Question: please i need the answer Barren Enterprises is considering relaxing its credit standards to increase its currently sagging sales. As a result of the proposed

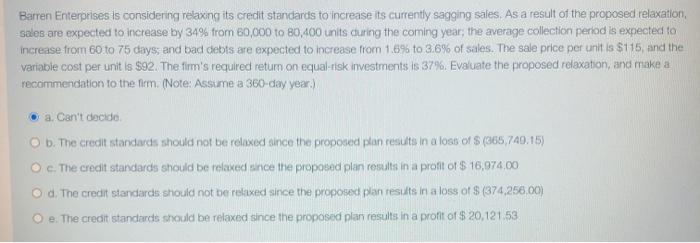

Barren Enterprises is considering relaxing its credit standards to increase its currently sagging sales. As a result of the proposed relaxation sales are expected to increase by 34% from 60,000 to 80,400 units curing the coming year, the average collection period is expected to increase from 60 to 75 days; and bad debts are expected to increase from 1.8% to 3.6% of sales. The sale price per unit is $115, and the variable cost per unit is $92. The firm's required return on equal risk investments is 37%. Evaluate the proposed relaxation, and make a recommendation to the liom (Note: Assume a 360-day year) a. Can't decide b. The credit standards should not be relaxed since the proposed plan results in a loss of $ (365,740.15) Oe. The credit standards should be relaxed since the proposed plan results in a profit or $ 16,974.00 d. The credit standards should not be relaxed since the proposed plan results in a loss of $ (374,256.00) Oe: The credit standards should be relaxed since the proposed plan results in a profit of $ 20,12153

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts