Question: Please, I post the change in the question so I want the answer after you change the question. 8-35 An oil company plans to purchase

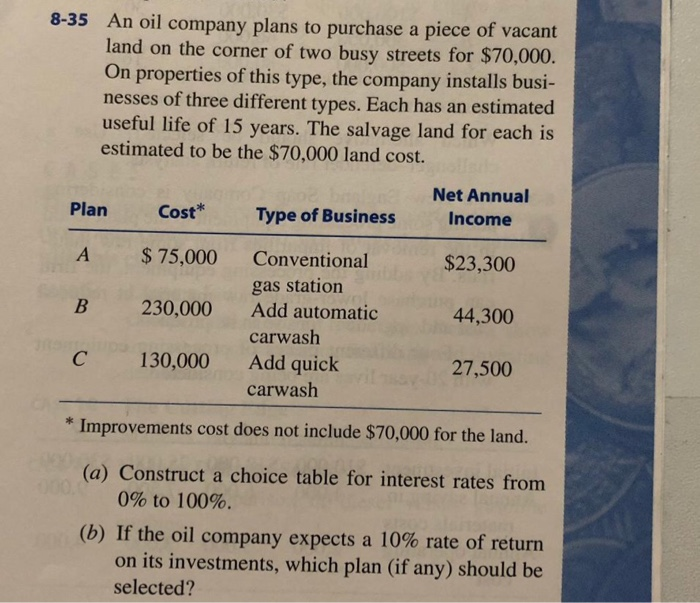

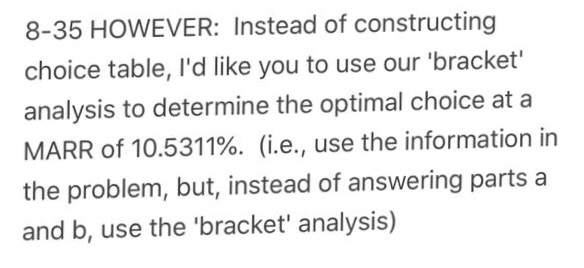

8-35 An oil company plans to purchase a piece of vacart land on the corner of two busy streets for $70,000. On properties of this type, the company installs busi- nesses of three different types. Each has an estimated useful life of 15 years. The salvage land for each is estimated to be the $70,000 land cost. Net Annual $23,300 44,300 27,500 A 75,000 Conventional B 230,000 Add automatio C 130,000 Add quick Improvements cost does not include $70,000 for the land. (a) Construct a choice table for interest rates from gas station carwash carwash 0% to 100%. (b) If the oil company expects a 10% rate of return on its investments, which plan (if any) should be selected? 8-35 HOWEVER: Instead of constructing choice table, I'd like you to use our 'bracket' analysis to determine the optimal choice ata MARR of 10.5311%. (i.e., use the information in the problem, but, instead of answering parts a and b, use the 'bracket' analysis)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts