Question: Please implement excel formulas when answering eaxh question. Suppose you are trying to open a restaurant that requires the initial investment of $120,000. You expect

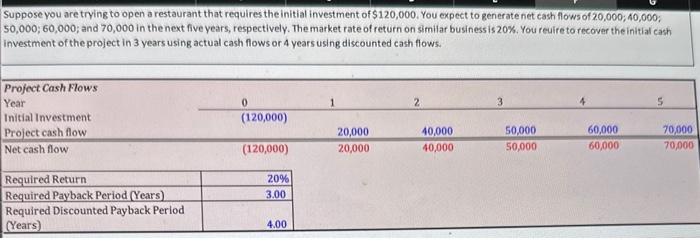

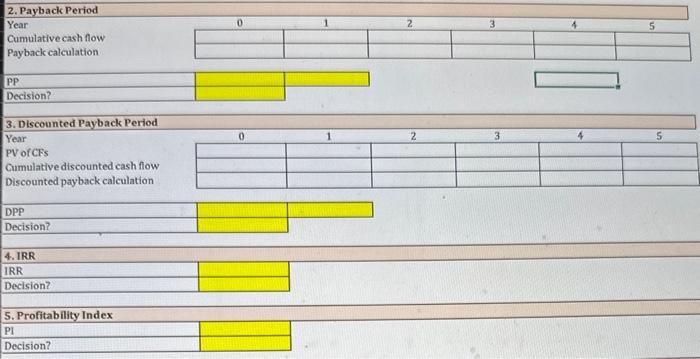

Suppose you are trying to open a restaurant that requires the initial investment of $120,000. You expect to generate net cash flows of 20,000;40,000; 50,000;60,000; and 70,000 in the next five years, respectively. The market rate of return on similar businessis 20%. You reuire to recover the initial cash nvestment of the project in 3 years using actual cash flows or 4 years using discounted cash flows. 2. Payback Period Year Cumulative cash flow Payback calculation \begin{tabular}{|l|l|l|l|l|l|} \hline 0 & 1 & 3 & 4 & 5 \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline PP & \\ \hline Decision? & & \\ \hline \end{tabular} 3. Discounted Payback Period Year Cumulative discounted cash flow Discounted payback calculation \begin{tabular}{|l|l|l|l|l|l|} \hline 0 & 1 & 2 & 3 & 4 & 5 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline DPP & \\ \hline Decision? & \\ \hline 4. IRR & \\ \hline IRR & \\ \hline Decision? & \\ \hline \end{tabular} 5. Profitability Index \begin{tabular}{|l|l|} \hline Pl & \\ \hline Decision? & \\ \hline \end{tabular} Suppose you are trying to open a restaurant that requires the initial investment of $120,000. You expect to generate net cash flows of 20,000;40,000; 50,000;60,000; and 70,000 in the next five years, respectively. The market rate of return on similar businessis 20%. You reuire to recover the initial cash nvestment of the project in 3 years using actual cash flows or 4 years using discounted cash flows. 2. Payback Period Year Cumulative cash flow Payback calculation \begin{tabular}{|l|l|l|l|l|l|} \hline 0 & 1 & 3 & 4 & 5 \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline PP & \\ \hline Decision? & & \\ \hline \end{tabular} 3. Discounted Payback Period Year Cumulative discounted cash flow Discounted payback calculation \begin{tabular}{|l|l|l|l|l|l|} \hline 0 & 1 & 2 & 3 & 4 & 5 \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline DPP & \\ \hline Decision? & \\ \hline 4. IRR & \\ \hline IRR & \\ \hline Decision? & \\ \hline \end{tabular} 5. Profitability Index \begin{tabular}{|l|l|} \hline Pl & \\ \hline Decision? & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts