Question: PLEASE, IF YOU WILL NOT COMPLETELY ANSWER THE QUESTION AND SHOW WORK, THEN DO NOT ANSWER You have just been hired as a financial analyst

PLEASE, IF YOU WILL NOT COMPLETELY ANSWER THE QUESTION AND SHOW WORK, THEN DO NOT ANSWER

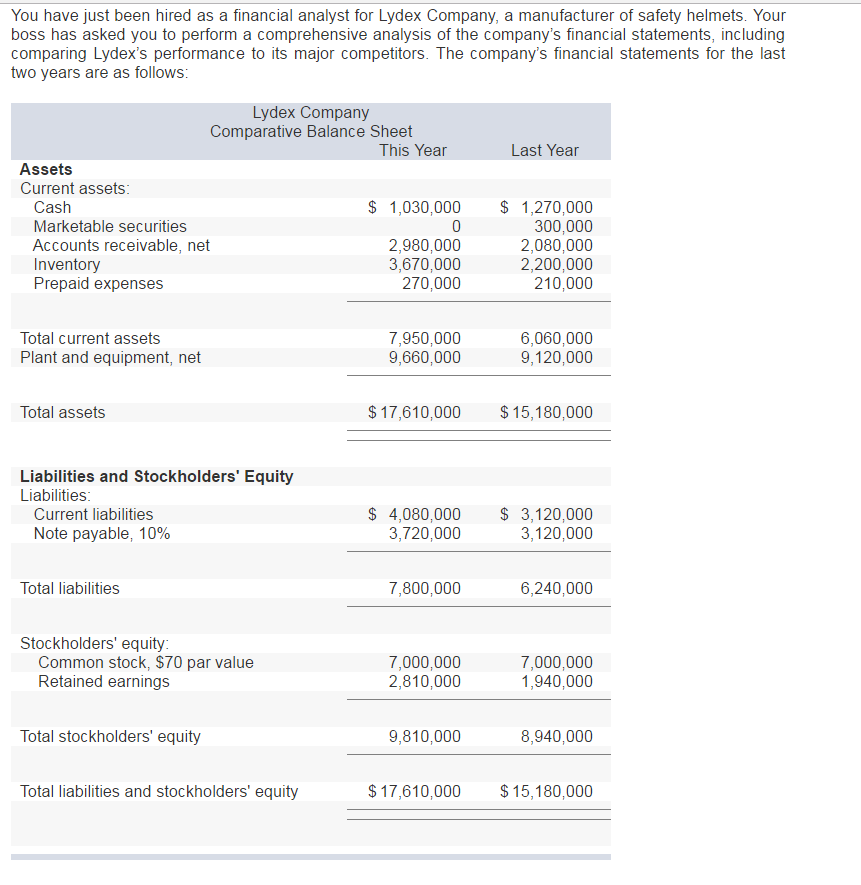

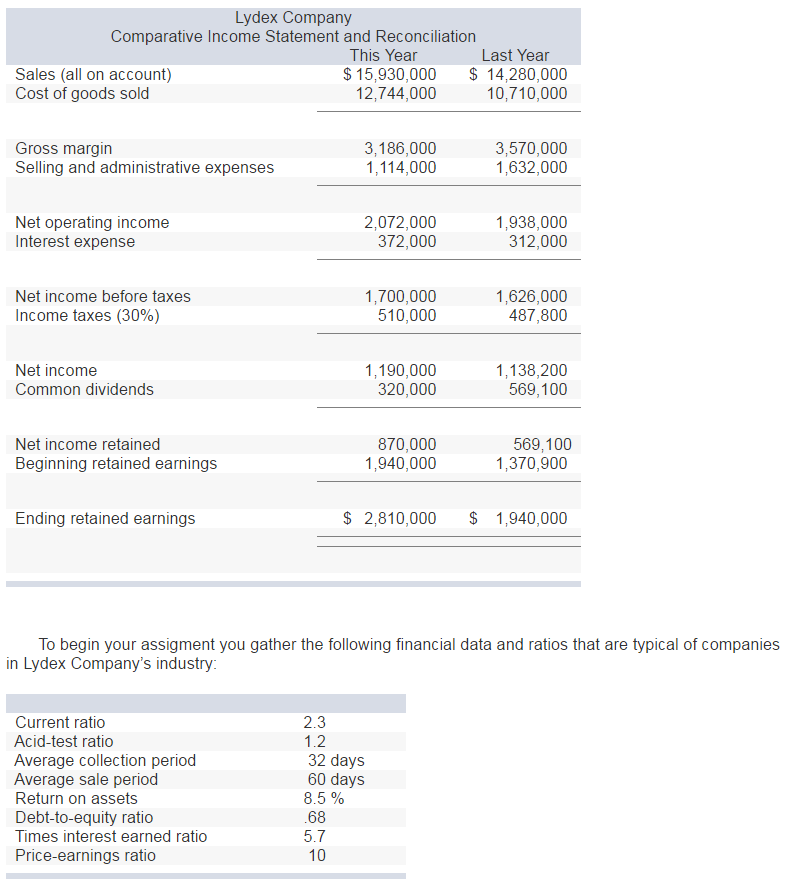

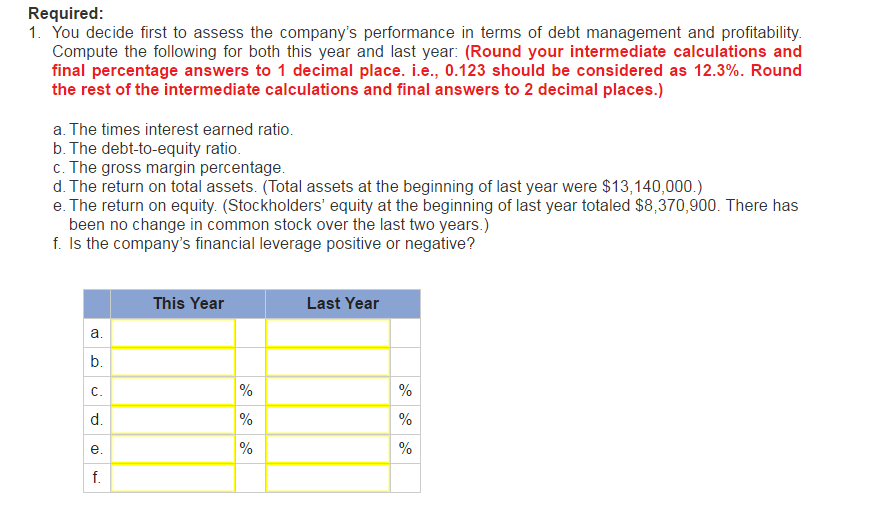

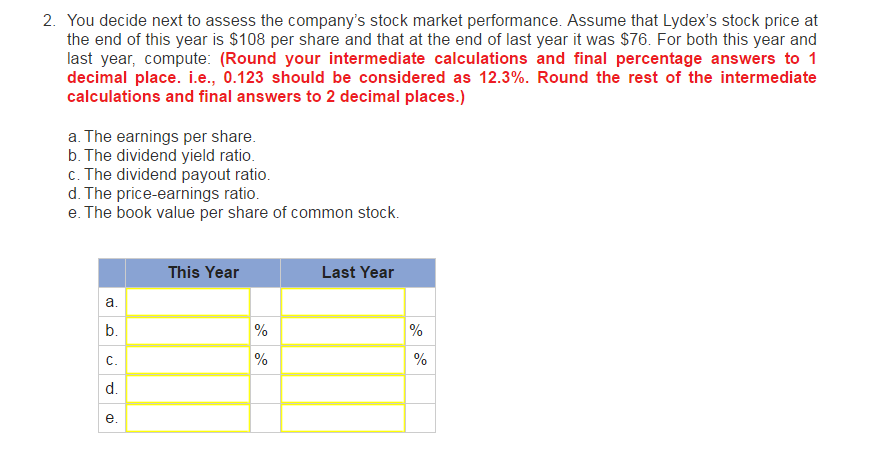

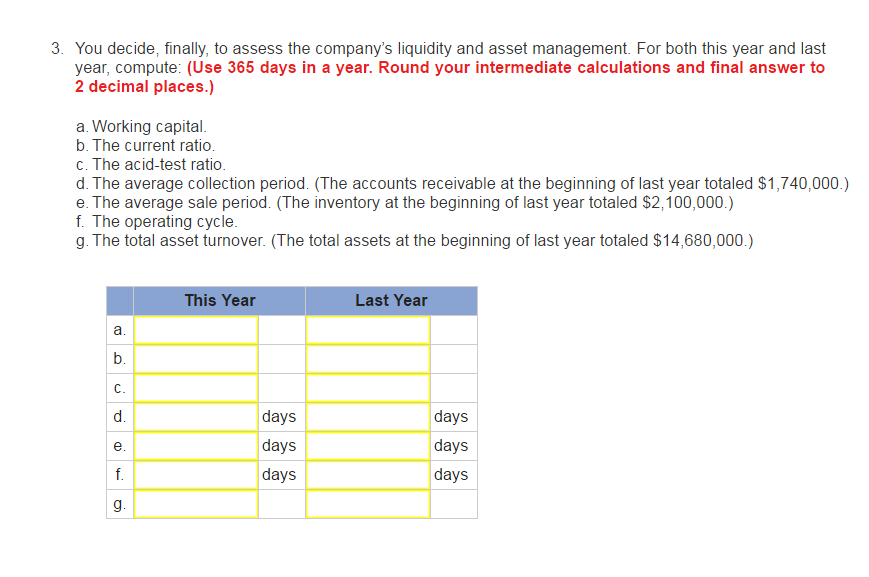

You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company's financial statements, including Comparing Lydexs performance to its major competitors. he Companys financial statements for the last two years are as follows: Lydex Company Comparative Balance Sheet This Year Last Year Assets Current assets: 1,030,000 1,270,000 Cash Marketable securities 300.000 2,980,000 Accounts receivable, net 2,080,000 2,200,000 Inventory 3,670,000 Prepaid expenses 270,000 210,000 7,950,000 6,060,000 Total current assets 9,660,000 9,120,000 Plant and equipment, net Total assets 17,610,000 15,180,000 Liabilities and Stockholders' Equity Liabilities 4,080,000 3,120,000 Current liabilities Note payable, 10% 3,720,000 3,120,000 7,800,000 Total liabilities 6,240,000 Stockholders' equity: 7,000,000 7,000,000 Common stock, $70 par value 1,940,000 Retained earnings 2,810,000 8,940,000 Total stockholders' equity 9,810,000 Total liabilities and stockholders' equity 17,610,000 15,180,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts