Question: Please I need the answer to this question 41. Teri Frazier owned three businesses and rental properties in 2020. During the year, her hair salon

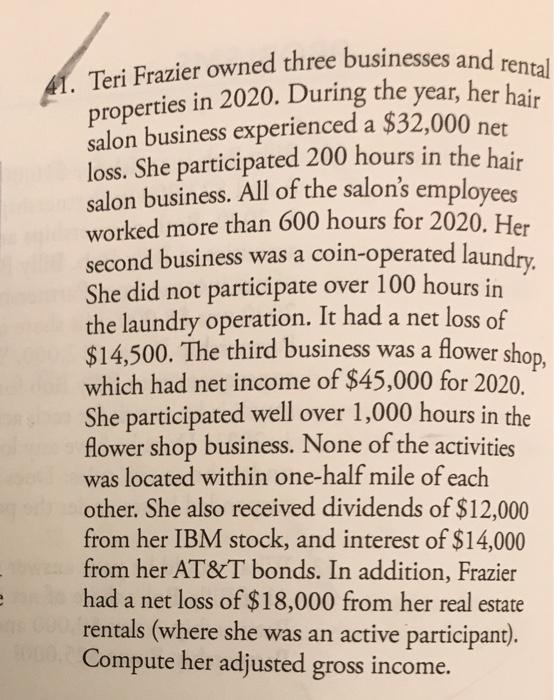

41. Teri Frazier owned three businesses and rental properties in 2020. During the year, her hair salon business experienced a $32,000 net loss. She participated 200 hours in the hair salon business. All of the salon's employees worked more than 600 hours for 2020. Her second business was a coin-operated laundry. She did not participate over 100 hours in the laundry operation. It had a net loss of $14,500. The third business was a flower shop, which had net income of $45,000 for 2020. She participated well over 1,000 hours in the flower shop business. None of the activities was located within one-half mile of each other. She also received dividends of $12,000 from her IBM stock, and interest of $14,000 from her AT&T bonds. In addition, Frazier had a net loss of $18,000 from her real estate rentals (where she was an active participant). Compute her adjusted gross income. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts