Question: please ignmentSessionLocator=&inprogress=false 1. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the first-in, first-out method and

please

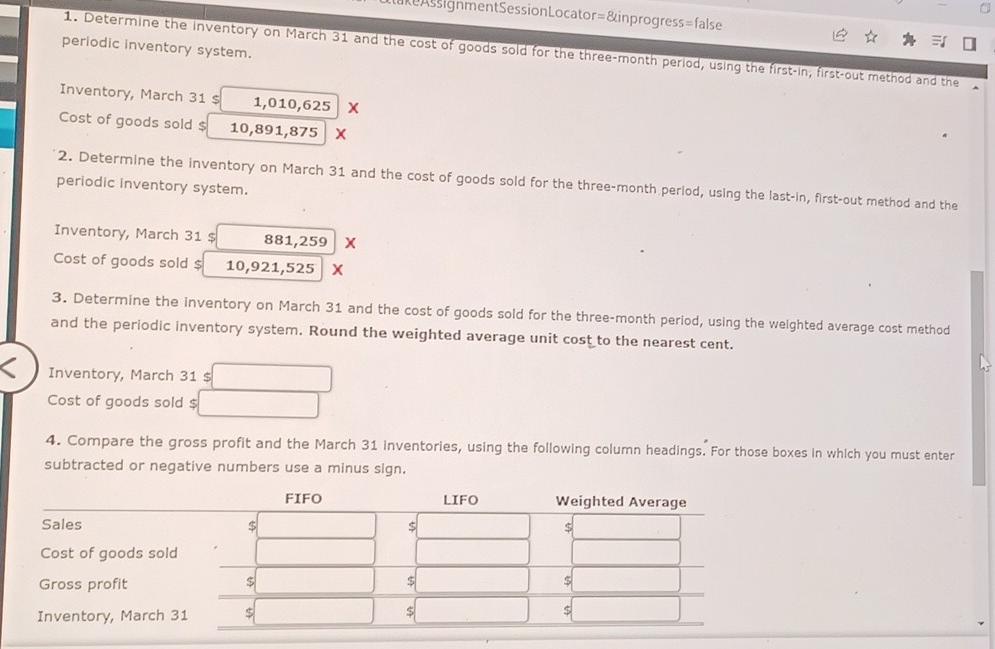

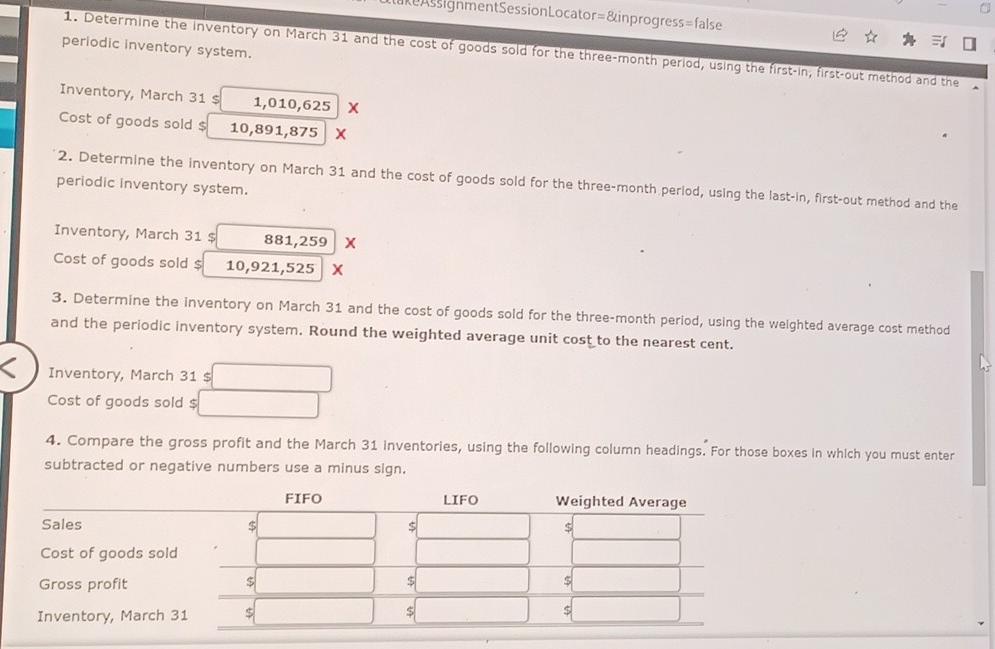

ignmentSessionLocator=&inprogress=false 1. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the first-in, first-out method and the periodic inventory system. Inventory, March 31 s 1,010,625 X Cost of goods sold s 10,891,875 X 2. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the last-in, first-out method and the periodic inventory system. Inventory, March 31 $ 881,259 X Cost of goods sold 10,921,525 X 3. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the weighted average cost method and the periodic inventory system. Round the weighted average unit cost to the nearest cent. Inventory, March 31 s Cost of goods sold s 4. Compare the gross profit and the March 31 Inventories, using the following column headings. For those boxes in which you must enter subtracted or negative numbers use a minus sign. FIFO LIFO Weighted Average $ Sales $ $ Cost of goods sold $ $ Gross profit $ $ Inventory, March 31 $ ignmentSessionLocator=&inprogress=false 1. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the first-in, first-out method and the periodic inventory system. Inventory, March 31 s 1,010,625 X Cost of goods sold s 10,891,875 X 2. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the last-in, first-out method and the periodic inventory system. Inventory, March 31 $ 881,259 X Cost of goods sold 10,921,525 X 3. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the weighted average cost method and the periodic inventory system. Round the weighted average unit cost to the nearest cent. Inventory, March 31 s Cost of goods sold s 4. Compare the gross profit and the March 31 Inventories, using the following column headings. For those boxes in which you must enter subtracted or negative numbers use a minus sign. FIFO LIFO Weighted Average $ Sales $ $ Cost of goods sold $ $ Gross profit $ $ Inventory, March 31 $ ignmentSessionLocator=&inprogress=false 1. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the first-in, first-out method and the periodic inventory system. Inventory, March 31 s 1,010,625 X Cost of goods sold s 10,891,875 X 2. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the last-in, first-out method and the periodic inventory system. Inventory, March 31 $ 881,259 X Cost of goods sold 10,921,525 X 3. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the weighted average cost method and the periodic inventory system. Round the weighted average unit cost to the nearest cent. Inventory, March 31 s Cost of goods sold s 4. Compare the gross profit and the March 31 Inventories, using the following column headings. For those boxes in which you must enter subtracted or negative numbers use a minus sign. FIFO LIFO Weighted Average $ Sales $ $ Cost of goods sold $ $ Gross profit $ $ Inventory, March 31 $ ignmentSessionLocator=&inprogress=false 1. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the first-in, first-out method and the periodic inventory system. Inventory, March 31 s 1,010,625 X Cost of goods sold s 10,891,875 X 2. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the last-in, first-out method and the periodic inventory system. Inventory, March 31 $ 881,259 X Cost of goods sold 10,921,525 X 3. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the weighted average cost method and the periodic inventory system. Round the weighted average unit cost to the nearest cent. Inventory, March 31 s Cost of goods sold s 4. Compare the gross profit and the March 31 Inventories, using the following column headings. For those boxes in which you must enter subtracted or negative numbers use a minus sign. FIFO LIFO Weighted Average $ Sales $ $ Cost of goods sold $ $ Gross profit $ $ Inventory, March 31 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts