Question: please I would appreciate your help with the question, be careful with the numbers and calculations. for (e) the options the NPV (negative,positive), is well

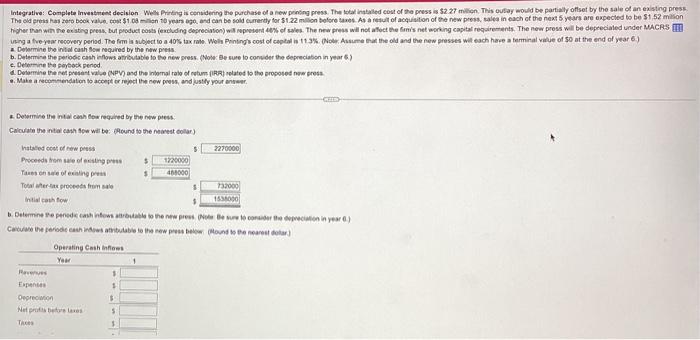

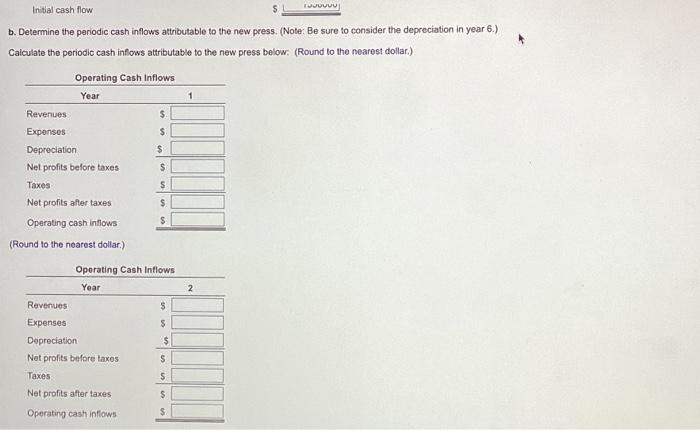

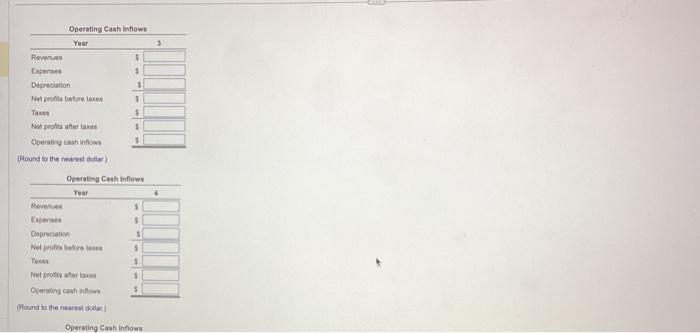

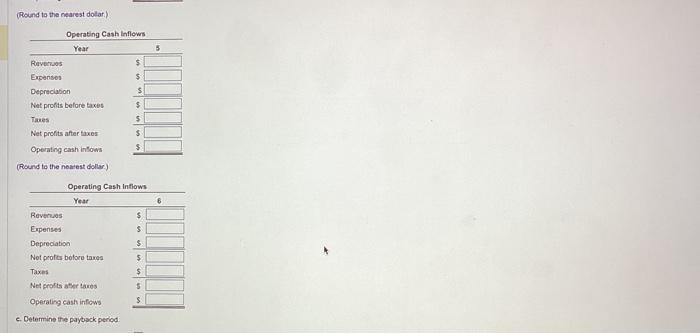

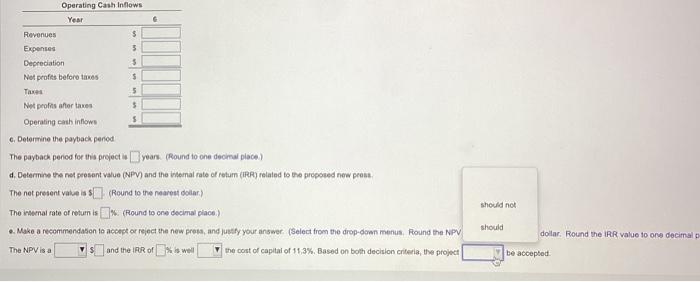

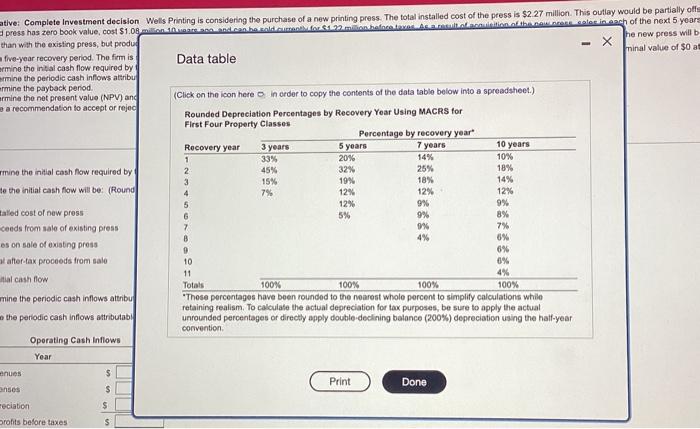

a. Delermine the intal canh 10m required by the now pers b. Determine the peribde cash infows atributable io the new press. (Nole ee suge io consder the depreciabon in year 6 ) c, Deswrine the poyesck period e. Mate a rectmtiendation so actept er repet the new peess, and justly your ensed. a. Determine the intar canh des requined by the now ptes: Calcuate the inta cash sew wit ta diceind to the nevest tollar) b. Determine the periodic cash inflows attributable to the new press. (Note: Be sure to consider the deprociation in year 6 .) Calculate the periodic cash inflows attributable to the new press below: (Round to the nearest dollar.) () Operating cash inflows (Round to the nearest dolar.) (fooung to the nomesr colac) e. Determine the payback period The payback pence for this preject is year. (Round to one decinal place) d. Determme the net peosant value (NPV) and the inbemal rate of retum (IRR) related to the proposed new peese. The net present value is $ (Round to the nearest dolar.) The issenal rate of retum is W. (Round to ore decimal place) e. Make a recommendason le accepe or reject the new prets, and ) usty your answer. (Select from the drop-ogen menus. Fouind the NPr) iolar. Round the IRR value to one decimal The NPV is a and the IPR of the cont of capitai of 11,3%. Based on both decision criteria, the project be accepted. Data table (Click on the icon here B. in erder to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes - Inese percentages nave been rounced to the noarest whole percens to sumpury carcuiavons wrue retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the hatf-year corivention. a. Delermine the intal canh 10m required by the now pers b. Determine the peribde cash infows atributable io the new press. (Nole ee suge io consder the depreciabon in year 6 ) c, Deswrine the poyesck period e. Mate a rectmtiendation so actept er repet the new peess, and justly your ensed. a. Determine the intar canh des requined by the now ptes: Calcuate the inta cash sew wit ta diceind to the nevest tollar) b. Determine the periodic cash inflows attributable to the new press. (Note: Be sure to consider the deprociation in year 6 .) Calculate the periodic cash inflows attributable to the new press below: (Round to the nearest dollar.) () Operating cash inflows (Round to the nearest dolar.) (fooung to the nomesr colac) e. Determine the payback period The payback pence for this preject is year. (Round to one decinal place) d. Determme the net peosant value (NPV) and the inbemal rate of retum (IRR) related to the proposed new peese. The net present value is $ (Round to the nearest dolar.) The issenal rate of retum is W. (Round to ore decimal place) e. Make a recommendason le accepe or reject the new prets, and ) usty your answer. (Select from the drop-ogen menus. Fouind the NPr) iolar. Round the IRR value to one decimal The NPV is a and the IPR of the cont of capitai of 11,3%. Based on both decision criteria, the project be accepted. Data table (Click on the icon here B. in erder to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes - Inese percentages nave been rounced to the noarest whole percens to sumpury carcuiavons wrue retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the hatf-year corivention

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts