Question: please include all parts, thanks! EXERCISE SET 1 (Declining Balance Depreciation). Use the Spreadsheet and Graphing perspectives in GeoGebra to help with your work. 1.

please include all parts, thanks!

please include all parts, thanks!

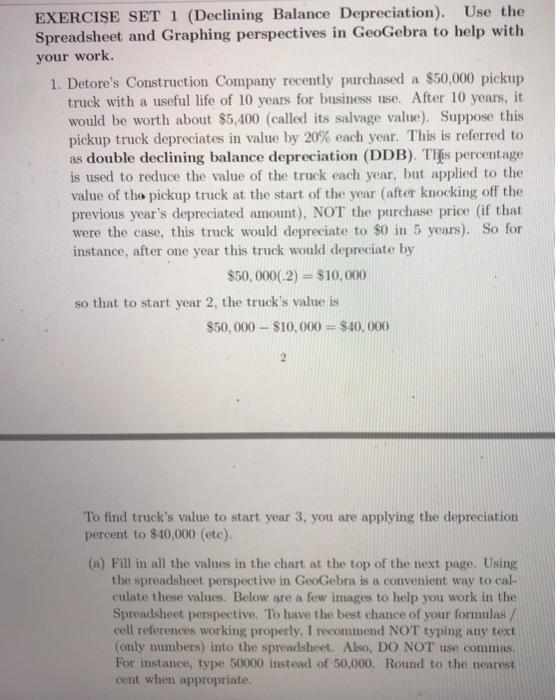

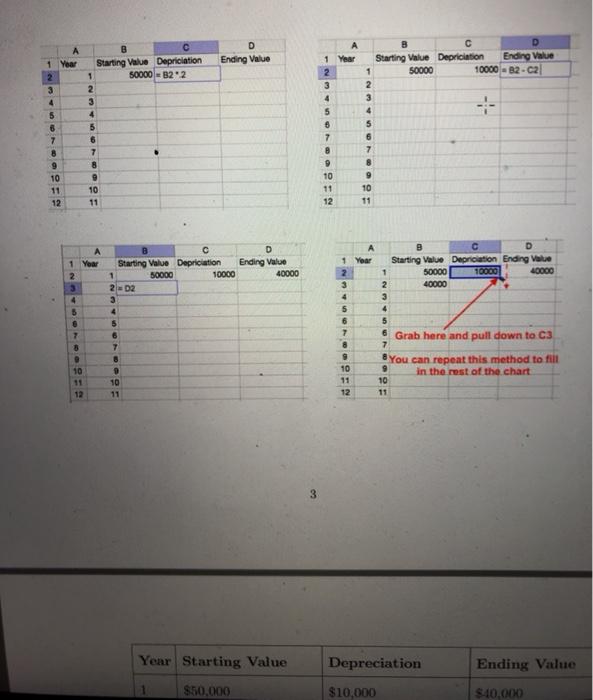

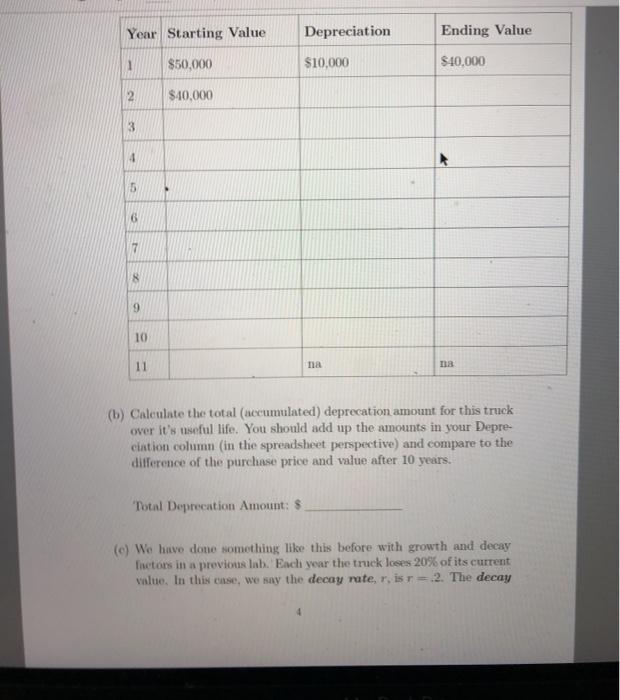

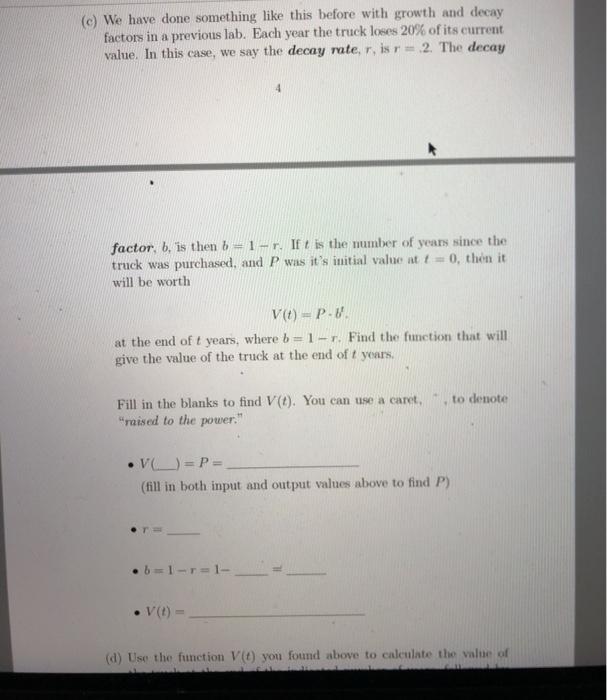

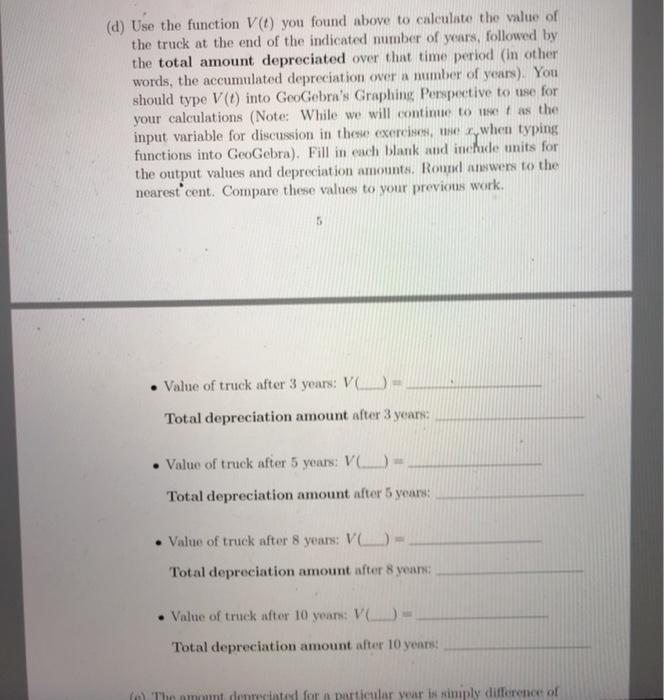

EXERCISE SET 1 (Declining Balance Depreciation). Use the Spreadsheet and Graphing perspectives in GeoGebra to help with your work. 1. Detore's Construction Company recently purchased a $50,000 pickup truck with a useful life of 10 years for business use. After 10 years, it would be worth about $5,400 (called its salvage value). Suppose this pickup truck depreciates in value by 20% each year. This is referred to as double declining balance depreciation (DDB). This percentage is used to reduce the value of the truck each year, but applied to the value of the pickup truck at the start of the year after knocking off the previous year's depreciated amount). NOT the purchase price (if that were the case, this truck would depreciate $0 in 5 years). So for instance, after one year this truck would depreciate by $50,000(-2) = $10,000 so that to start year 2, the truck's value is $50,000 - $10,000 = $40.000 2 To find truck's value to start year 3, you are applying the depreciation percent to $10,000 (etc). (a) Fill in all the values in the chart at the top of the next page. Using the spreadsheet perspective in GeoGebra is a convenient way to cal- culate these values. Below are a few images to help you work in the Spreadsheet perspective. To have the best chance of your formulas / cell references working properly, I recommend NOT typing any text (only numbers) into the spreadsheet. Also, DO NOT se commas For instance, type 50000 instead of 50,000. Round to the nearest cent when appropriate. D Ending Value 1 Year 2 3 B Starting Value Deprication 1 50000 B22 2 3 4 1 Year 2 3 4 4 --- 5 6 7 8 D Starting Value Depriciation Ending Value 1 50000 10000 - B2-C2 2 3 4 5 6 7 8 9 10 11 5 6 7 8 9 10 11 12 5 6 7 8 9 10 11 12 10 11 Year 1 A 1 Yoar 2. 3 4 D Starting Value Deprication Ending Valu 50000 10000 40000 40000 D Starting Value Deprication Ending Value 1 50000 10000 40000 2-D2 3 1 2 3 2 3 4 5 6 7 8 4 5 6 5 5 7 8 7 7 9 6 Grab here and pull down to C3 You can repeat this method to fill in the rest of the chart 10 11 10 9 10 11 10 11 12 12 3 Year Starting Value Depreciation Ending Value 1 850,000 $10,000 $10.000 Year Starting Value Depreciation Ending Value 1 $50,000 $10,000 $10,000 2 $40,000 3 4 15 6 7 8 9 10 11 na (b) Calculate the total accumulated) deprecation amount for this truck over it's useful life. You should add up the amounts in your Depre- ciation column (in the spreadsheet perspective) and compare to the difference of the purchase price and value after 10 years. Total Deprecation Amount: $ (c) We have done something like this before with growth and decay Inetors in a previous lab. Each year the truck loses 20% of its current value. In this case, we say the decay rate, r, is =2. The decay (c) We have done something like this before with growth and decay factors in a previous lab. Each year the truck loses 20% of its current value. In this case, we say the decay rate,r, is r = 2. The decay factor, b. is then b-1-r. If t is the number of years since the truck was purchased, and P was it's initial value at t = 0, then it will be worth V(t) = P.U. at the end of t years, where b=1-r. Find the function that will give the value of the truck at the end of t years. Fill in the blanks to find V(). You can use a caretto denote raised to the power." .VO)=P= (fill in both input and output values above to find P) b=1-1- . V(0) - (d) Use the function V (t) you found above to calculate the value of (d) Use the function VC) you found above to calculate the value of the truck at the end of the indicated number of years, followed by the total amount depreciated over that time period (in other words, the accumulated depreciation over a number of years). You should type V (1) into GeoGebra's Graphing Perspective to use for your calculations (Note: While we will continue to ust as the input variable for discussion in the exercises, sex, when typing functions into GeoGebra). Fill in each blank and include units for the output values and depreciation amounts. Round answers to the nearest cent. Compare these values to your previous work. 5 Value of truck after 3 years: VC) Total depreciation amount after 3 years Value of truck after 5 years: VC) Total depreciation amount after 5 years: Value of truck after 8 years: VC) - Total depreciation amount after 8 years Value of truck after 10 years V) Total depreciation amount after 10 years! The amount de recites for particular year is simply difference of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts