Question: please include all steps. reduction to Use the information in the table to calculate the depreciation for the Building and Land Improvements for the first

please include all steps.

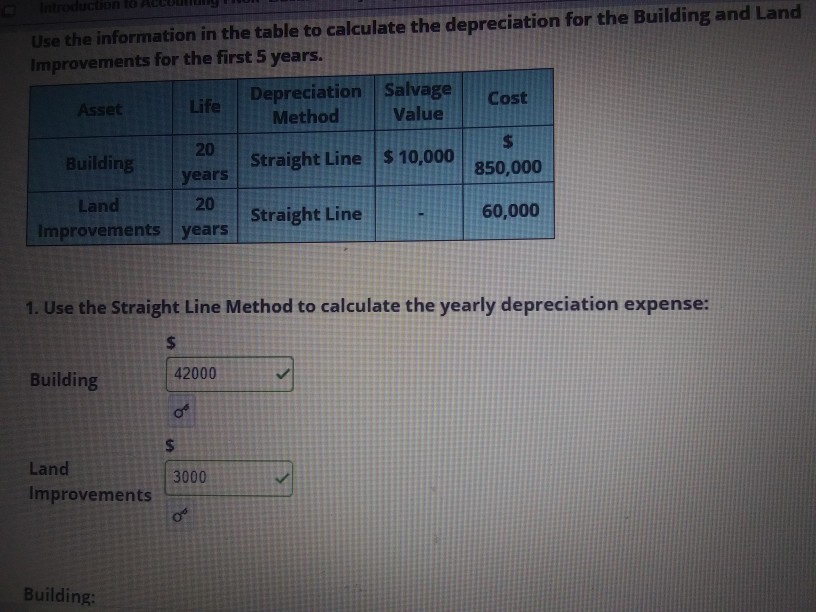

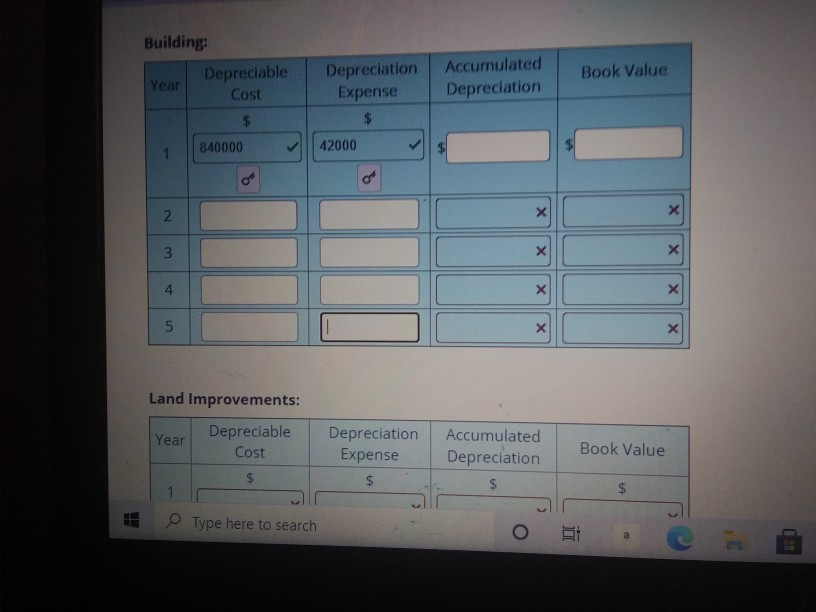

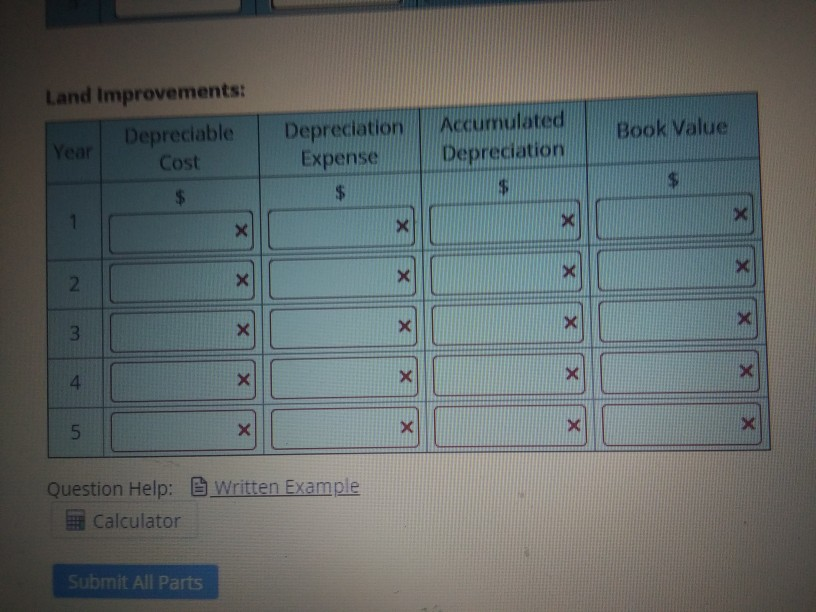

reduction to Use the information in the table to calculate the depreciation for the Building and Land Improvements for the first 5 years. Cost Asset Depreciation Salvage Method Value Life Building Straight Line $ 10,000 $ 850,000 20 years 20 years Land Improvements Straight Line 60,000 1. Use the Straight Line Method to calculate the yearly depreciation expense: $ $ Building 42000 $ Land Improvements 3000 Building: Building: Depreciable Year Cost Accumulated Depreciation Book Value Depreciation Expense $ 42000 1 840000 o N x 4 5 X X Land Improvements: Depreciable Year Cost Depreciation Expense $ Book Value Accumulated Depreciation $ $ $ E Type here to search Land Improvements: Depreciable Year Cost Depreciation Expense $ Accumulated Depreciation Book Value $ $ X X X X X 2. X X X X X 3 4. X x 5 X X X Question Help: Written Example Calculator Submit All Parts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts