Question: please i really need your help in solving these 2 questions. 6. Assume that market expects the Inflation rate to be 3% next two years,

please i really need your help in solving these 2 questions.

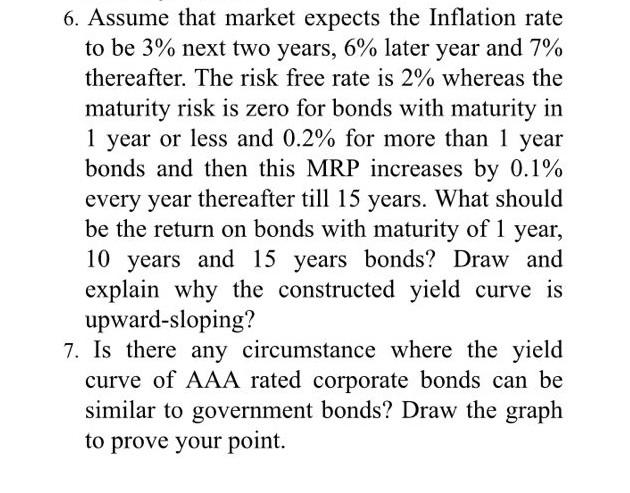

6. Assume that market expects the Inflation rate to be 3% next two years, 6% later year and 7% thereafter. The risk free rate is 2% whereas the maturity risk is zero for bonds with maturity in 1 year or less and 0.2% for more than 1 year bonds and then this MRP increases by 0.1% every year thereafter till 15 years. What should be the return on bonds with maturity of 1 year, 10 years and 15 years bonds? Draw and explain why the constructed yield curve is upward-sloping? 7. Is there any circumstance where the yield curve of AAA rated corporate bonds can be similar to government bonds? Draw the graph to prove your point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts