Question: please if you can help with both :) Carson Corp. is expanding rapidly and currently reinvests all its earnings into the company. However, the company

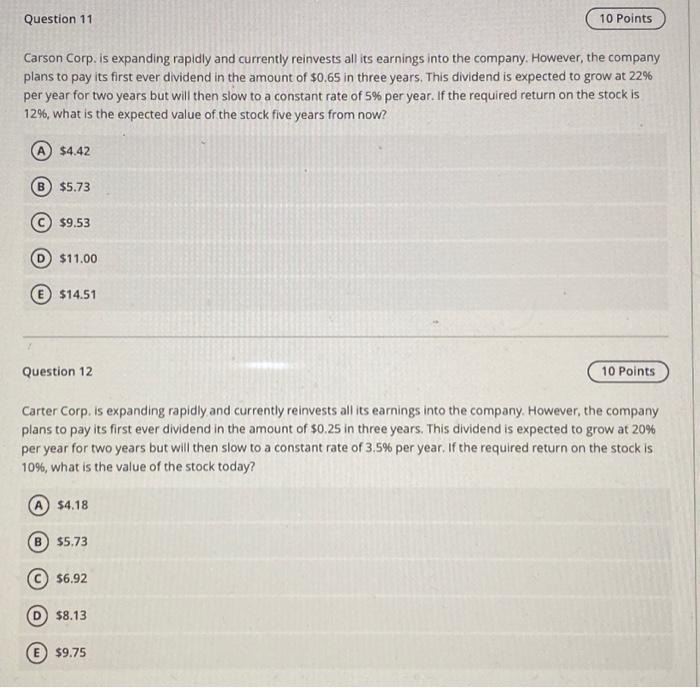

Carson Corp. is expanding rapidly and currently reinvests all its earnings into the company. However, the company plans to pay its first ever dividend in the amount of $0.65 in three years. This dividend is expected to grow at 22% per year for two years but will then slow to a constant rate of 5% per year. If the required return on the stock is 12%, what is the expected value of the stock five years from now? $4.42 (B) $5.73 $9.53 (D) $11.00 $14.51 Question 12 Carter Corp. is expanding rapidly and currently reinvests all its earnings into the company. However, the company plans to pay its first ever dividend in the amount of $0.25 in three years. This dividend is expected to grow at 20% per year for two years but will then slow to a constant rate of 3.5% per year. If the required return on the stock is 10%, what is the value of the stock today? 54.18 $5,73 (C) 56.92 (D) $8.13 (E) $9.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts