Question: Please I need it in Excel 1. You are considering purchasing a 45,000 rentable sf office building. You project a $30.50 full service rental rate

Please I need it in Excel

Please I need it in Excel

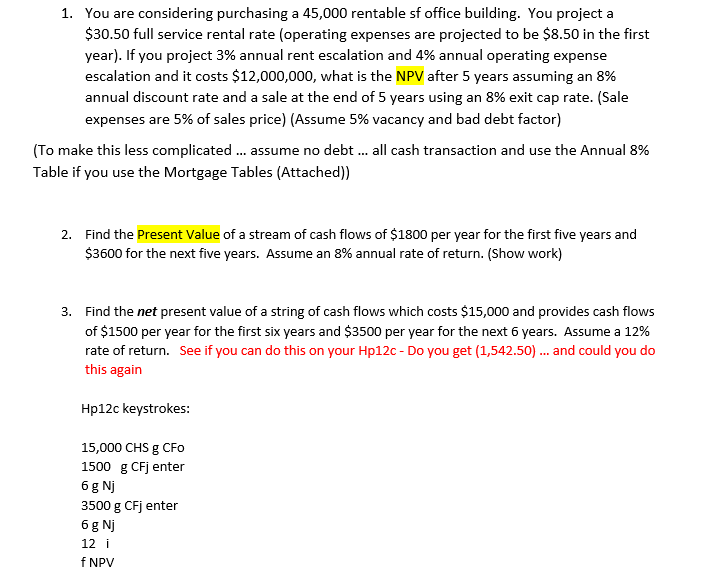

1. You are considering purchasing a 45,000 rentable sf office building. You project a $30.50 full service rental rate (operating expenses are projected to be $8.50 in the first year). If you project 3% annual rent escalation and 4% annual operating expense escalation and it costs $12,000,000, what is the NPV after 5 years assuming an 8% annual discount rate and a sale at the end of 5 years using an 8% exit cap rate. (Sale expenses are 5% of sales price) (Assume 5% vacancy and bad debt factor) (To make this less complicated ... assume no debt ... all cash transaction and use the Annual 8% Table if you use the Mortgage Tables (Attached)) 2. Find the Present Value of a stream of cash flows of $1800 per year for the first five years and $3600 for the next five years. Assume an 8% annual rate of return. (Show work) 3. Find the net present value of a string of cash flows which costs $15,000 and provides cash flows of $1500 per year for the first six years and $3500 per year for the next 6 years. Assume a 12% rate of return. See if you can do this on your Hp 12c-Do you get (1,542.50) ... and could you do this again Hp12c keystrokes: 15,000 CHS g CFO 1500 g CFj enter 6 g Nj 3500 g CFj enter 6 g Nj 12 i f NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts