Question: please include all steps. i dont understand why this is the answer Question 5. a) Motors (GM) Ine wants to undertake a new project. It

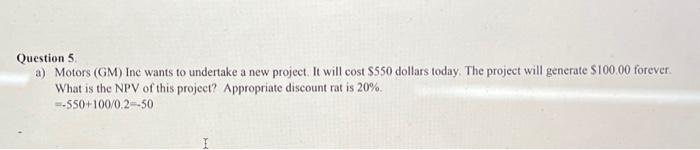

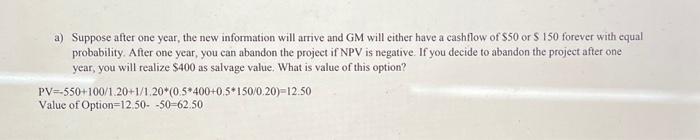

Question 5. a) Motors (GM) Ine wants to undertake a new project. It will cost $550 dollars today. The project will generate $100.00 forever. What is the NPV of this project? Appropriate discount rat is 20%. =550+100/0.2=50 a) Suppose after one year, the new information will arrive and GM will either have a cashflow of $50 or $150 forever with equal probability. After one year, you can abandon the project if NPV is negative. If you decide to abandon the project after one year, you will realize $400 as salvage value. What is value of this option? PV=550+100/1.20+1/1.20(0.5400+0.5+150/0.20)=12.50 Value of Option =12.5050=62.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts