Question: Please i need step by step solutions 28. (a) What is the cost of three August 35 call option contracts on BeTa stock given the

Please i need step by step solutions

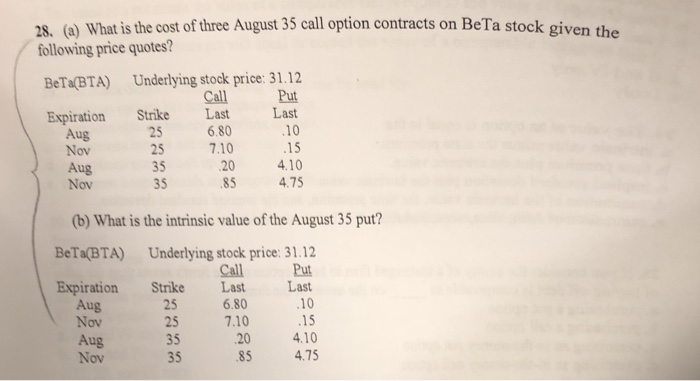

Please i need step by step solutions 28. (a) What is the cost of three August 35 call option contracts on BeTa stock given the following price quotes? BeTa(BTA) Underlying stock price: 31.12 Call Put Expiration Strike Last Last Aug Nov Aug Nov 25 35 35 6.80 7.10 20 85 .10 .15 4.10 4.75 (b) What is the intrinsic value of the August 35 put? BeTa(BTA) Underlying stock price: 31.12 Call Put Expiration Strike Last Last .10 .15 20 4.10 85 475 6.80 7.10 Aug Nov Aug Nov 25 25 35 35 28. (a) What is the cost of three August 35 call option contracts on BeTa stock given the following price quotes? BeTa(BTA) Underlying stock price: 31.12 Call Put Expiration Strike Last Last Aug Nov Aug Nov 25 35 35 6.80 7.10 20 85 .10 .15 4.10 4.75 (b) What is the intrinsic value of the August 35 put? BeTa(BTA) Underlying stock price: 31.12 Call Put Expiration Strike Last Last .10 .15 20 4.10 85 475 6.80 7.10 Aug Nov Aug Nov 25 25 35 35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts