Question: Please, if possible use Excel formulas, cell references, & horizontal timelines to show all work. The Darlington Equipment Company purchased a machine 5 years ago

Please, if possible use Excel formulas, cell references, & horizontal timelines to show all work.

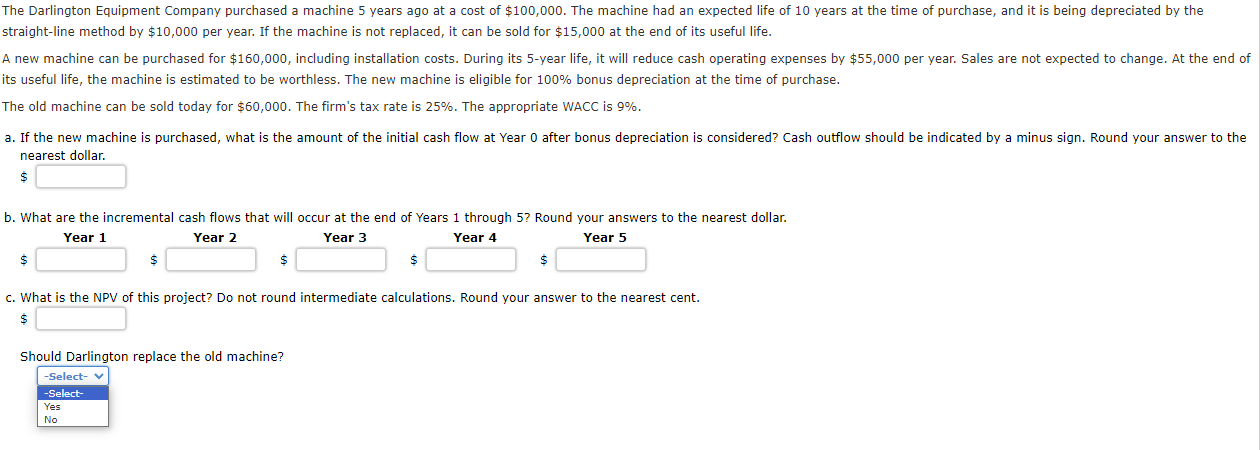

The Darlington Equipment Company purchased a machine 5 years ago at a cost of $100,000. The machine had an expected life of 10 years at the time of purchase, and it is being depreciated by the straight-line method by $10,000 per year. If the machine is not replaced, it can be sold for $15,000 at the end of its useful life.

A new machine can be purchased for $160,000, including installation costs. During its 5-year life, it will reduce cash operating expenses by $55,000 per year. Sales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. The new machine is eligible for 100% bonus depreciation at the time of purchase.

The old machine can be sold today for $60,000. The firm's tax rate is 25%. The appropriate WACC is 9%.

- If the new machine is purchased, what is the amount of the initial cash flow at Year 0 after bonus depreciation is considered? Cash outflow should be indicated by a minus sign. Round your answer to the nearest dollar. $

- What are the incremental cash flows that will occur at the end of Years 1 through 5? Round your answers to the nearest dollar.

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| $ | $ | $ | $ | $ |

- What is the NPV of this project? Do not round intermediate calculations. Round your answer to the nearest cent. $ Should Darlington replace the old machine? -Select-YesNoItem 8

straight-line method by $10,000 per year. If the machine is not replaced, it can be sold for $15,000 at the end of its useful life. its useful life, the machine is estimated to be worthless. The new machine is eligible for 100% bonus depreciation at the time of purchase. The old machine can be sold today for $60,000. The firm's tax rate is 25%. The appropriate WACC is 9%. nearest dollar. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts