Question: please if you could help me with this the same way in excel Sweeten Company had no jobs in progress at the beginning of March

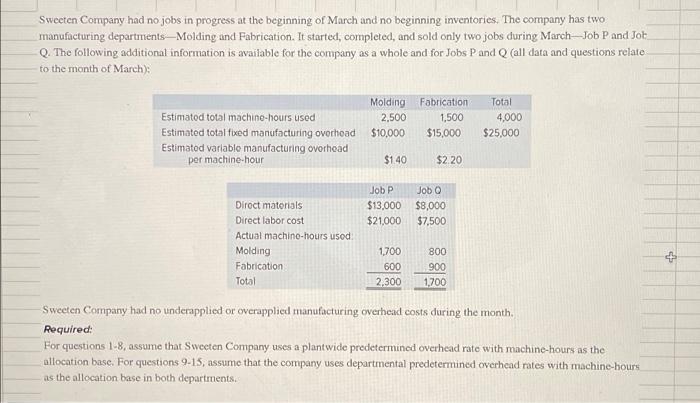

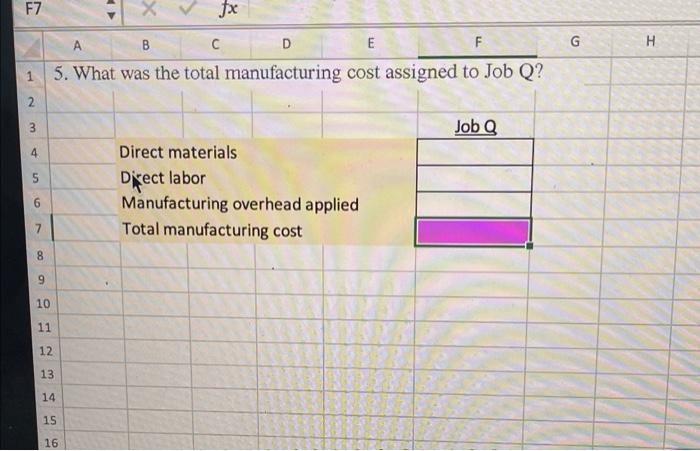

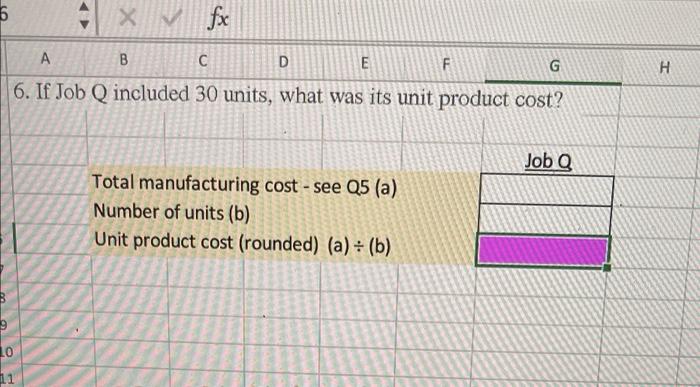

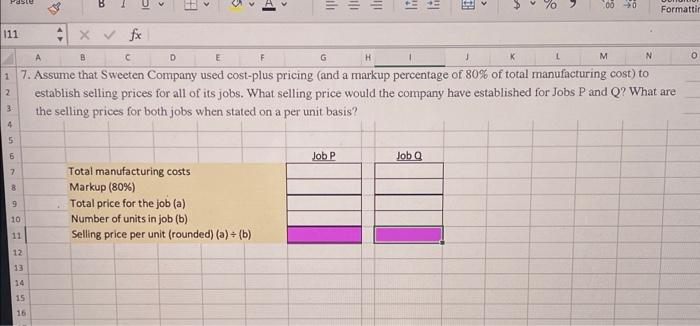

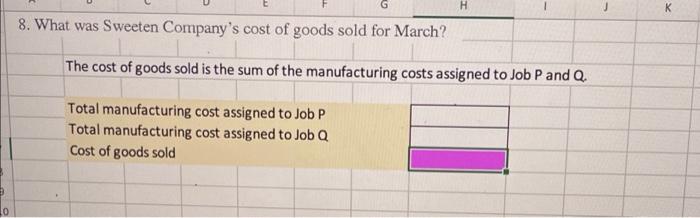

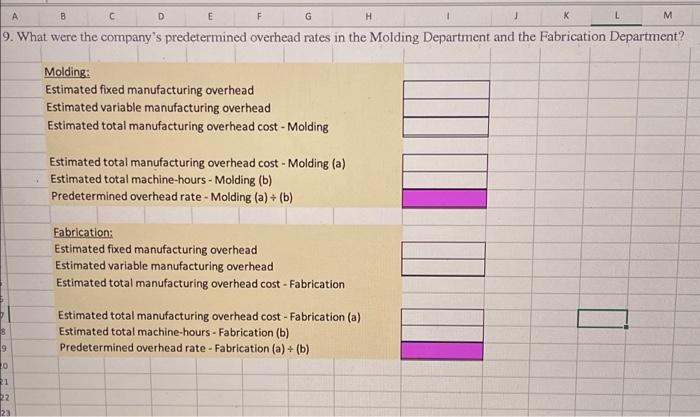

Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during March --Job P and Joh. Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Molding 2.500 $10,000 Estimatod total machine-hours usod Estimated totalfixed manufacturing overhoad Estimatod variable manufacturing overhead per machine-hour Fabrication 1,500 $15,000 Total 4,000 $25,000 $140 $2.20 Job P $13,000 $21,000 Job $8,000 $7,500 Direct materials Direct labor cost Actual machino-hours used Molding Fabrication Total 800 1,700 600 2,300 900 1,700 Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments F7 f B E F G H D 5. What was the total manufacturing cost assigned to Job Q? 1 2 3 Job 4 Direct materials 5 Direct labor 6 Manufacturing overhead applied Total manufacturing cost 7 8 9 10 11 12 13 14 15 16 6 X fx A B D E F G H H 6. If Job Q included 30 units, what was its unit product cost? Job Total manufacturing cost - see Q5 (a) Number of units (b) Unit product cost (rounded) (a) = (b) 9 10 11 Posle 3 + = ill IM 70 000 Formattir 111 B D E F G H N O ex fx M 1 7. Assume that Sweeten Company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis? 2 3 4 5 6 Job P Job 2 8 9 Total manufacturing costs Markup (80%) Total price for the job (a) Number of units in job (b) Selling price per unit (rounded) () = (b) 10 11 12 13 14 15 16 H K K 8. What was Sweeten Company's cost of goods sold for March? The cost of goods sold is the sum of the manufacturing costs assigned to Job P and Q. Total manufacturing cost assigned to Job P Total manufacturing cost assigned to Job Q Cost of goods sold 10 B E F G J K L M 9. What were the company's predetermined overhead rates in the Molding Department and the Fabrication Department? Molding: Estimated fixed manufacturing overhead Estimated variable manufacturing overhead Estimated total manufacturing overhead cost - Molding Estimated total manufacturing overhead cost - Molding (a) Estimated total machine-hours - Molding (b) Predetermined overhead rate - Molding (a) + (b) Fabrication: Estimated fixed manufacturing overhead Estimated variable manufacturing overhead Estimated total manufacturing overhead cost - Fabrication 8 Estimated total manufacturing overhead cost - Fabrication (a) Estimated total machine-hours - Fabrication (b) Predetermined overhead rate - Fabrication (a) + (b) 9 0 21 2 123

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts