Question: please i need it now!!!! it's all the same question..please Sol-Electronics Company starts from November 1, 2020. The company's accounting year end is December 31.

please i need it now!!!! it's all the same question..please

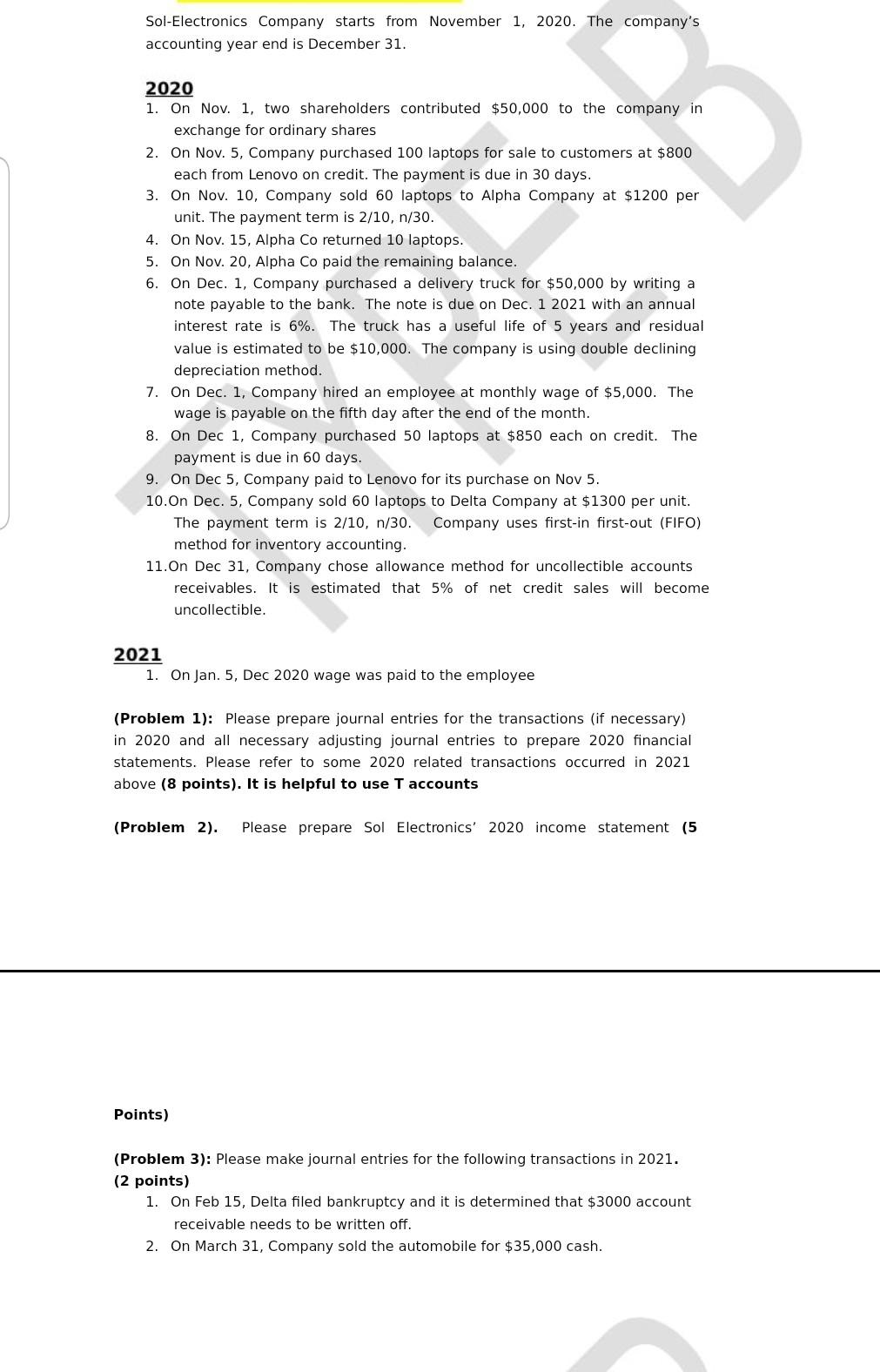

Sol-Electronics Company starts from November 1, 2020. The company's accounting year end is December 31. 2020 1. On Nov. 1, two shareholders contributed $50,000 to the company in exchange for ordinary shares 2. On Nov. 5, Company purchased 100 laptops for sale to customers at $800 each from Lenovo on credit. The payment is due in 30 days. 3. On Nov. 10, Company sold 60 laptops to Alpha Company at $1200 per unit. The payment term is 2/10, n/30. 4. On Nov. 15, Alpha Co returned 10 laptops. 5. On Nov. 20, Alpha Co paid the remaining balance. 6. On Dec. 1, Company purchased a delivery truck for $50,000 by writing a note payable to the bank. The note is due on Dec. 1 2021 with an annual interest rate is 6%. The truck has a useful life of 5 years and residual value is estimated to be $10,000. The company is using double declining depreciation method. 7. On Dec. 1, Company hired an employee at monthly wage of $5,000. The wage is payable on the fifth day after the end of the month. 8. On Dec 1, Company purchased 50 laptops at $850 each on credit. The payment is due in 60 days. 9. On Dec 5, Company paid to Lenovo for its purchase on Nov 5. 10.On Dec. 5, Company sold 60 laptops to Delta Company at $1300 per unit. The payment term is 2/10, n/30. Company uses first in first-out (FIFO) method for inventory accounting. 11.On Dec 31, Company chose allowance method for uncollectible accounts receivables. It is estimated that 5% of net credit sales will become uncollectible. 2021 1. On Jan. 5, Dec 2020 wage was paid to the employee (Problem 1): Please prepare journal entries for the transactions (if necessary) in 2020 and all necessary adjusting journal entries to prepare 2020 financial statements. efer to some 2020 transactions in 2021 above (8 points). It is helpful to use T accounts (Problem 2). Please prepare Sol Electronics' 2020 income statement (5 Points) (Problem 3): Please make journal entries for the following transactions in 2021. (2 points) 1. On Feb 15, Delta filed bankruptcy and it is determined that $3000 account receivable needs to be written off. 2. On March 31, Company sold the automobile for $35,000 cash. Sol-Electronics Company starts from November 1, 2020. The company's accounting year end is December 31. 2020 1. On Nov. 1, two shareholders contributed $50,000 to the company in exchange for ordinary shares 2. On Nov. 5, Company purchased 100 laptops for sale to customers at $800 each from Lenovo on credit. The payment is due in 30 days. 3. On Nov. 10, Company sold 60 laptops to Alpha Company at $1200 per unit. The payment term is 2/10, n/30. 4. On Nov. 15, Alpha Co returned 10 laptops. 5. On Nov. 20, Alpha Co paid the remaining balance. 6. On Dec. 1, Company purchased a delivery truck for $50,000 by writing a note payable to the bank. The note is due on Dec. 1 2021 with an annual interest rate is 6%. The truck has a useful life of 5 years and residual value is estimated to be $10,000. The company is using double declining depreciation method. 7. On Dec. 1, Company hired an employee at monthly wage of $5,000. The wage is payable on the fifth day after the end of the month. 8. On Dec 1, Company purchased 50 laptops at $850 each on credit. The payment is due in 60 days. 9. On Dec 5, Company paid to Lenovo for its purchase on Nov 5. 10.On Dec. 5, Company sold 60 laptops to Delta Company at $1300 per unit. The payment term is 2/10, n/30. Company uses first in first-out (FIFO) method for inventory accounting. 11.On Dec 31, Company chose allowance method for uncollectible accounts receivables. It is estimated that 5% of net credit sales will become uncollectible. 2021 1. On Jan. 5, Dec 2020 wage was paid to the employee (Problem 1): Please prepare journal entries for the transactions (if necessary) in 2020 and all necessary adjusting journal entries to prepare 2020 financial statements. efer to some 2020 transactions in 2021 above (8 points). It is helpful to use T accounts (Problem 2). Please prepare Sol Electronics' 2020 income statement (5 Points) (Problem 3): Please make journal entries for the following transactions in 2021. (2 points) 1. On Feb 15, Delta filed bankruptcy and it is determined that $3000 account receivable needs to be written off. 2. On March 31, Company sold the automobile for $35,000 cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts