Question: please if you could do 4 and 5 for me i would appreciate idk how to do them 1.6 is the right answer how to

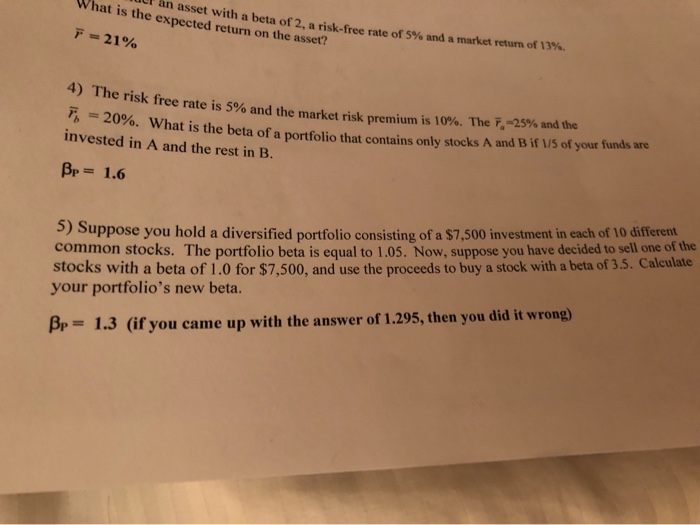

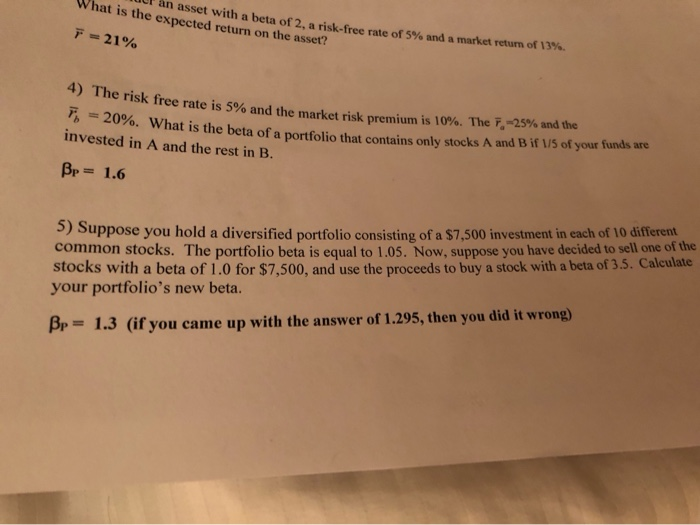

an asset with a beta of 2. a risk-free rate of 5% and a market return of 137. What is the expected return on the asset? F = 21% ne risk free rate is 5% and the market risk premium is 10%. The T-25% and the 7 = 20%. What is the beta of a portfolio that con is the beta of a portfolio that contains only stocks A and B IF 1/5 of your funds are invested in A and the rest in B. Bp= 1.6 I suppose you hold a diversified portfolio consisting of a $7.500 investment in each of 10 m m common stocks. The portfolio beta is equal to 1.05. Now, suppose you have decided to sell one of the Stocks with a beta of 1.0 for $7.500, and use the proceeds to buy a stock with a beta of 3.5. Calcula your portfolio's new beta. Bp = 1.3 (if you came up with the answer of 1.295, then you did it wrong) an asset with a beta of 2. a risk-free rate of 5% and a market return of 137. What is the expected return on the asset? F = 21% 4) The risk free rate is 5% and the risk free rate is 5% and the market risk premium is 10%. The T.-25% and the 7, 20%. What is the beta of a portfolio that co invested in A and the rest in B. is the beta of a portfolio that contains only stocks A and B IF 1/5 of your funds are Bp= 1.6 I suppose you hold a diversified portfolio consisting of a $7.500 investment in each of 10 amerem common stocks. The portfolio beta is equal to 1.05. Now, suppose you have decided to sell one of the stocks with a beta of 1.0 for $7,500, and use the proceeds to buy a stock with a beta of 3.5. Calcula your portfolio's new beta. Bp = 1.3 (if you came up with the answer of 1.295, then you did it wrong)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts