Question: please if you could help me with the rest, I put here everything from 1-9 are done. please if you could help me with the

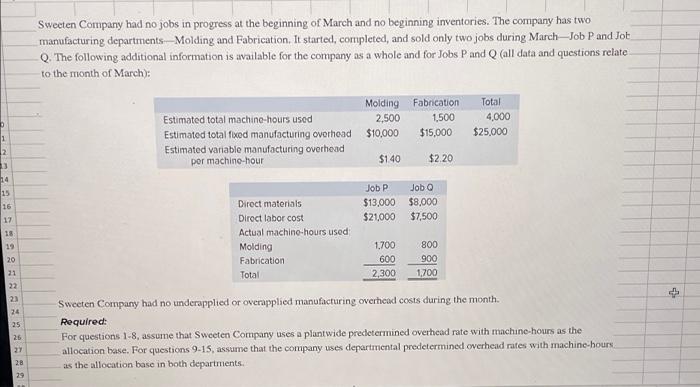

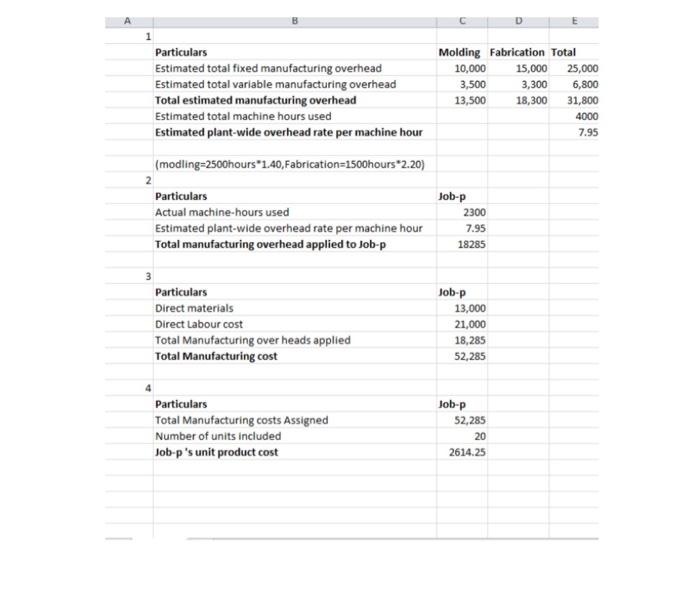

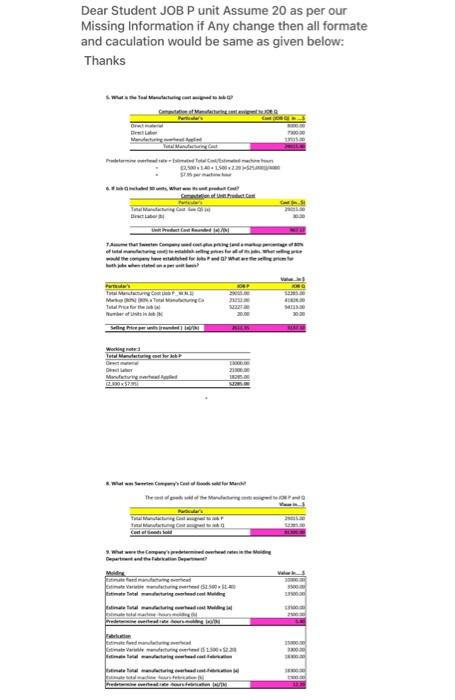

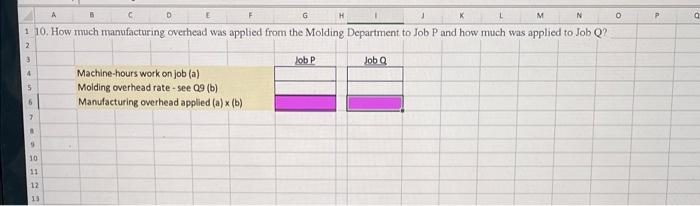

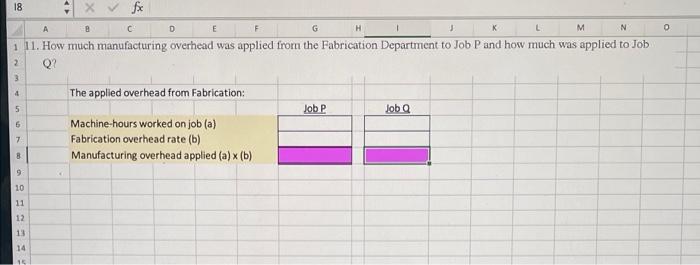

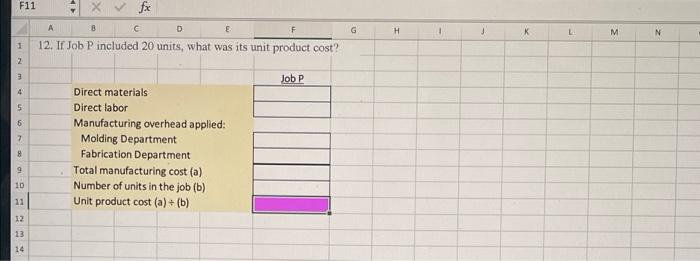

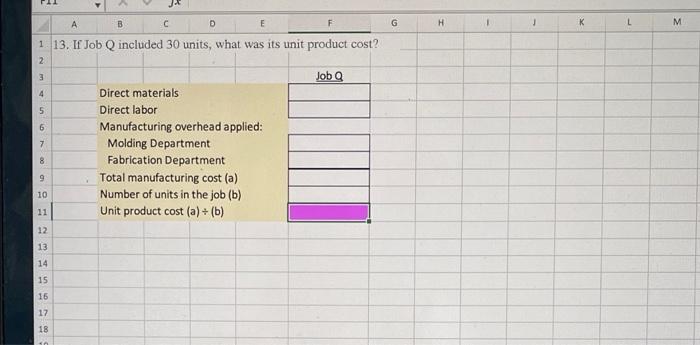

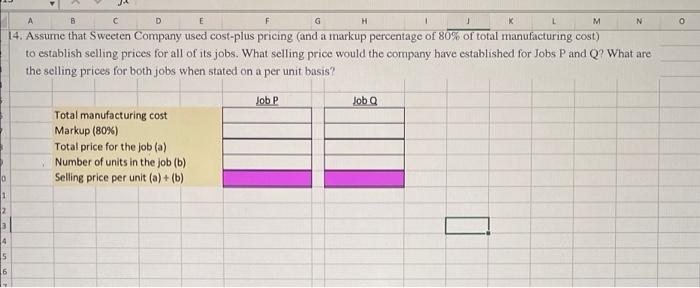

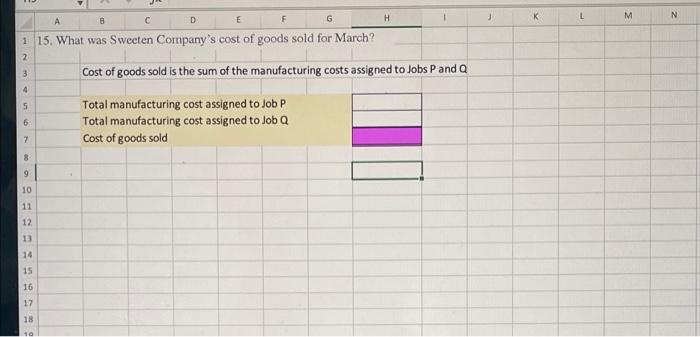

Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments - Molding and Fabrication. It started, completed, and sold only two jobs during March Job P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Molding Fabrication 2,500 1,500 $10,000 $15,000 Total 4,000 $25.000 Estimated total machine-hours used Estimated total fixed manufacturing overhead Estimated variable manufacturing overhead por machino-hour 1 2 $140 $2.20 14 Job P 15 Job $8,000 $7,500 16 $13,000 $21.000 17 Direct materials Direct labor cost Actual machino-hours used Molding Fabrication Total 19 1,700 600 2,300 800 900 1,700 21 22 23 + 24 25 26 Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine hours as the allocation base. For questions 9.15, assume that the company uses departmental predetermined overhead rates with machine bours as the allocation base in both departments 27 28 29 A 1 Particulars Estimated total fixed manufacturing overhead Estimated total variable manufacturing overhead Total estimated manufacturing overhead Estimated total machine hours used Estimated plant-wide overhead rate per machine hour Molding Fabrication Total 10,000 15,000 25,000 3,500 3,300 6,800 13,500 18,300 31,800 4000 7.95 (modling=2500hours*1.40,Fabrication=1500 hours *2.20) 2 Particulars Actual machine-hours used Estimated plant-wide overhead rate per machine hour Total manufacturing overhead applied to Job-p Job-p 2300 7.95 18285 3 Particulars Direct materials Direct Labour cost Total Manufacturing over heads applied Total Manufacturing cost Job-p 13,000 21,000 18,285 52,285 4 Particulars Total Manufacturing costs Assigned Number of units included Job-p's unit product cost Job-p 52,285 20 2614.25 Dear Student JOB P unit Assume 20 as per our Missing Information if Any change then all formate and caculation would be same as given below: Thanks Wow Me 01.01.22 What .. herford Two wengi wewe este for where heel! tra Ma Total for Numeri Works Tuted Wardaturing Manga 300x3753 Telugu stine Vielen Tower Mit older whe provedene etter being www. 2012 rama trai mas A B C D E F G K L M N o P 9 1 10. How much manufacturing overhead was applied from the Molding Department to Job P and how much was applied to Job Q? 2 3 Job P Job 4 + 5 Machine-hours work on job (a) Molding overhead rate - see 09 (b) Manufacturing overhead applied (a) x (b) 5 7 1 5 10 11 12 13 18 Xfx B C D E G H K M N 0 2 3 4 i 11. How much manufacturing overhead was applied from the Fabrication Department to Job Pand how much was applied to Job Q? The applied overhead from Fabrication: Job P Job Machine-hours worked on job (a) Fabrication overhead rate (b) Manufacturing overhead applied (a) (b) 5 6 7 8 9 10 11 12 13 14 16 F11 - fx A B F 12. If Job Pincluded 20 units, what was its unit product cost? D E G H M M 1 2. 3 Job P 4 5 6 7 Direct materials Direct labor Manufacturing overhead applied: Molding Department Fabrication Department Total manufacturing cost (a) Number of units in the job (b) Unit product cost (a)+(b) 8 9 10 11 12 13 14 B C D E G H K L M M 1. 13. If Job Q included 30 units, what was its unit product cost? 2 3 Job 4 5 6 7 8 Direct materials Direct labor Manufacturing overhead applied: Molding Department Fabrication Department Total manufacturing cost (a) Number of units in the job (b) Unit product cost (a)+ (b) 9 10 11 12 13 14 15 16 17 18 od E F H K M N G 14. Assume that Sweeten Company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis? Job P Job Total manufacturing cost Markup (80%) Total price for the job (a) Number of units in the job (b) Selling price per unit (a) + (b) 0 1 4 5 16 8 L N E M D F G H 1 15. What was Sweeten Company's cost of goods sold for March? 2 3 Cost of goods sold is the sum of the manufacturing costs assigned to Jobs P and Q 4 5 6 Total manufacturing cost assigned to Job P Total manufacturing cost assigned to Job Q Cost of goods sold 7 8 9 10 11 12 13 14 15 16 17 18 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts