Question: Please I need the answer as soon as possible 5. Harding Corporation acquired via a basket purchase real estate that contained land, building and equipment.

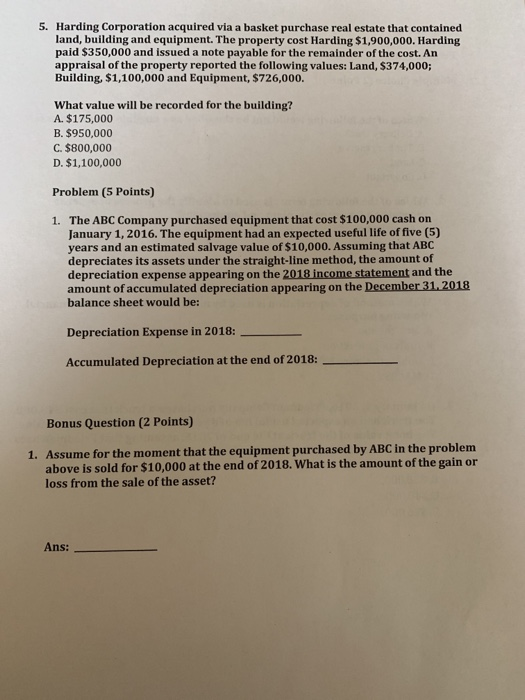

5. Harding Corporation acquired via a basket purchase real estate that contained land, building and equipment. The property cost Harding $1,900,000. Harding paid $350,000 and issued a note payable for the remainder of the cost. An appraisal of the property reported the following values: Land, $374,000; Building, $1,100,000 and Equipment, $726,000. What value will be recorded for the building? A. $175,000 B. $950,000 C. $800,000 D. $1,100,000 Problem (5 Points) The ABC Company purchased equipment that cost $100,000 cash on January 1, 2016. The equipment had an expected useful life of five (5) years and an estimated salvage value of $10,000. Assuming that ABC depreciates its assets under the straight-line method, the amount of depreciation expense appearing on the 2018 income statement and the amount of accumulated depreciation appearing on the December 312018 balance sheet would be: 1. Depreciation Expense in 2018:- Accumulated Depreciation at the end of 2018: Bonus Question (2 Points) Assume for the moment that the equipment purchased by ABC in the problem above is sold for $10,000 at the end of 2018. What is the amount of the gain or loss from the sale of the asset? 1. Ans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts