Question: please if you could show the steps for calculating part B Border plonas me following share capital and loan stock in se on May 2010

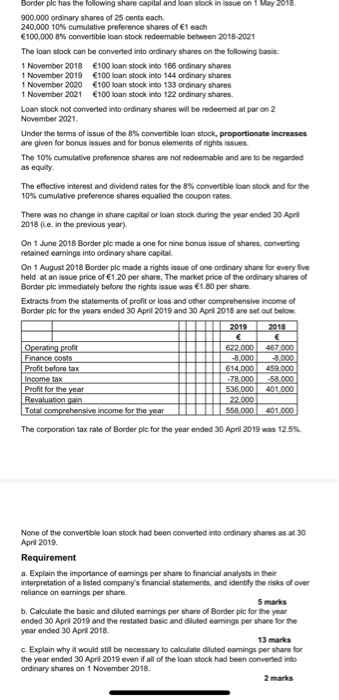

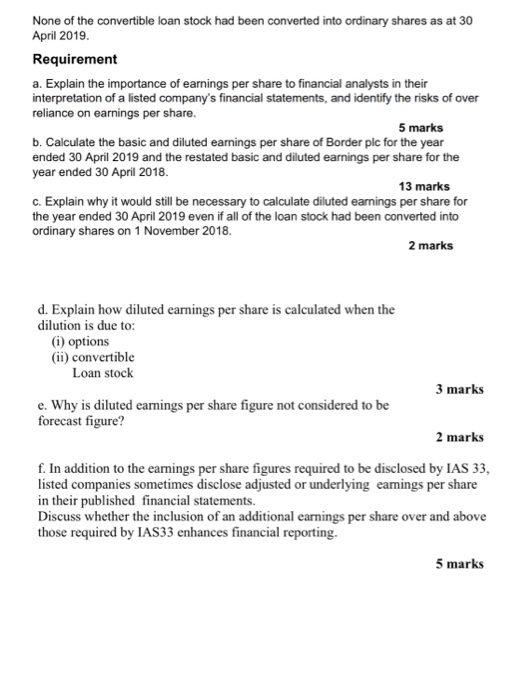

Border plonas me following share capital and loan stock in se on May 2010 900.000 ordinary shares of 25 cents each 240.000 10% cumulative preference shares of 1 each 100,000 8% convertible loan stock redeemable between 2018-2021 The loan stock can be converted into ordinary shares on the following basis: 1 November 2018 100 loan stock into 166 ordinary shares 1 November 2019 100 loan stock into 144 ordinary shares 1 November 2020 100 loan stock into 133 ordinary shares 1 November 2021 100 loan stock into 122 ordinary shares Loan stock not converted into ordinary shares will be redeemed at paron 2 November 2021 Under the terms of issue of the 8% convertible loan stock, proportionate increases are given for bonus issues and for bonus elements of this issues The 10% cumulative preference shares are not redeemable and are to be regarded The effective interest and dividend es for the convertible loan stock and for the 10% cumulative preference shares equalled the coupon rates There was no change in share capital or loan stock during the year ended 30 April 2018 in the previous year On June 2018 Border plc made a one for nine bonus issue of shares, converting retained earnings into ordinary share capital On 1 August 2018 Border plc made a rights issue of one ordinary share for every five held at an issue price of 1 20 per share. The market price of the ordinary shares of Border plc immediately before the rights issue was 1.80 per share Extracts from the statements of profit or loss and other comprehensive income of Border pic for the years onded 30 April 2019 and 30 April 2018 are set out below 2019 2018 Operating profit Finance costs Profit before tax 1622000 457000 -8.000 614 000459000 -78.000 250.000 536.000 401 000 22.000 II 558 000 401 000 Revaluation gain Total comprehensive income for the year The corporation tax rate of Border plc for the year ended 30 April 2019 was 12.5% None of the convertible loan stock had been converted into ordinary shares as at 30 Apr 2019 Requirement a. Explain the importance of earnings per share to financial analysts in their Interpretation of a sted company's financial statements, and identify the risk of over reliance on earnings per share. 5 mars b. Calculate the basic and diluted earnings per share of Border plc for the year ended 30 April 2019 and the restated basic and diluted earings per share for the year ended 30 April 2018 13 marks c. Explain why would still be necessary to calculate diluted earnings per share for the year ended 30 April 2019 even if all of the loan stock had been converted into ordinary shares on 1 November 2018 2 marks None of the convertible loan stock had been converted into ordinary shares as at 30 April 2019. Requirement a. Explain the importance of earnings per share to financial analysts in their interpretation of a listed company's financial statements, and identify the risks of over reliance on earnings per share. 5 marks b. Calculate the basic and diluted earnings per share of Border plc for the year ended 30 April 2019 and the restated basic and diluted earnings per share for the year ended 30 April 2018. 13 marks c. Explain why it would still be necessary to calculate diluted earnings per share for the year ended 30 April 2019 even if all of the loan stock had been converted into ordinary shares on 1 November 2018. 2 marks d. Explain how diluted earnings per share is calculated when the dilution is due to: (i) options (ii) convertible Loan stock 3 marks e. Why is diluted earnings per share figure not considered to be forecast figure? 2 marks f. In addition to the earnings per share figures required to be disclosed by IAS 33, listed companies sometimes disclose adjusted or underlying eamings per share in their published financial statements. Discuss whether the inclusion of an additional earnings per share over and above those required by IAS33 enhances financial reporting. 5 marks Border plonas me following share capital and loan stock in se on May 2010 900.000 ordinary shares of 25 cents each 240.000 10% cumulative preference shares of 1 each 100,000 8% convertible loan stock redeemable between 2018-2021 The loan stock can be converted into ordinary shares on the following basis: 1 November 2018 100 loan stock into 166 ordinary shares 1 November 2019 100 loan stock into 144 ordinary shares 1 November 2020 100 loan stock into 133 ordinary shares 1 November 2021 100 loan stock into 122 ordinary shares Loan stock not converted into ordinary shares will be redeemed at paron 2 November 2021 Under the terms of issue of the 8% convertible loan stock, proportionate increases are given for bonus issues and for bonus elements of this issues The 10% cumulative preference shares are not redeemable and are to be regarded The effective interest and dividend es for the convertible loan stock and for the 10% cumulative preference shares equalled the coupon rates There was no change in share capital or loan stock during the year ended 30 April 2018 in the previous year On June 2018 Border plc made a one for nine bonus issue of shares, converting retained earnings into ordinary share capital On 1 August 2018 Border plc made a rights issue of one ordinary share for every five held at an issue price of 1 20 per share. The market price of the ordinary shares of Border plc immediately before the rights issue was 1.80 per share Extracts from the statements of profit or loss and other comprehensive income of Border pic for the years onded 30 April 2019 and 30 April 2018 are set out below 2019 2018 Operating profit Finance costs Profit before tax 1622000 457000 -8.000 614 000459000 -78.000 250.000 536.000 401 000 22.000 II 558 000 401 000 Revaluation gain Total comprehensive income for the year The corporation tax rate of Border plc for the year ended 30 April 2019 was 12.5% None of the convertible loan stock had been converted into ordinary shares as at 30 Apr 2019 Requirement a. Explain the importance of earnings per share to financial analysts in their Interpretation of a sted company's financial statements, and identify the risk of over reliance on earnings per share. 5 mars b. Calculate the basic and diluted earnings per share of Border plc for the year ended 30 April 2019 and the restated basic and diluted earings per share for the year ended 30 April 2018 13 marks c. Explain why would still be necessary to calculate diluted earnings per share for the year ended 30 April 2019 even if all of the loan stock had been converted into ordinary shares on 1 November 2018 2 marks None of the convertible loan stock had been converted into ordinary shares as at 30 April 2019. Requirement a. Explain the importance of earnings per share to financial analysts in their interpretation of a listed company's financial statements, and identify the risks of over reliance on earnings per share. 5 marks b. Calculate the basic and diluted earnings per share of Border plc for the year ended 30 April 2019 and the restated basic and diluted earnings per share for the year ended 30 April 2018. 13 marks c. Explain why it would still be necessary to calculate diluted earnings per share for the year ended 30 April 2019 even if all of the loan stock had been converted into ordinary shares on 1 November 2018. 2 marks d. Explain how diluted earnings per share is calculated when the dilution is due to: (i) options (ii) convertible Loan stock 3 marks e. Why is diluted earnings per share figure not considered to be forecast figure? 2 marks f. In addition to the earnings per share figures required to be disclosed by IAS 33, listed companies sometimes disclose adjusted or underlying eamings per share in their published financial statements. Discuss whether the inclusion of an additional earnings per share over and above those required by IAS33 enhances financial reporting. 5 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts