Question: please i need it as soon as possible :( !! QUESTION 14 Growth Co has decided to acquire one of its major competitors Cerxit Co.

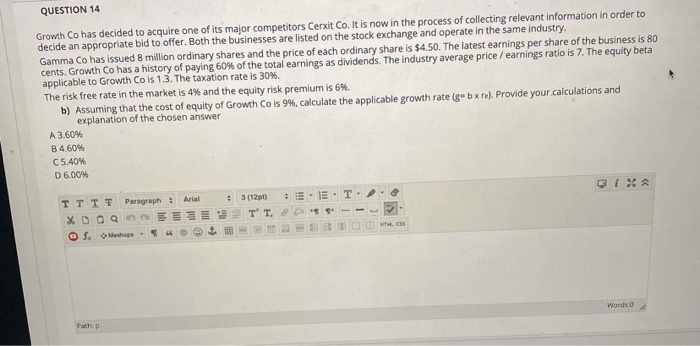

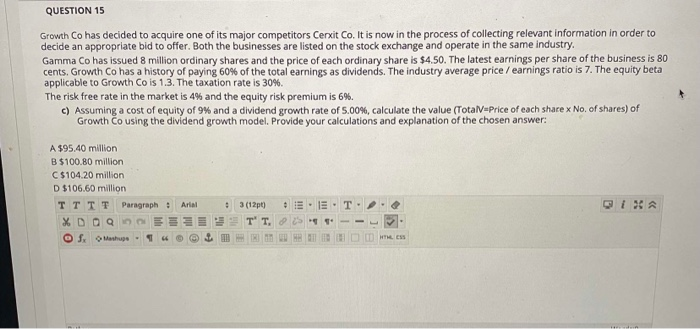

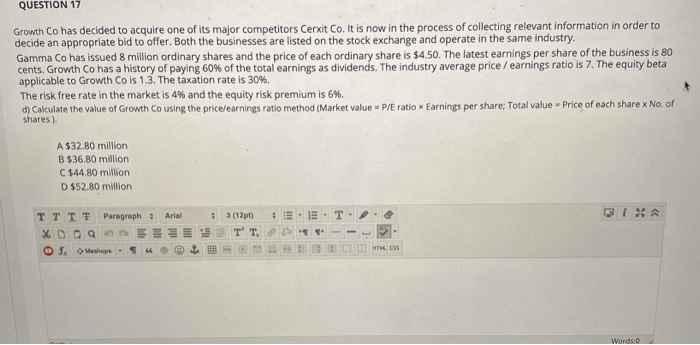

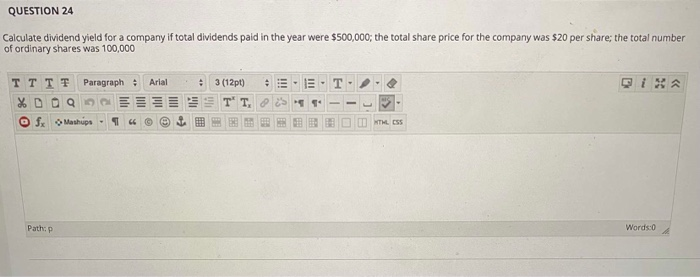

QUESTION 14 Growth Co has decided to acquire one of its major competitors Cerxit Co. It is now in the process of collecting relevant information in order to decide an appropriate bid to offer. Both the businesses are listed on the stock exchange and operate in the same industry. Gamma Co has issued 8 million ordinary shares and the price of each ordinary share is $4.50. The latest earnings per share of the business is 80 cents. Growth Co has a history of paying 60% of the total earnings as dividends. The industry average price / earnings ratio is 7. The equity beta applicable to Growth Co is 1.3. The taxation rate is 30%, The risk free rate in the market is 4% and the equity risk premium is 6%. b) Assuming that the cost of equity of Growth Co is 9%, calculate the applicable growth rate (g" bxre). Provide your calculations and explanation of the chosen answer A 3.60% B 4,60% C 5.40% D 6.0096 3 (121) !!! Arial III TTTT Paragraph XDOQ O S. Mashup Words PHP QUESTION 15 Growth Co has decided to acquire one of its major competitors Cerxit Co. It is now in the process of collecting relevant information in order to decide an appropriate bid to offer. Both the businesses are listed on the stock exchange and operate in the same industry. Gamma Co has issued 8 million ordinary shares and the price of each ordinary share is $4.50. The latest earnings per share of the business is 80 cents. Growth Co has a history of paying 60% of the total earnings as dividends. The industry average price / earnings ratio is 7. The equity beta applicable to Growth Co is 1.3. The taxation rate is 30%. The risk free rate in the market is 4% and the equity risk premium is 6%. c) Assuming a cost of equity of 9% and a dividend growth rate of 5.00%, calculate the value (Total =Price of each share x No. of shares) of Growth Co using the dividend growth model. Provide your calculations and explanation of the chosen answer: A $95.40 million B $100.80 million C$104.20 million D $106.60 million TT TT Paragraph : XDD Sx Mashup Aria . 1 { 3 (12 . T' T, 25 - THE QUESTION 17 Growth Co has decided to acquire one of its major competitors Cerxit Co. It is now in the process of collecting relevant information in order to decide an appropriate bid to offer. Both the businesses are listed on the stock exchange and operate in the same industry. Gamma Co has issued 8 million ordinary shares and the price of each ordinary share is $4.50. The latest earnings per share of the business is 80 cents. Growth Co has a history of paying 60% of the total earnings as dividends. The industry average price / earnings ratio is 7. The equity beta applicable to Growth Co is 1.3. The taxation rate is 30%. The risk free rate in the market is 4% and the equity risk premium is 6%. d) Calculate the value of Growth Co using the price/earnings ratio method (Market value P/E ratio * Earnings per share; Total value - Price of each share x No. of shares) A $32.80 million B $36.80 million C $44.80 million D$52.80 million Arial TIT TT TT Paragraph %DOQ OS Mashup 3 (12pt) T T HTML CSS Words:0 QUESTION 24 Calculate dividend yield for a company if total dividends paid in the year were $500,000; the total share price for the company was $20 per share the total number of ordinary shares was 100,000 Paragraph Arial III %DOO T 3 (12pt) + T T S fx Mashups BEBE I MTML CSS Path:p Words:0 QUESTION 23 A CL Company bond has a 10% coupon rate and a $1000 face value. Interest is paid semiannually, and the bond has 20 years to maturity. If investors require a 12% yield, what is the bond value and the effective annual yield on the bond? E-T { TTTT Paragraph # Arial %DOQ fx Mashups 3 (12pt) TT. - HTML CSS Path:p Words:0 QUESTION 22 If the sales volume increased by 10% by how much would the EBIT increase? Give your answer in percentage and in Dirhams. If the sales volume increased by 5% by how much would EPS increase? Give your answer in percentage and in Dirhams. If the EBIT increased by 20%, by how much would EPS increase? Give you answer in percentage and Dirhams The sales manager would like to increase net income by 30%. What percentage change in sales is required to achieve this goal? . iii Qia 111 TTTT Paragraph : Arial X DOO O S. Mashups - 14 3(12pt) T' T. HTML CSS Words:0 Patho QUESTION 14 Growth Co has decided to acquire one of its major competitors Cerxit Co. It is now in the process of collecting relevant information in order to decide an appropriate bid to offer. Both the businesses are listed on the stock exchange and operate in the same industry. Gamma Co has issued 8 million ordinary shares and the price of each ordinary share is $4.50. The latest earnings per share of the business is 80 cents. Growth Co has a history of paying 60% of the total earnings as dividends. The industry average price / earnings ratio is 7. The equity beta applicable to Growth Co is 1.3. The taxation rate is 30%, The risk free rate in the market is 4% and the equity risk premium is 6%. b) Assuming that the cost of equity of Growth Co is 9%, calculate the applicable growth rate (g" bxre). Provide your calculations and explanation of the chosen answer A 3.60% B 4,60% C 5.40% D 6.0096 3 (121) !!! Arial III TTTT Paragraph XDOQ O S. Mashup Words PHP QUESTION 15 Growth Co has decided to acquire one of its major competitors Cerxit Co. It is now in the process of collecting relevant information in order to decide an appropriate bid to offer. Both the businesses are listed on the stock exchange and operate in the same industry. Gamma Co has issued 8 million ordinary shares and the price of each ordinary share is $4.50. The latest earnings per share of the business is 80 cents. Growth Co has a history of paying 60% of the total earnings as dividends. The industry average price / earnings ratio is 7. The equity beta applicable to Growth Co is 1.3. The taxation rate is 30%. The risk free rate in the market is 4% and the equity risk premium is 6%. c) Assuming a cost of equity of 9% and a dividend growth rate of 5.00%, calculate the value (Total =Price of each share x No. of shares) of Growth Co using the dividend growth model. Provide your calculations and explanation of the chosen answer: A $95.40 million B $100.80 million C$104.20 million D $106.60 million TT TT Paragraph : XDD Sx Mashup Aria . 1 { 3 (12 . T' T, 25 - THE QUESTION 17 Growth Co has decided to acquire one of its major competitors Cerxit Co. It is now in the process of collecting relevant information in order to decide an appropriate bid to offer. Both the businesses are listed on the stock exchange and operate in the same industry. Gamma Co has issued 8 million ordinary shares and the price of each ordinary share is $4.50. The latest earnings per share of the business is 80 cents. Growth Co has a history of paying 60% of the total earnings as dividends. The industry average price / earnings ratio is 7. The equity beta applicable to Growth Co is 1.3. The taxation rate is 30%. The risk free rate in the market is 4% and the equity risk premium is 6%. d) Calculate the value of Growth Co using the price/earnings ratio method (Market value P/E ratio * Earnings per share; Total value - Price of each share x No. of shares) A $32.80 million B $36.80 million C $44.80 million D$52.80 million Arial TIT TT TT Paragraph %DOQ OS Mashup 3 (12pt) T T HTML CSS Words:0 QUESTION 24 Calculate dividend yield for a company if total dividends paid in the year were $500,000; the total share price for the company was $20 per share the total number of ordinary shares was 100,000 Paragraph Arial III %DOO T 3 (12pt) + T T S fx Mashups BEBE I MTML CSS Path:p Words:0 QUESTION 23 A CL Company bond has a 10% coupon rate and a $1000 face value. Interest is paid semiannually, and the bond has 20 years to maturity. If investors require a 12% yield, what is the bond value and the effective annual yield on the bond? E-T { TTTT Paragraph # Arial %DOQ fx Mashups 3 (12pt) TT. - HTML CSS Path:p Words:0 QUESTION 22 If the sales volume increased by 10% by how much would the EBIT increase? Give your answer in percentage and in Dirhams. If the sales volume increased by 5% by how much would EPS increase? Give your answer in percentage and in Dirhams. If the EBIT increased by 20%, by how much would EPS increase? Give you answer in percentage and Dirhams The sales manager would like to increase net income by 30%. What percentage change in sales is required to achieve this goal? . iii Qia 111 TTTT Paragraph : Arial X DOO O S. Mashups - 14 3(12pt) T' T. HTML CSS Words:0 Patho

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts