Question: please include all calculations Problem 3: A company is considering the purchase of new equipment with a cost of $425,000. It will be eligible for

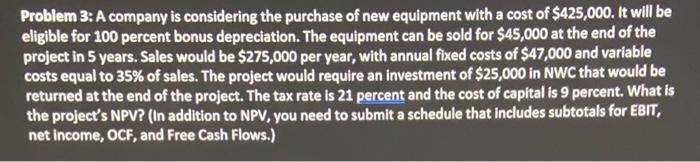

Problem 3: A company is considering the purchase of new equipment with a cost of $425,000. It will be eligible for 100 percent bonus depreciation. The equipment can be sold for $45,000 at the end of the project in 5 years. Sales would be $275,000 per year, with annual fixed costs of $47,000 and variable costs equal to 35% of sales. The project would require an investment of $25,000 in NWC that would be returned at the end of the project. The tax rate is 21 percent and the cost of capital is 9 percent. What is the project's NPV? (In addition to NPV, you need to submit a schedule that includes subtotals for EBIT, net income, OCF, and Free Cash Flows.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts