Question: please I need it urgent thanks only do Q 26 26. Please use the following data to answer the questions The company has a target

please I need it urgent thanks only do Q 26

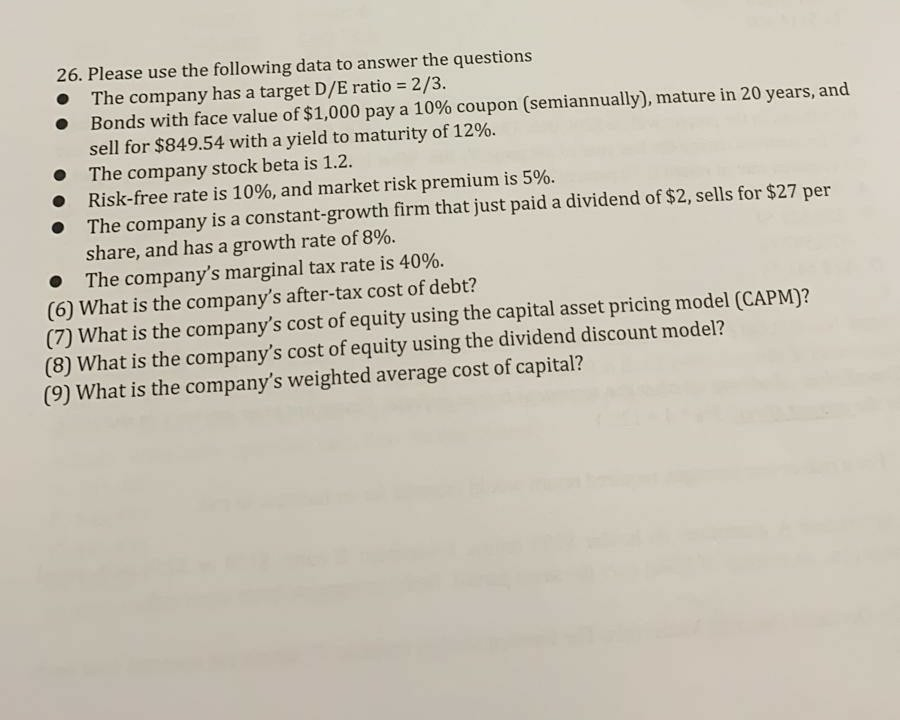

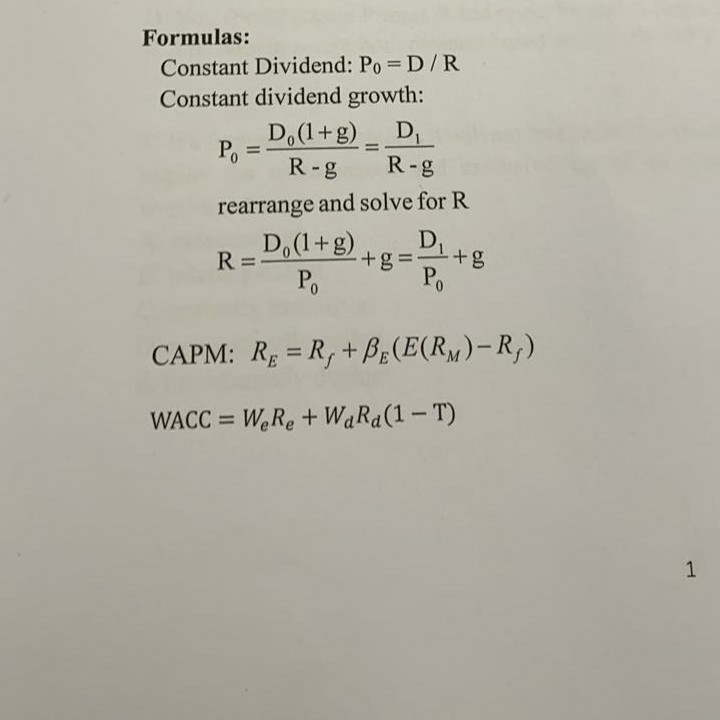

26. Please use the following data to answer the questions The company has a target D/E ratio = 2/3. Bonds with face value of $1,000 pay a 10% coupon (semiannually), mature in 20 years, and sell for $849.54 with a yield to maturity of 12%. The company stock beta is 1.2. Risk-free rate is 10%, and market risk premium is 5%. The company is a constant-growth firm that just paid a dividend of $2, sells for $27 per share, and has a growth rate of 8%. The company's marginal tax rate is 40%. (6) What is the company's after-tax cost of debt? (7) What is the company's cost of equity using the capital asset pricing model (CAPM)? (8) What is the company's cost of equity using the dividend discount model? (9) What is the company's weighted average cost of capital? Formulas: Constant Dividend: Po=D/R Constant dividend growth: P.-D,(1+g) D, R-g R-g rearrange and solve for R RD.(1+g) +.-D. + R =- P, Po CAPM: Rp = R,+BE(E(RM)-R,) WACC = W Re + WaRd(1-T)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts