Question: please I need the answer on the Excel sheet I have hour left Suppose that you just purchased 300 shares of Beta Banana's stock for

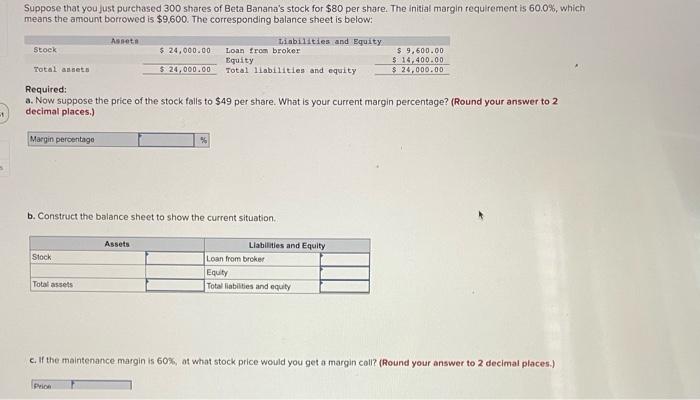

Suppose that you just purchased 300 shares of Beta Banana's stock for $80 per share. The initial margin requirement is 60.0%, which means the amount borrowed is $9,600. The corresponding balance sheet is below: Assets Liabilities and Equity Stock $ 24,000.00 Loan from broker $ 9,500.00 Equity $ 14,400.00 Total assets $ 24,000.00 Total liabilities and equity $ 24,000.00 Required: a. Now suppose the price of the stock falls to $49 per share. What is your current margin percentage? (Round your answer to 2 decimal places.) Margin percentage b. Construct the balance sheet to show the current situation. Assets Stock Liabilities and Equity Loan from broker Equity Total liabilities and equity Total assets c. If the maintenance margin is 60%, ot what stock price would you get a margin coll? (Round your answer to 2 decimal places.) Prion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts