Question: please i'll like d. $7,928.46 e. $9,034.86 20. Which one of the following statements is TRUE? a. APR would always be greater than or equal

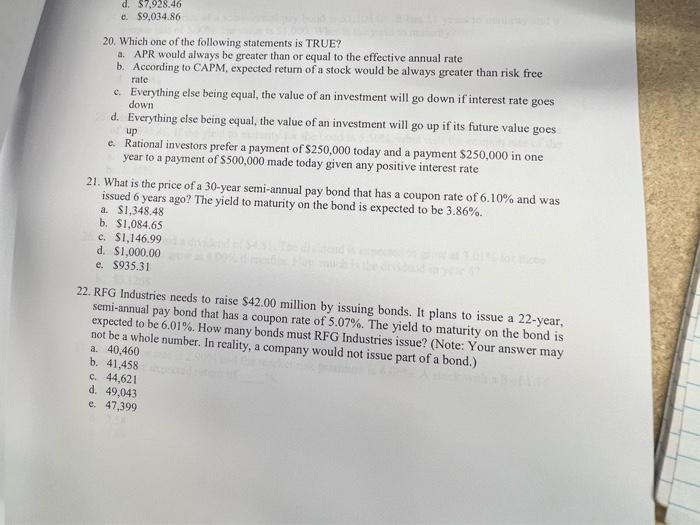

d. $7,928.46 e. $9,034.86 20. Which one of the following statements is TRUE? a. APR would always be greater than or equal to the effective annual rate b. According to CAPM, expected return of a stock would be always greater than risk free rate c. Everything else being equal, the value of an investment will go down if interest rate goes down d. Everything else being equal, the value of an investment will go up if its future value goes of up e. Rational investors prefer a payment of $250,000 today and a payment $250,000 in one year to a payment of $500,000 made today given any positive interest rate 21. What is the price of a 30-year semi-annual pay bond that has a coupon rate of 6.10% and was issued 6 years ago? The yield to maturity on the bond is expected to be 3.86%. a. $1,348.48 b. $1,084.65 c. $1,146.99. d. $1,000.00 e. $935.31 22. RFG Industries needs to raise $42.00 million by issuing bonds. It plans to issue a 22-year, semi-annual pay bond that has a coupon rate of 5.07%. The yield to maturity on the bond is expected to be 6.01%. How many bonds must RFG Industries issue? (Note: Your answer may not be a whole number. In reality, a company would not issue part of a bond.) a. 40,460 b. 41,458 c. 44,621 d. 49,043 e. 47,399

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts