Question: Please include a clear detailed solution/explanation Assume there are only 3 assets in the economy. Riskless asset Rg = 2% and two risky assets A

Please include a clear detailed solution/explanation

Please include a clear detailed solution/explanation

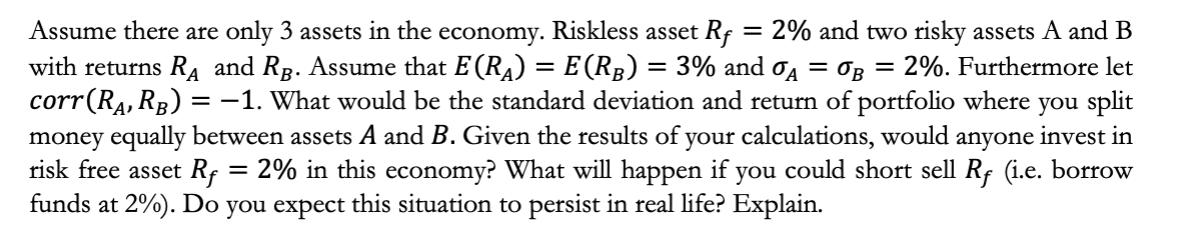

Assume there are only 3 assets in the economy. Riskless asset Rg = 2% and two risky assets A and B with returns Ra and Rs. Assume that E (RA) = E(RB) = 3% and 0A = OB = 2%. Furthermore let corr(R, RB) = 1. What would be the standard deviation and return of portfolio where you split money equally between assets A and B. Given the results of your calculations, would anyone invest in risk free asset Rq = 2% in this economy? What will happen if you could short sell Rq (i.e. borrow funds at 2%). Do you expect this situation to persist in real life? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts