Question: Please, I need help You will need you to create a spreadsheet /proforma of the cash flows All you have to do is layout the

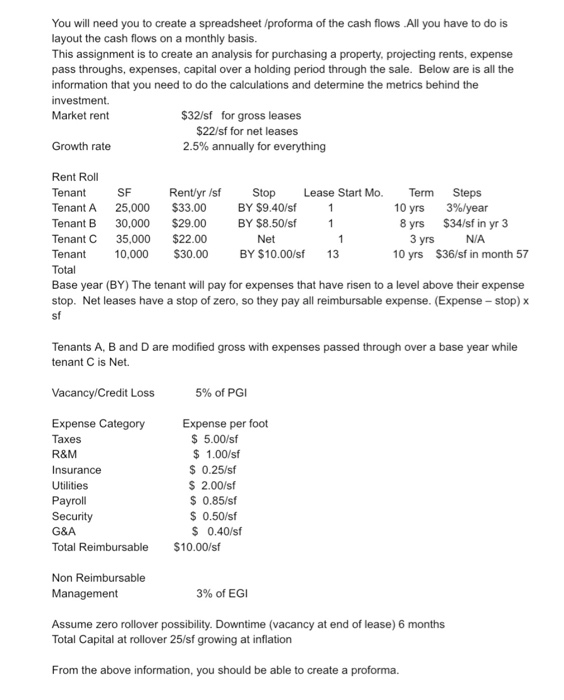

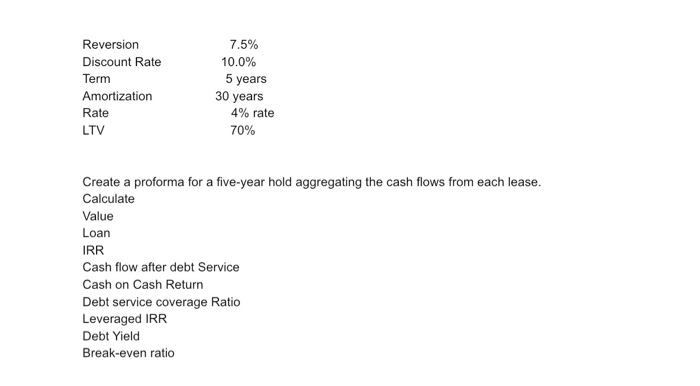

You will need you to create a spreadsheet /proforma of the cash flows All you have to do is layout the cash flows on a monthly basis. This assignment is to create an analysis for purchasing a property, projecting rents, expense pass throughs, expenses, capital over a holding period through the sale. Below are is all the information that you need to do the calculations and determine the metrics behind the investment. Market rent $32/sf for gross leases $22/sf for net leases 2.5% annually for everything Growth rate Rent Roll Tenant Rentlyr Isf Stop Lease Start Mo. Term Steps SF Tenant A 25,000 $33.00 BY $9.40/sf 10yrs 3%/year 8 yrs $34/sf in yr3 3 yrs 10 yrs $36/sf in month 57 BY $8.50/sf Tenant B 30,000 $29.00 Tenant C 35,000 $22.00 Tenant 10,000 $30.00 Net N/A BY $10.00/sf 13 Total Base year (BY) The tenant will pay for expenses that have risen to a level above their expense stop. Net leases have a stop of zero, so they pay all reimbursable expense. (Expense - stop) x sf Tenants A, B and D are modified gross with expenses passed through over a base year while tenant C is Net. Vacancy/Credit Loss 5% of PGI Expense Category Expense per foot $ 5.00/sf 1.00/sf Taxes R&M $ 0.25/sf Insurance S 2.00/sf 0.85/sf S 0.50/sf Utilities Payroll Security S 0.40/sf Total Reimbursable $10.00/sf G&A Non Reimbursable Management 3% of EGI Assume zero rollover possibility. Downtime (vacancy at end of lease) 6 months Total Capital at rollover 25/sf growing at inflation From the above information, you should be able to create a proforma. Reversion 10.0% Discount Rate Term 5 years 30 years 4% rate Amortization Rate 70% LTV Create a proforma for a five-year hold aggregating the cash flows from each lease Calculate Value Loan IRR Cash flow after debt Service Cash on Cash Return Debt service coverage Ratio Leveraged IRR Debt Yield Break-even ratio You will need you to create a spreadsheet /proforma of the cash flows All you have to do is layout the cash flows on a monthly basis. This assignment is to create an analysis for purchasing a property, projecting rents, expense pass throughs, expenses, capital over a holding period through the sale. Below are is all the information that you need to do the calculations and determine the metrics behind the investment. Market rent $32/sf for gross leases $22/sf for net leases 2.5% annually for everything Growth rate Rent Roll Tenant Rentlyr Isf Stop Lease Start Mo. Term Steps SF Tenant A 25,000 $33.00 BY $9.40/sf 10yrs 3%/year 8 yrs $34/sf in yr3 3 yrs 10 yrs $36/sf in month 57 BY $8.50/sf Tenant B 30,000 $29.00 Tenant C 35,000 $22.00 Tenant 10,000 $30.00 Net N/A BY $10.00/sf 13 Total Base year (BY) The tenant will pay for expenses that have risen to a level above their expense stop. Net leases have a stop of zero, so they pay all reimbursable expense. (Expense - stop) x sf Tenants A, B and D are modified gross with expenses passed through over a base year while tenant C is Net. Vacancy/Credit Loss 5% of PGI Expense Category Expense per foot $ 5.00/sf 1.00/sf Taxes R&M $ 0.25/sf Insurance S 2.00/sf 0.85/sf S 0.50/sf Utilities Payroll Security S 0.40/sf Total Reimbursable $10.00/sf G&A Non Reimbursable Management 3% of EGI Assume zero rollover possibility. Downtime (vacancy at end of lease) 6 months Total Capital at rollover 25/sf growing at inflation From the above information, you should be able to create a proforma. Reversion 10.0% Discount Rate Term 5 years 30 years 4% rate Amortization Rate 70% LTV Create a proforma for a five-year hold aggregating the cash flows from each lease Calculate Value Loan IRR Cash flow after debt Service Cash on Cash Return Debt service coverage Ratio Leveraged IRR Debt Yield Break-even ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts