Question: please i need your help with both Jefferson inc's common stock currently trades at $55.00 a share. It is expected to pay an annual dividend

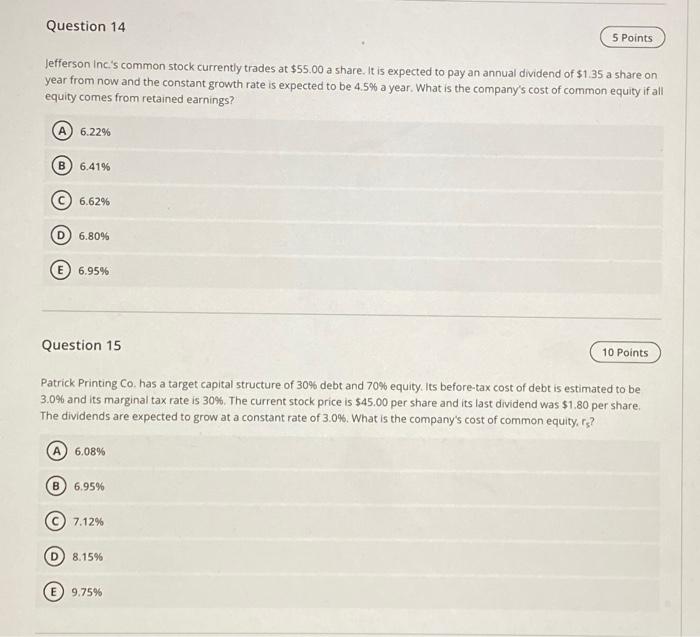

Jefferson inc's common stock currently trades at $55.00 a share. It is expected to pay an annual dividend of $1.35 a share on year from now and the constant growth rate is expected to be 4.5% a year. What is the company's cost of common equity if all equity comes from retained earnings? \begin{tabular}{|l|} \hline 6.22% \\ \hline 6.41% \\ \hline 6.62% \\ \hline 6.80% \\ \hline 6.95% \\ \hline \end{tabular} Question 15 Patrick Printing Co. has a target capital structure of 30% debt and 70% equity. Its before-tax cost of debt is estimated to be 3.0% and its marginal tax rate is 30%. The current stock price is $45.00 per share and its last dividend was $1.80 per share. The dividends are expected to grow at a constant rate of 3.0%. What is the company's cost of common equity, is? 6.08% 6.95% (C) 7.12% (D) 8.15% (E) 9.75%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts