Question: please, i need your help with both Your division is considering two projects with the following cash flows. Project A costs $175 million and has

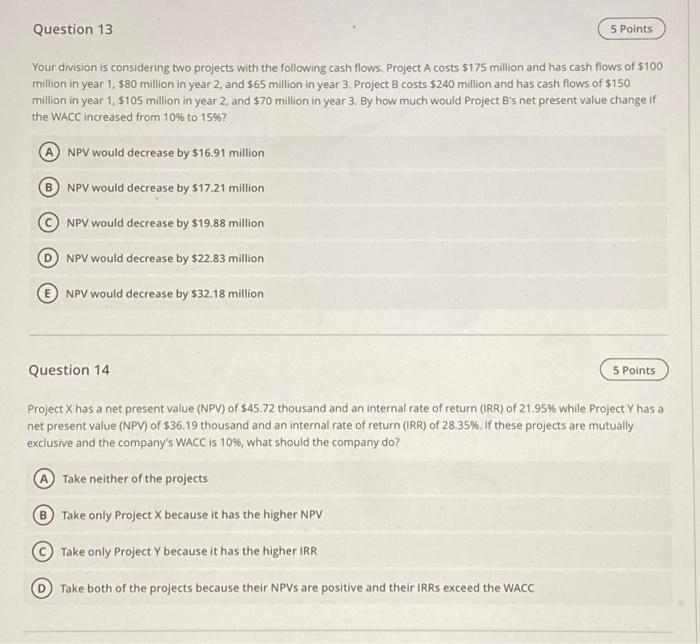

Your division is considering two projects with the following cash flows. Project A costs $175 million and has cash flows of $100 million in year 1, $80 million in year 2 , and $65 million in year 3. Project B costs $240 million and has cash flows of $150 million in year 1, \$105 million in year 2, and $70 million in year 3. By how much would Project B's net present value change if the WACC increased from 10% to 15% ? NPV would decrease by $16.91 million NPV would decrease by $17.21 million NPV would decrease by $19.88 million NPV would decrease by $22.83 million NPV would decrease by $32.18 million Question 14 Project X has a net present value (NPV) of $45.72 thousand and an internal rate of return (IRR) of 21.95% while Project Y has a net present value (NPV) of $36.19 thousand and an internal rate of return (IRR) of 28.35%. If these projects are mutually exclusive and the company's WACC is 10%, what should the company do? Take neither of the projects Take only Project X because it has the higher NPV Take only Project Y because it has the higher IRR Take both of the projects because their NPVs are positive and their IRRs exceed the WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts