Question: Please I need the answer for question 5 as soon as possible 5. Harding Corporation acquired via a basket purchase real estate that contained land,

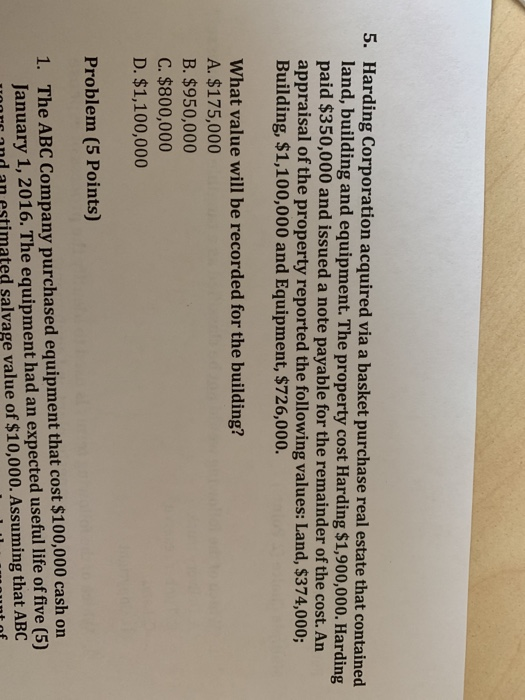

5. Harding Corporation acquired via a basket purchase real estate that contained land, building and equipment. The property cost Harding $1,900,000. Harding paid $350,000 and issued a note payable for the remainder of the cost. An appraisal of the property reported the following values: Land, $374,000; Building, $1,100,000 and Equipment, $726,000. What value will be recorded for the building? A. $175,000 B. $950,000 C. $800,000 D. $1,100,000 Problem (5 Points) The ABC Company purchased equipment that cost $100,000 cash on January 1, 2016. The equipment had an expected useful life of five (5) r nnd an estimated salvage value of $10,000. Assuming that ABC 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts