Question: please if you can show steps to solving to study them Joint Cost Allocation-Market Value at Split-off Method Sugar Sweetheart, Inc., jointly produces raw sugar,

please if you can show steps to solving to study them

please if you can show steps to solving to study them

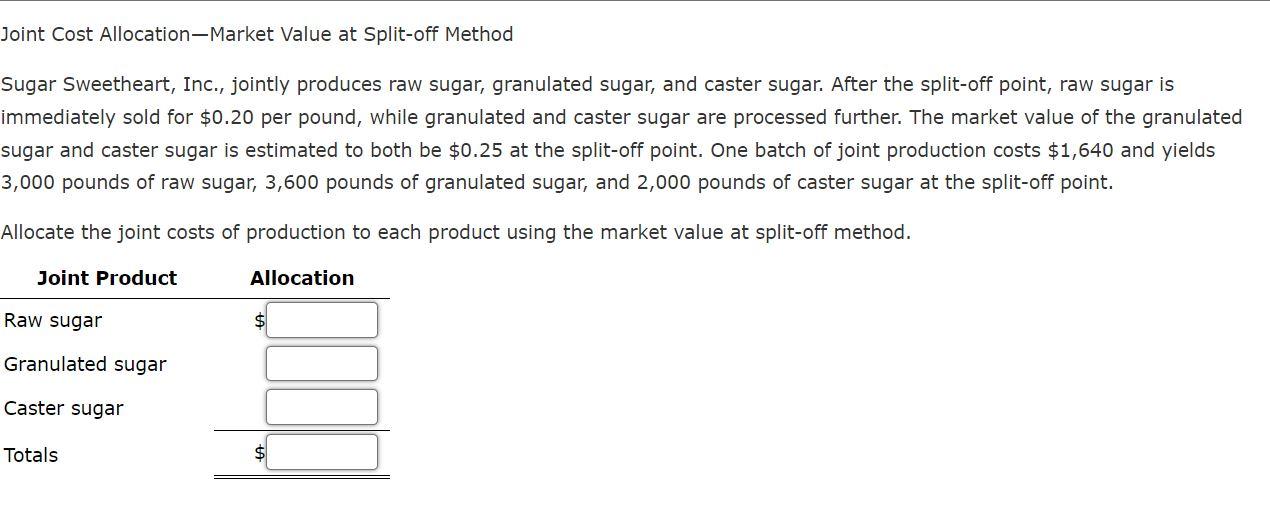

Joint Cost Allocation-Market Value at Split-off Method Sugar Sweetheart, Inc., jointly produces raw sugar, granulated sugar, and caster sugar. After the split-off point, raw sugar is immediately sold for $0.20 per pound, while granulated and caster sugar are processed further. The market value of the granulated sugar and caster sugar is estimated to both be $0.25 at the split-off point. One batch of joint production costs $1,640 and yields 3,000 pounds of raw sugar, 3,600 pounds of granulated sugar, and 2,000 pounds of caster sugar at the split-off point. Allocate the joint costs of production to each product using the market value at split-off method. Joint Product Allocation Raw sugar Granulated sugar Caster sugar Totals $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts