Question: please i needbthe right answer! Elmo Inc. is a U.S. corporation with a branch office in foreign country Z. During the current year, Elmo had

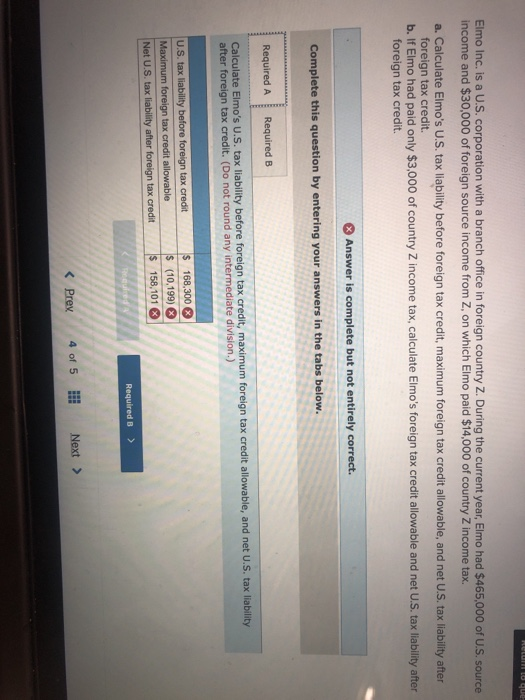

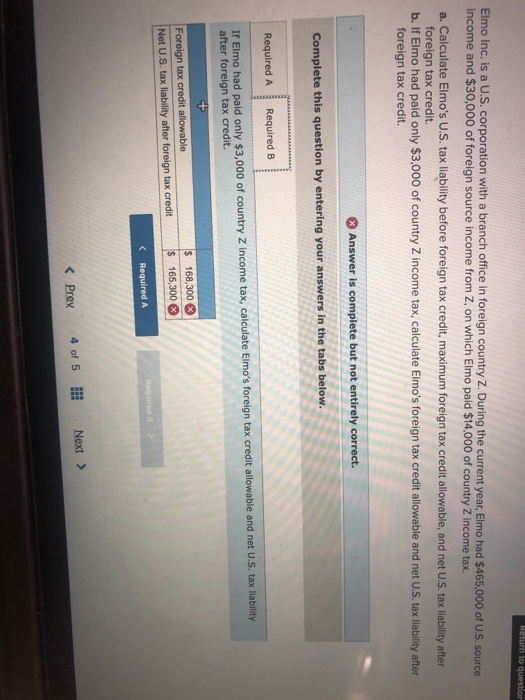

Elmo Inc. is a U.S. corporation with a branch office in foreign country Z. During the current year, Elmo had $465,000 of U.S. source income and $30,000 of foreign source income from Z, on which Elmo paid $14,000 of country Z income tax. a. Calculate Elmo's U.S. tax liability before foreign tax credit, maximum foreign tax credit allowable, and net U.S. tax liability after foreign tax credit. b. If Elmo had paid only $3,000 of country Z income tax, calculate Elmo's foreign tax credit allowable and net U.S. tax liability after foreign tax credit. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required ARequired B tax liability before foreign tax credit, maximum foreign tax credit allowable, and net U.S. tax liability Calculate Elmo's U.S. after foreign tax credit. (Do not round any intermediate division.) U.S. tax liability s (10,199) s 158,101 Required B > Next> 40f 5 Prey to Elmo Inc. is a US, corporation with a branch office in foreign country Z. During the current year, Elmo had $465,000 of us. Source income and $30,000 of foreign source income from Z, on which Elmo paid $14,000 of country Z income tax. a. Calculate Elmo's U.S. tax liability before foreign tax credit, maximum foreign tax credit allowable, and net U.S. tax liability after foreign tax credit. b. If Elmo had paid only $3,000 of country Z income tax, calculate Elmo's foreign tax credit allowable and net U.S. tax liability after foreign tax credit. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required ARequired B If Elmo had paid only $3,000 of country Z income tax, calculate Elmo's foreign tax credit allowable and net U.S. tax liability after foreign tax credit. 168,300 65,300 Net U.S. tax liability after foreign tax credit K Required A Elmo Inc. is a U.S. corporation with a branch office in foreign country Z. During the current year, Elmo had $465,000 of U.S. source income and $30,000 of foreign source income from Z, on which Elmo paid $14,000 of country Z income tax. a. Calculate Elmo's U.S. tax liability before foreign tax credit, maximum foreign tax credit allowable, and net U.S. tax liability after foreign tax credit. b. If Elmo had paid only $3,000 of country Z income tax, calculate Elmo's foreign tax credit allowable and net U.S. tax liability after foreign tax credit. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required ARequired B tax liability before foreign tax credit, maximum foreign tax credit allowable, and net U.S. tax liability Calculate Elmo's U.S. after foreign tax credit. (Do not round any intermediate division.) U.S. tax liability s (10,199) s 158,101 Required B > Next> 40f 5 Prey to Elmo Inc. is a US, corporation with a branch office in foreign country Z. During the current year, Elmo had $465,000 of us. Source income and $30,000 of foreign source income from Z, on which Elmo paid $14,000 of country Z income tax. a. Calculate Elmo's U.S. tax liability before foreign tax credit, maximum foreign tax credit allowable, and net U.S. tax liability after foreign tax credit. b. If Elmo had paid only $3,000 of country Z income tax, calculate Elmo's foreign tax credit allowable and net U.S. tax liability after foreign tax credit. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required ARequired B If Elmo had paid only $3,000 of country Z income tax, calculate Elmo's foreign tax credit allowable and net U.S. tax liability after foreign tax credit. 168,300 65,300 Net U.S. tax liability after foreign tax credit K Required A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts