Question: please if possible answer both questions. I'll be giving a like to whomever helps me out. thanks 3. Suppose you have the following financial information

please if possible answer both questions. I'll be giving a like to whomever helps me out. thanks

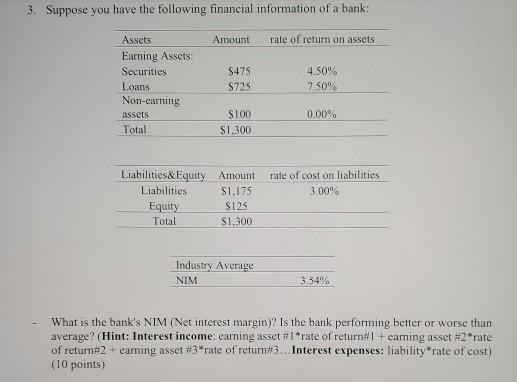

3. Suppose you have the following financial information of a bank: Amount rate of return on assets Assets Earning Assets Securities Loans Non-earning assets Total $475 $725 4.50% 7.50% 0.00% S100 S1.300 Tate of cost on liabilities 3.00% Liabilities& Equity Amount Liabilities S1.175 Equity S125 Total $1,300 Industry Average NIM 3.54% What is the bank's NIM (Net interest margin)? Is the bank performing better or worse than average? (Hint: Interest income earning asset #1* rate of return#1 +earning asset #2*rate of return#2 +eaming asset #3* rate of return #3. Interest expenses: liability*rate of cost) (10 points) 4. What are the major advantages (at least 2) a bank gains by expanding into international bank services? What are major disadvantages (at least 2) of international expansion? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts