Question: please I try to do as mach I can clear Unit 5 Comprehensive Assignment The Accounting Cycle Students will complete the first four steps in

please I try to do as mach I can clear

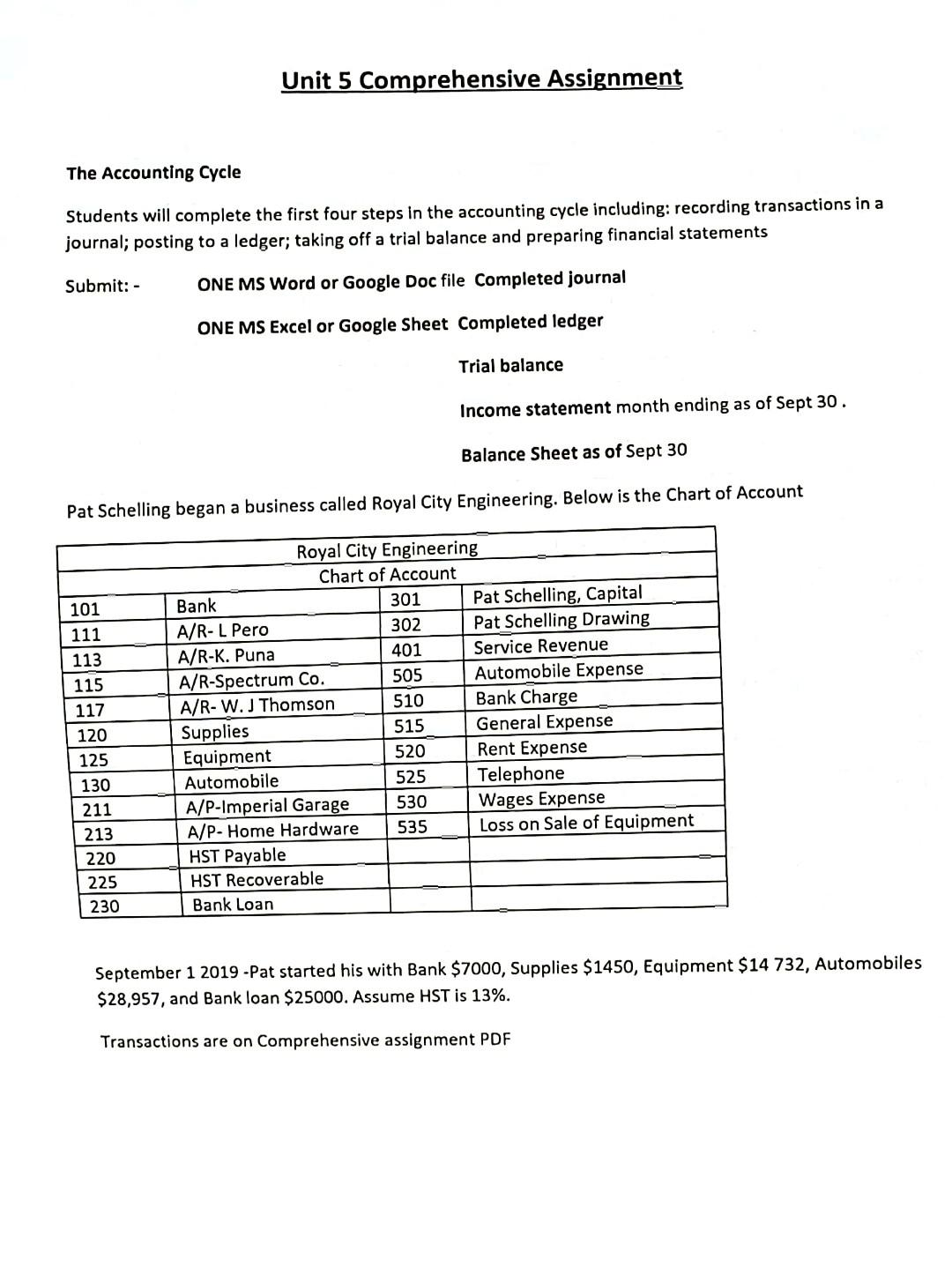

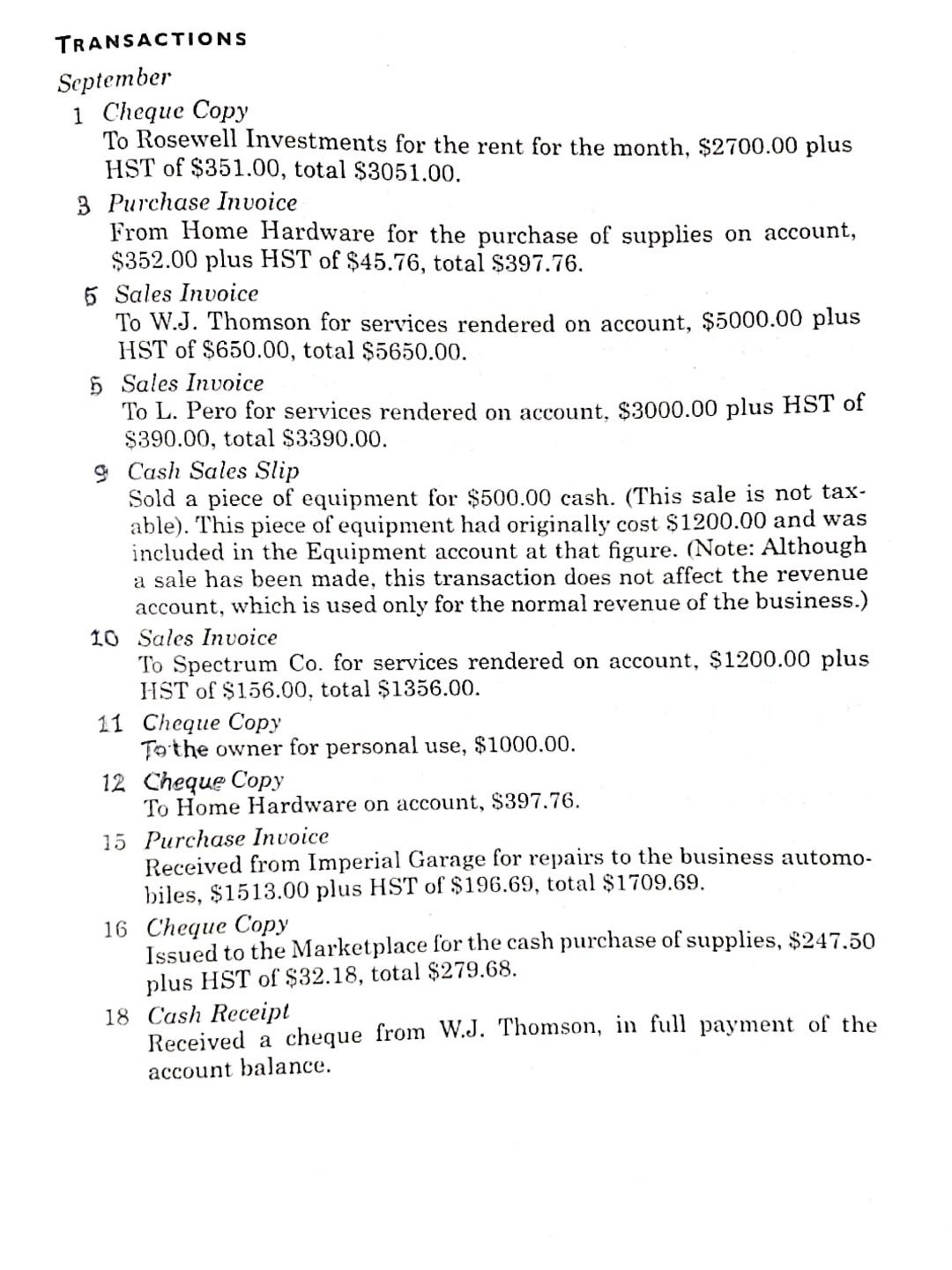

Unit 5 Comprehensive Assignment The Accounting Cycle Students will complete the first four steps in the accounting cycle including: recording transactions in a journal; posting to a ledger; taking off a trial balance and preparing financial statements Submit: - ONE MS Word or Google Doc file Completed journal ONE MS Excel or Google Sheet Completed ledger Trial balance Income statement month ending as of Sept 30. Balance Sheet as of Sept 30 Pat Schelling began a business called Royal City Engineering. Below is the Chart of Account 302 101 111 113 115 117 120 125 130 211 213 220 225 230 Royal City Engineering Chart of Account Bank 301 Pat Schelling, Capital A/R-L Pero Pat Schelling Drawing A/R-K. Puna 401 Service Revenue A/R-Spectrum Co. 505 Automobile Expense A/R-W. J Thomson 510 Bank Charge Supplies 515 General Expense Equipment Rent Expense Automobile 525 Telephone A/P-Imperial Garage 530 Wages Expense A/P- Home Hardware 535 Loss on Sale of Equipment HST Payable HST Recoverable Bank Loan 520 September 1 2019 - Pat started his with Bank $7000, Supplies $1450, Equipment $14 732, Automobiles $28,957, and Bank loan $25000. Assume HST is 13%. Transactions are on Comprehensive assignment PDF TRANSACTIONS September 1 Cheque Copy To Rosewell Investments for the rent for the month, $2700.00 plus HST of $351.00, total $3051.00. 3 Purchase Invoice From Home Hardware for the purchase of supplies on account, $352.00 plus HST of $45.76, total $397.76. 5 Sales Invoice To W.J. Thomson for services rendered on account, $5000.00 plus HST of $650.00, total $5650.00. 5 Sales Invoice To L. Pero for services rendered on account, $3000.00 plus HST of $390.00, total $3390.00. 9 Cash Sales Slip Sold a piece of equipment for $500.00 cash. (This sale is not tax- able). This piece of equipment had originally cost $1200.00 and was included in the Equipment account at that figure. (Note: Although a sale has been made, this transaction does not affect the revenue account, which is used only for the normal revenue of the business.) 10 Sales Invoice To Spectrum Co. for services rendered on account, $1200.00 plus HST of $156.00, total $1356.00. 11 Cheque Copy To the owner for personal use, $1000.00. 12 Cheque Copy To Home Hardware on account, $397.76. 15 Purchase Invoice Received from Imperial Garage for repairs to the business automo- biles, $1513.00 plus HST of $196.69, total $1709.69. 16 Cheque Copy Issued to the Marketplace for the cash purchase of supplies, $247.50 plus HST of $32.18, total $279.68. 18 Cash Receipt Received a cheque from W.J. Thomson, in full payment of the account balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts