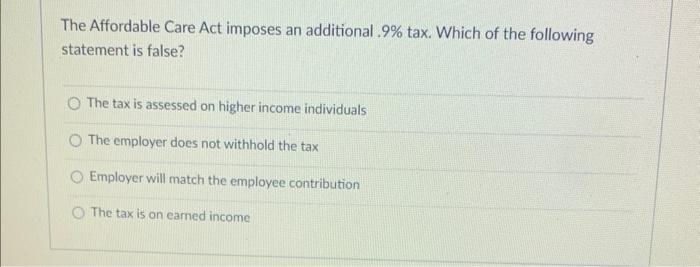

If a satisfactory result is not reached during an IRS examination with the IRS, the taxpayer can litigate in: All of the choices Federal District Court Tax Court Court of Federal Claims Question 2 The Federal Estate Tax is assessed on the taxpayer's income at the time of death. True False An example of the Federal Tax law attempting to influence social behavior is: Requiring high income eamers to pay a higher tax Allowing a deduction for mortgage interest Providing tax credits to farmers IRS performing routine examinations of low income taxpayer Question 4 Internal Revenue Code Section 61(a) gives Congress the authority to assess an individual income tax. True False The Affordable Care Act imposes an additional 9% tax. Which of the following statement is false? The tax is assessed on higher income individuals The employer does not withhold the tax Employer will match the employee contribution The tax is on eamed income If a satisfactory result is not reached during an IRS examination with the IRS, the taxpayer can litigate in: All of the choices Federal District Court Tax Court Court of Federal Claims Question 2 The Federal Estate Tax is assessed on the taxpayer's income at the time of death. True False An example of the Federal Tax law attempting to influence social behavior is: Requiring high income eamers to pay a higher tax Allowing a deduction for mortgage interest Providing tax credits to farmers IRS performing routine examinations of low income taxpayer Question 4 Internal Revenue Code Section 61(a) gives Congress the authority to assess an individual income tax. True False The Affordable Care Act imposes an additional 9% tax. Which of the following statement is false? The tax is assessed on higher income individuals The employer does not withhold the tax Employer will match the employee contribution The tax is on eamed income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts